Advertisement

Advertisement

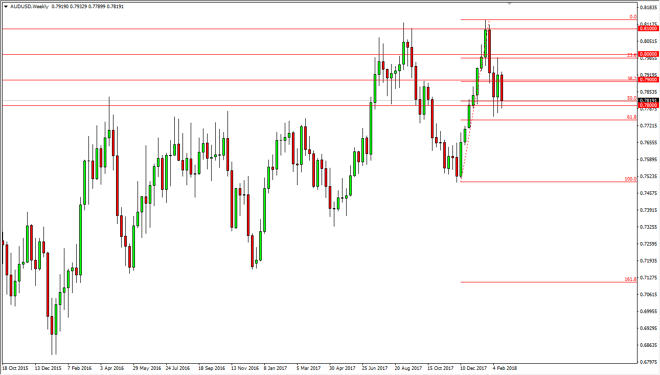

AUD/USD forecast for the week of February 26, 2018, Technical Analysis

Updated: Feb 24, 2018, 04:15 UTC

The Australian dollar has fallen a bit during the week, reaching down towards the 50% Fibonacci retracement level of the recent move. Beyond that, the 0.78 level has offered a bit of support, as we have seen previously.

This has been an interesting week for the gold markets, and by extension the Australian dollar. We have pulled back rather significantly, but within the overall range of trading that we had been involved in over the previous couple of weeks. For me, I believe that the market is trying to make “higher lows”, and on the short-term chart it looks as if we are going to continue to see tenacity in this market. I think that we will eventually reach towards the 0.79 level, and then the 0.80 level after that. Ultimately, I think the real issue is going to be the 0.81 handle, as it was the most recent highs. I look at the 0.80 level as a region that the market will continue to bounce around in, but once we clear to a fresh, new high, the market is very likely to continue to extend into more of a “buy-and-hold” market.

I think that short-term pullbacks will be looked upon as buying opportunities, and I believe that the 0.78 level underneath will be supportive, extending down to the 61.8% Fibonacci retracement level. Longer-term, I look at these pullbacks as value, and I think that most of the market will as well. Gold markets also look very likely to continue to push against significant resistance, and if we can break above the $1400 level Sunday, that should unleash the Australian dollar to go much higher. If we broke down below the 61.8% Fibonacci retracement level, then I think we go looking towards the 0.7550 region.

AUD/USD Video 26.02.18

About the Author

Christopher Lewisauthor

Being FXEmpire’s analyst since the early days of the website, Chris has over 20 years of experience across various markets and assets – currencies, indices, and commodities. He is a proprietary trader as well trading institutional accounts.

Did you find this article useful?

Latest news and analysis

Advertisement