- Fed rate hike is likely coming next week so what will happen to the 105 USD/JPY support remains to be seen.

- The USD/JPY is struggling between risk-off and monetary policy divergence.

The USD/JPY is currently trading at around 106.70 down 0.26% on the day as US industrial data, JOLTS and Michigan consumer index come in better than expected earlier in the American session.

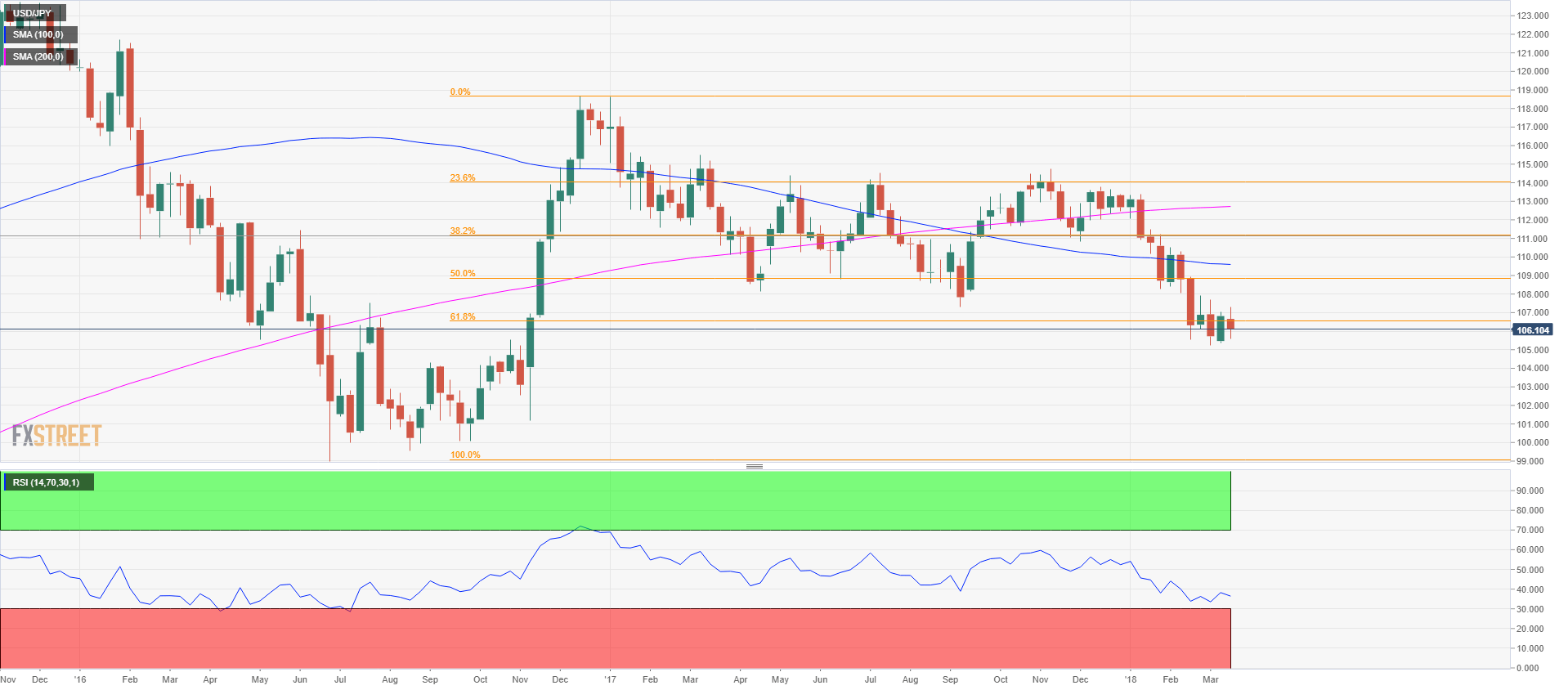

USD/JPY weekly chart

The USD/JPY has been steadily declining since the start of the year. On a weekly basis, the bulls were never able to close a bar above a previous week’s high, therefore suggesting a strong bearish momentum in the pair. However, this week was different as the bulls were able to break above the previous week’s high, which is the first time since 2018. It doesn’t mean the bearish trend is coming to an end but it informs us that bulls are indeed at work and trying. In the last four weeks, bulls have tried to break above 107 and 108 key levels but they are having a hard time so far as sellers seem relentless to bring the market back to 105. The Yen has benefited from a lot of risk-off sentiment among political scandals in Japan, Trump’s trade wars and UK-Russia relations deteriorating on the back of an attempted murder of an ex-Russian spy in the UK. Nothing to get bored about. However it is worth noting that the monetary policy divergence theory, from the Fed and the Bank of Japan, would still theoretically support higher USD/JPY in the medium run as the Bank of Japan keeps its aggressive easing monetary policy and the Fed is most likely to raise rates no less than four times this year, according to most analysts. However, we will let the market dictate the price and follow the trends.

