- GBP/CHF is on a 4-day bull run.

- The Pound is still vulnerable to any news from the EU-UK trade deal

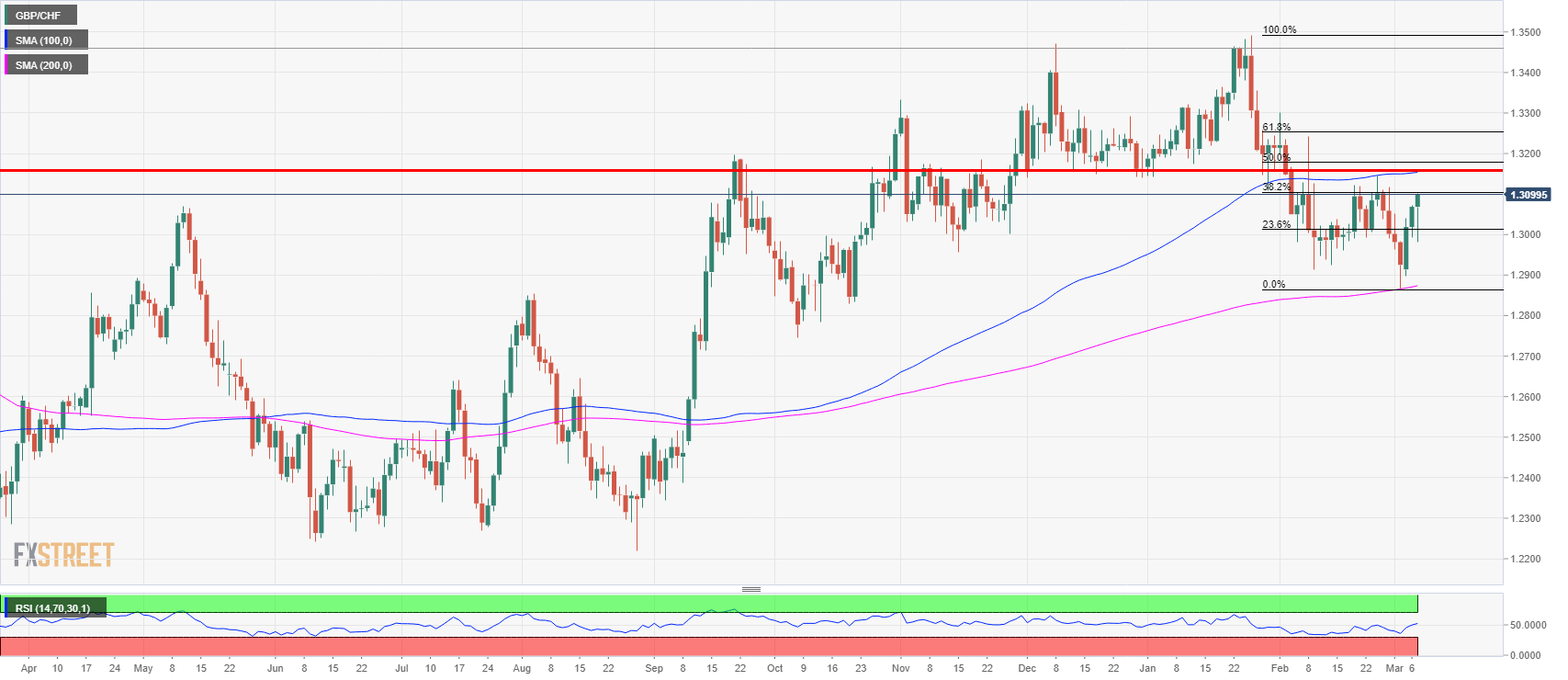

The GBP/CHF is trading around 1.3095 up 0.20% on the day after reversing sharply higher from a low made at 1.2982. The GBP/CHF has been on a bull tear since Friday where it found support at the 200 DMA gaining more than 230 pips in the process. It is now testing the 32.8% Fibonacci retracement at 1.3100 as seen on the daily chart below. If the bulls effort is successful the next resistance is seen at 1.3160 which has been a key supply/demand zone since September 2017. Maybe a positive outcome from the EU-UK trade deal will help the buyers to have the conviction to add capital to their long positions to break the 1.3160 barrier.

