- GBP/USD can break 1.4000 and reach 1.4300 according to ING.

- The Federal Reserve is most likely to pull the trigger next week.

The Cable is trading at around 1.3935 virtually unchanged on the day while earlier in the US Session, US industrial output data came stronger than expected 1.1% vs 0.3% consensus while JOLTS job openings in January came at 6.312m vs 8.890m expected. The Michigan consumer sentiment index came in at 102.0 vs 99.3 consensus which boosted the USD which saw a strong breakout in the Dollar index which rose from 89.90 low to 90.37 high in the US session to stabilize at 90.20 at the time of writing.

Next week is certainly going to be an important one for the GBP and USD alike, with the Fed expected to hike interest rates, the Bank of England meeting, UK macro data and last but not least the conclusion of the trade deal between the European Union and the United Kingdom. Traders should be expecting great volatility ahead especially in the GBP/USD. Analysts at ING expect the pair to grow in value if the Brexit deal has a positive conclusion, the main sticking issue is the Irish border though. According to analysts, if the Brexit transition deal comes out a success, the Bank of England maintain a hawkish stance and if the UK wage inflation data is constructive, then 1.4000 should be broken to the upside and bulls will be targetting the 1.4250-1.4300 year’s high.

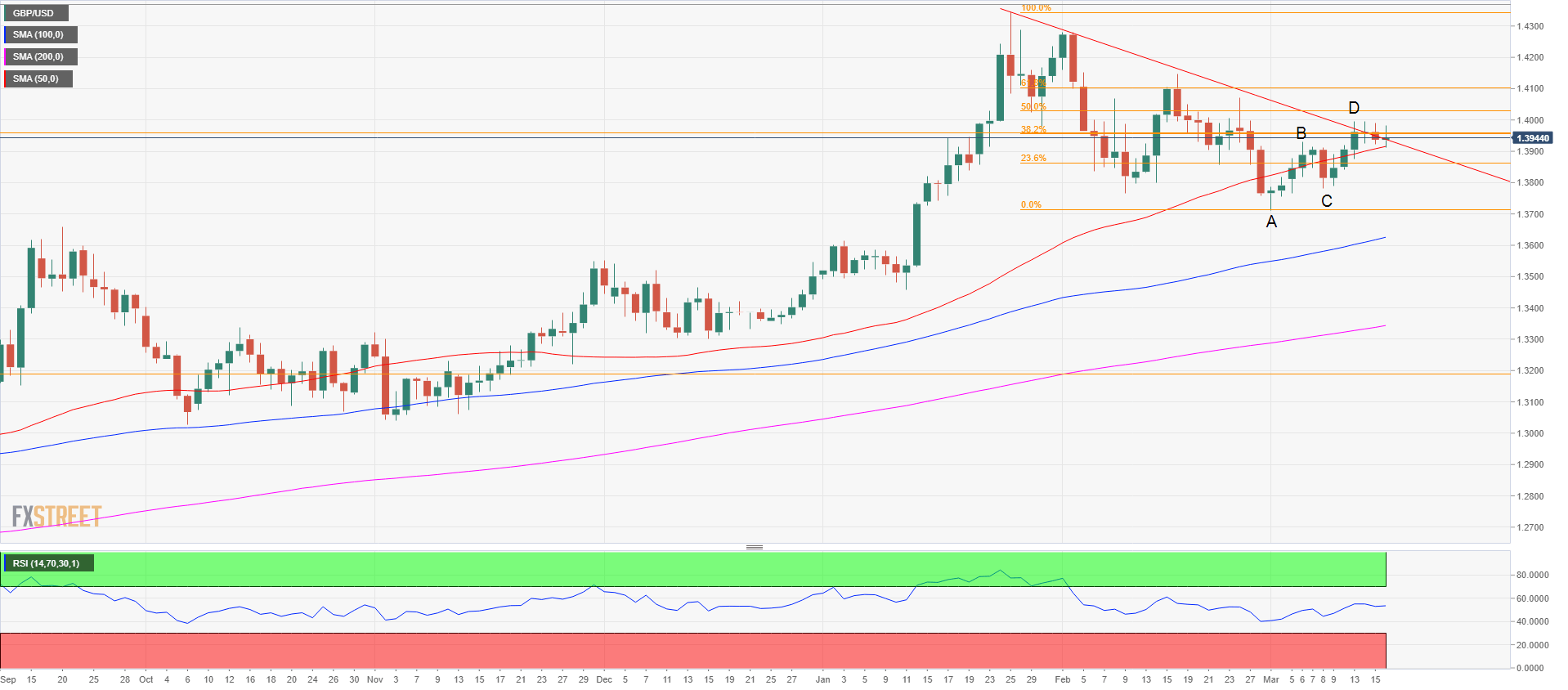

GBP/USD daily chart

The Cable is trying to find support at its 50-period simple moving average as for the last three days, the market has been compressed between the 50 SMA and the 1.4000 level. The Pound managed to break above the bearish trendline but the bull attacks have all failed so far leaving wicks on top of bars, implying that bulls couldn’t close the bar at the top. After two legs up, the ABCD pattern, the GBP/USD is struggling to break above 1.4000. A strong bear breakout below 1.3900 psychological level suggests a pullback to 1.3800 ‘B’ point, followed by 1.3700 ‘A’ point which was the start of the two-legged pattern. If buyers manage to breakout above 1.4000, then 1.4100 handle is in the cards with the 61.8% Fibonacci retracement from the December 25-March 1 bear leg, followed by 1.4300 figure close to the high of the year.

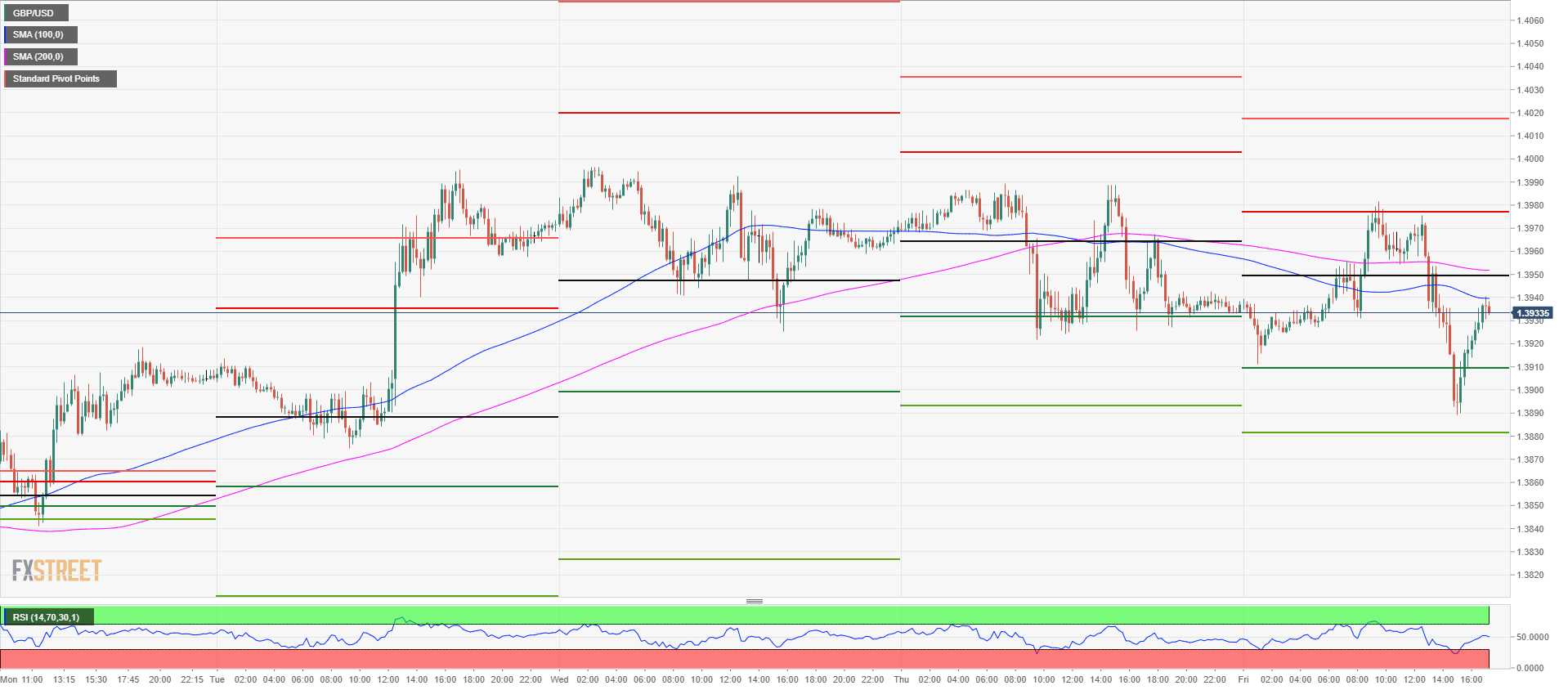

GBP/USD 15-minute chart

The market found intraday resistance close to the 1.3880 level after a decline from the 1.3980 resistance. Resistance is now seen at the 1.3950 daily pivot with both the 100 and 200 SMA barrier, higher up there is the 1.3980 resistance which was the high of the day. Support is seen at 1.3910 S1 pivot and 1.3880 S2 pivot.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.