- UK expulses 23 Russian diplomats.

- NZ GDP expected to increase to 3.1%.

The GBP/NZD is currently trading at around 1.9055 virtually unchanged on Wednesday so far. Earlier, in relation to the murder of the ex-spy and his daughter in the UK, 23 Russian diplomats have been expulsed. While the GBP/USD has been affected negatively, the news had virtually no impact on the GBP/NZD which is still trading well within its range of 1.8940 and 1.9080.

With the US Session being macro news free, the market is taking clues from sentiment and possibly later from the New-Zealand GDP at 21.45 GMT, expected at 0.7% q/q and 3.1% y/y versus 2.7% in the previous reading.

Wednesday saw the UK spring statement on the budget, in which Hammond said that the UK's 2018 GDP growth forecast was revised up to 1.5% and making some upbeat comment on inflation saying that the Bank of England would likely reach its 2% target within a year. On the budget deficit, he said it would be £10b lower compared with 2010. The market was eager to buy the pound on the back of this positive outlook laid out by the finance minister.

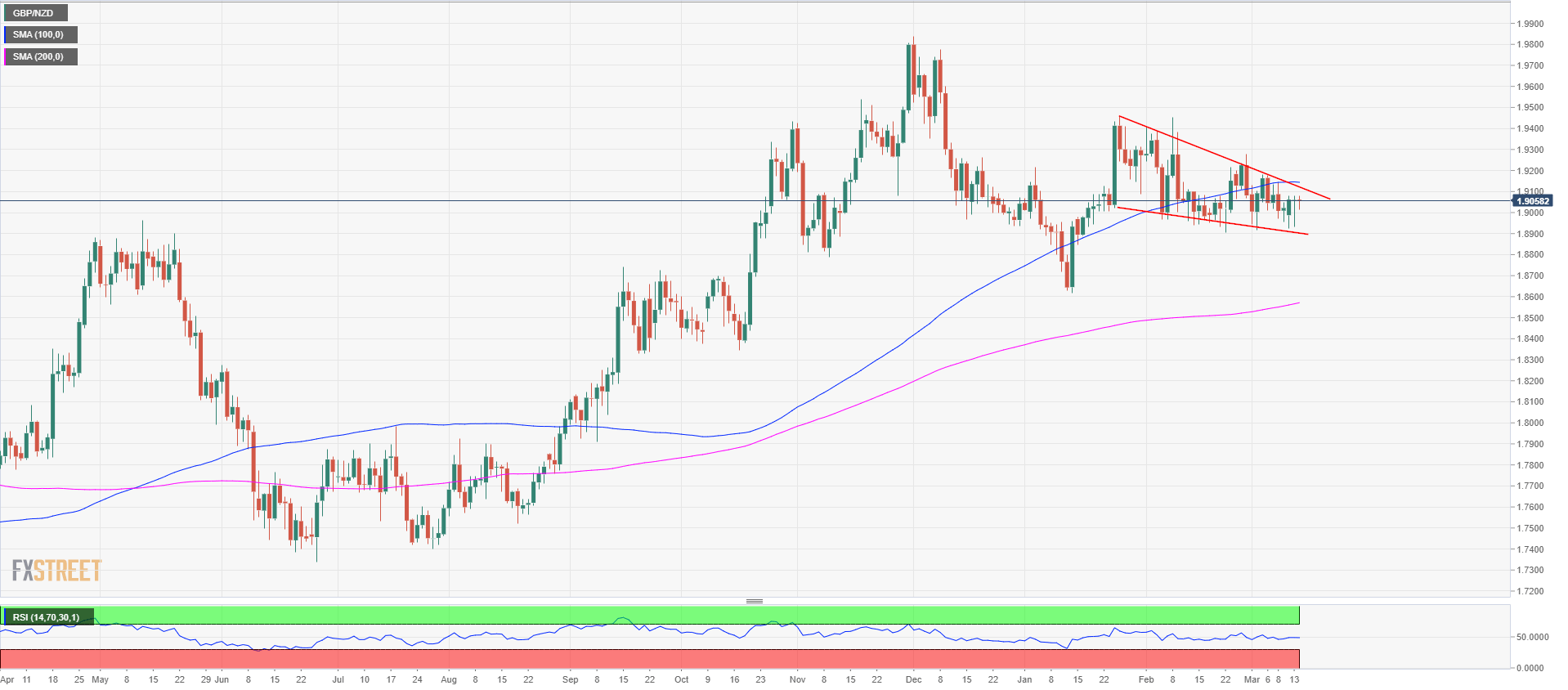

GBP/NZD daily chart

From a technical point of view, the GBP/NZD seems to be poised for a leg higher with a compression pattern which has been in the making since January 24 of this year. A clear breakout above the descending trendline (red) would likely lead to higher prices with 1.9400 being the first scaling point (highest point of the pattern), followed by 1.9800 cyclical high. On the flip side, if the pattern fails, support is seen at 1.8800 psychological figure and 1.8600 cyclical low.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.