- US dollar shorts get fidgety ahead of Fed expectations of upgraded rate projection.

- NZD/USD approaching the 0.7200 multi-month support.

The NZD is currently trading at around 0.7214 after declining approx 130 pips in the last 24 hours as the 2-year benchmark yields are at their highest since 2008. The Kiwi started its decline two days ago as the New Zealand GDP data came in below expected, in an immediate reaction the pair sold off more than 30 pips. On Friday NZD weakness was exacerbated by US dollar strength as prospects of Fed rate hikes next week and encouraging industrial data, JOLTS opening job and Michigan consumer sentiment index came all above expectation. For most market participants a rate hike next week is virtually a done deal, the question will be what happens after it.

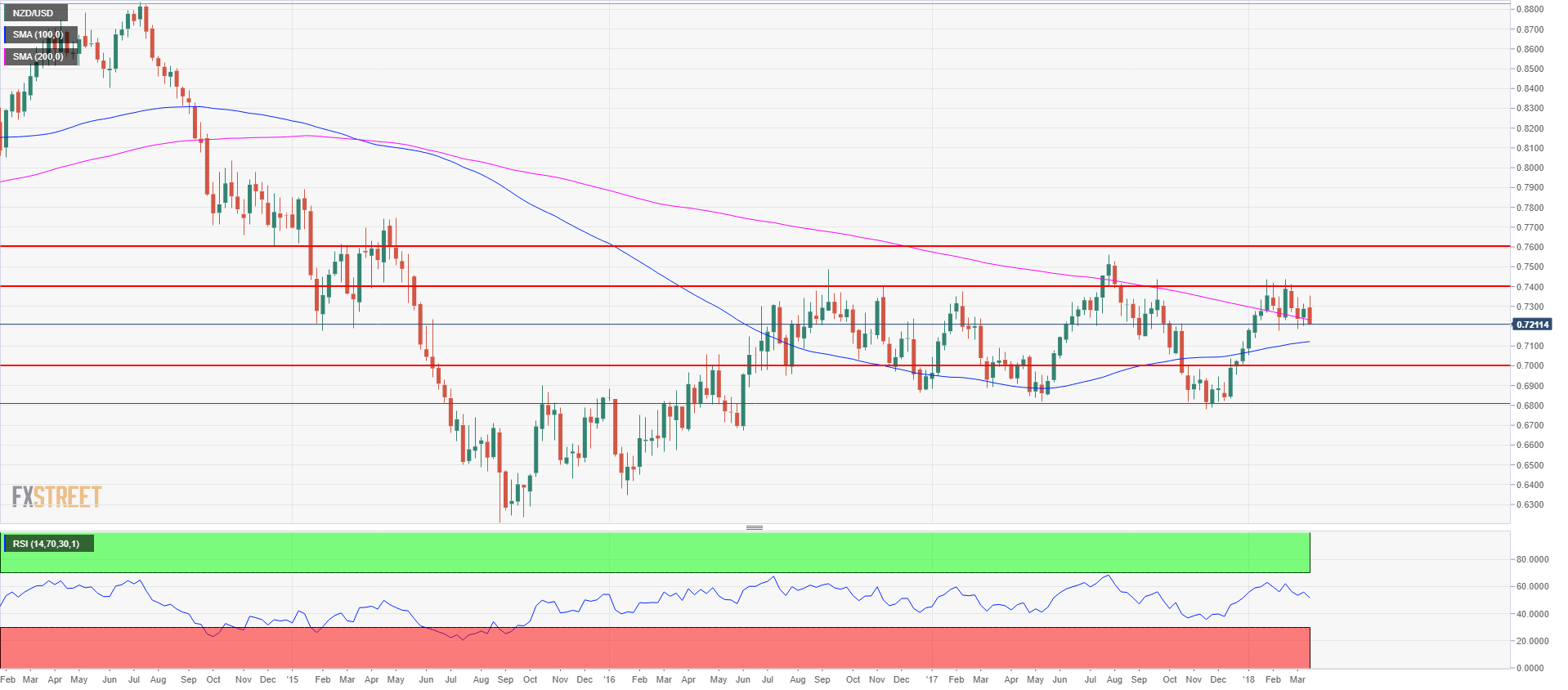

NZD/USD weekly chart

The NZD/USD is sliding below the 200-period simple moving average as the week is coming to an end. 0.7300 and 0.7400 acted as strong resistance since the start of the year. The technical configuration would have us believe that bulls took their chance but they failed to break the 0.7400 level. Immediate support is seen at 0.7200 which is the low of the range of the last weeks, followed by 0.7100 with the 100-period simple moving average. If bulls can maintain the market above 0.7200, resistance is seen at 0.7400 key level followed by 0.7600.