Technically, the USD/JPY is consolidating and coiling at around 106.60, the 61.8% Fibonacci retracement from the July-December 2016 bull move. A decisive break and close above the 107-108 key area might confirm that bulls have the upper hand and a bottom might possibly be in place. To the flip side, if bulls are unable to support the market and 105 level support break, then 103.50 is likely next as it is the 78.6% Fibonacci retracement level.

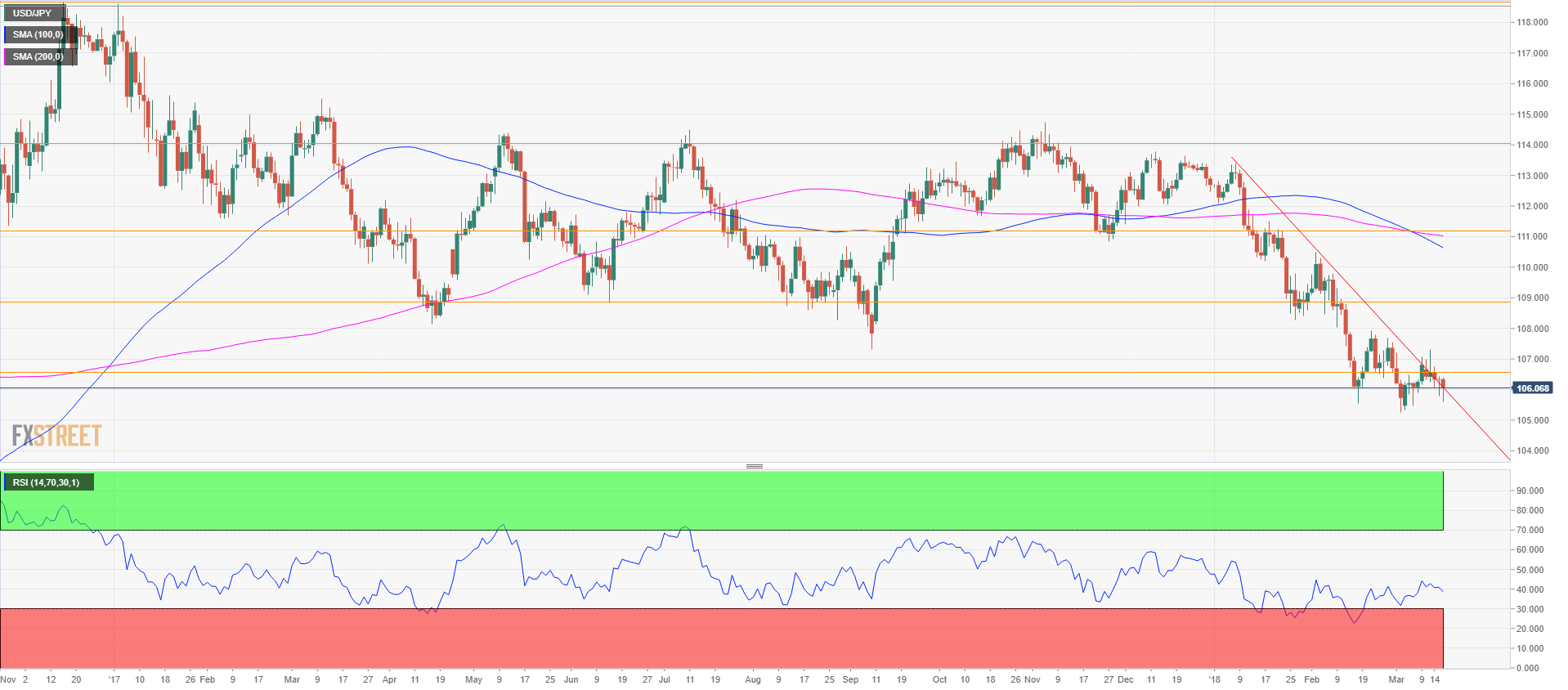

USD/JPY daily chart

Bulls managed to break above the descending trendline although the bullish momentum has been weak after the breakout. The daily RSI is posting a bullish divergence as the market has been pretty much in balance for the last 4 weeks of trading.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.