GBP/CHF daily chart

Helping the pound to gain against the Swiss franc is the risk on sentiment with North Korea having talks of denuclearization if the international community recognizes its communist regime.

UK macro numbers, coming up on Friday are the industrial production as well as trade data for January. Earlier on Wednesday, Halifax House Prices m/m came in rose to 0.4% vs 0.3% and 1.8% vs 1.6% y/y.

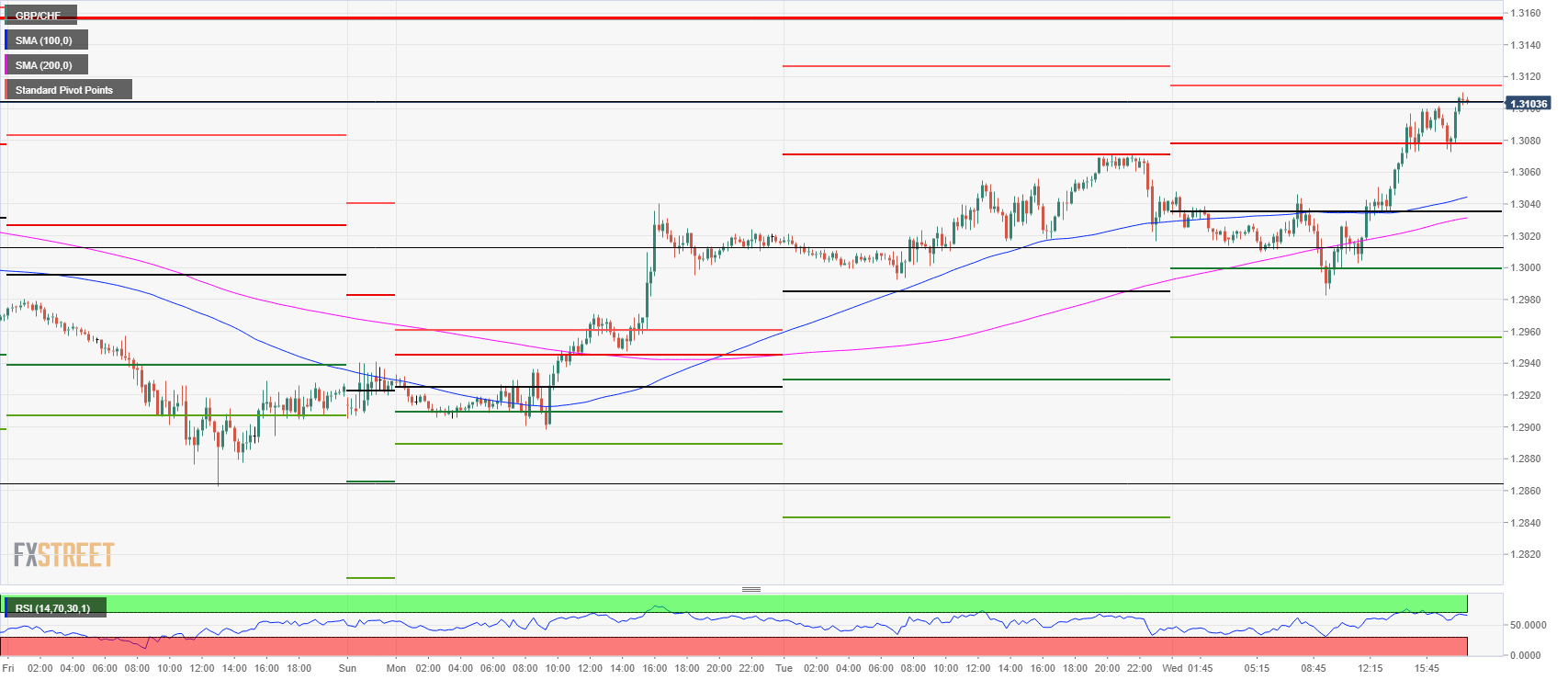

The GBP/CHF is testing the R2 pivot point resistance at 1.3114. If this level is broken the next resistance become the 1.3116 multi-month supply/demand zone. To the downside support is seen at 1.3080 S1 pivot point and further down at 1.3040 daily pivot which is exactly between the 100 and 200 SMA. The price action and the RSI indicator show a bearish divergence.

GBP/CHF 15-minutes chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.