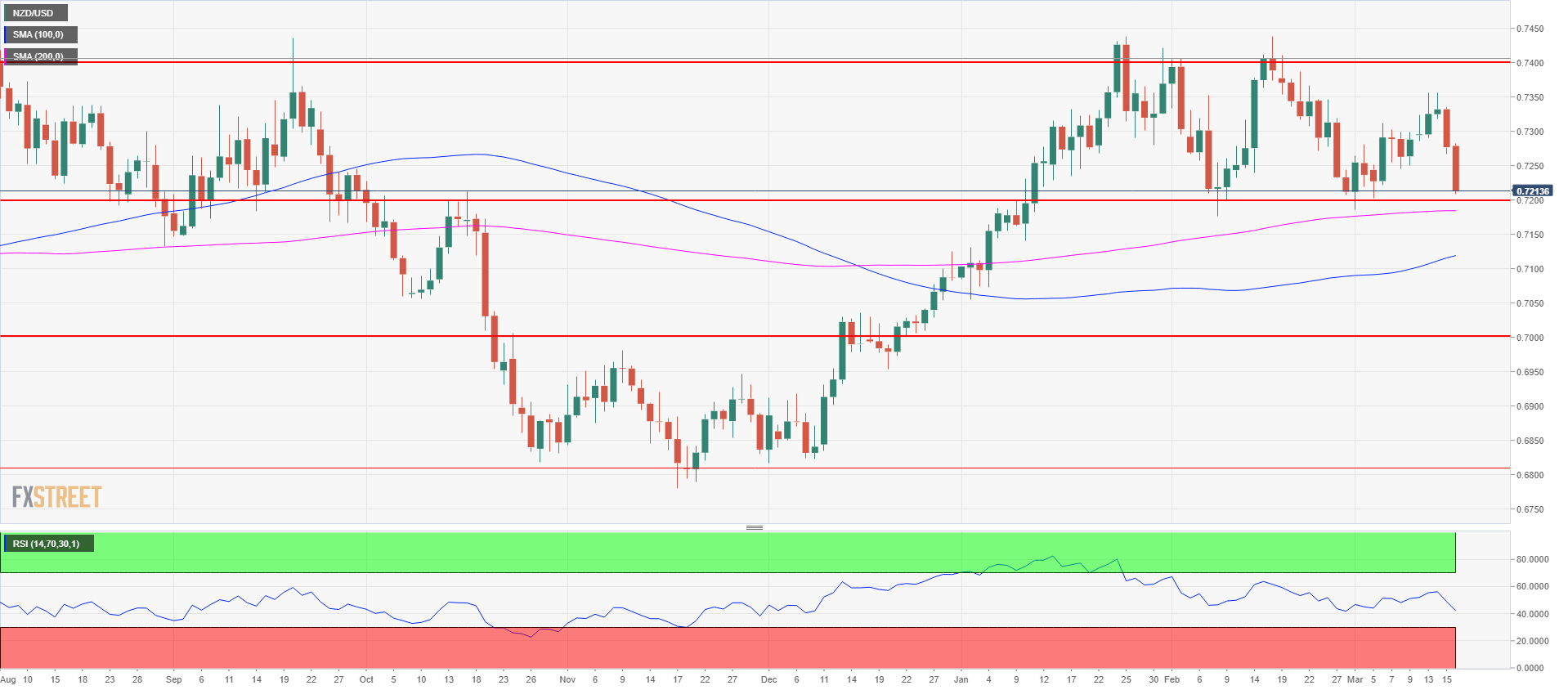

NZD/USD daily chart

On the daily time frame, the NZD/USD made a triple top or arguably a head and shoulder pattern. The 0.7200 level is the strong support to look for as buyers have defended the level since January. The 200-period simple moving average is also not far from the key level so bears will need to have conviction to break through it. The prospects of four rate hikes from the Fed might give the bears the strength they need.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.