Bank Of America: 5 Top Tech Stocks Poised For Future Growth

Look out: “The future is arriving sooner than investors expect” according to Beijia Ma, Bank of America’s leading investing strategist.

Luckily Bank of America has compiled a list of ‘buy’ rated stocks with “material exposure” to future tech themes. These are the stocks they believe look set to benefit the most from these themes over the next 2-5 years.

“By 2020E, we see electric and autonomous vehicles, the Internet of Things (IoT), AI and other hyperbolic technologies impacting lives on Main Street. 2023E serves as an inflection point for tectonic shifts including peak labour, the maturing of Gen Y & Z, and grid parity for renewables — while many moonshots [like animal-free meat] come closer to reality.”

Here we use TipRanks’ insights to dive into the outlook of five of these highlighted stocks. We cover both the overall Street perspective, and the take of top-performing analysts. This allows us to pinpoint recommendations from the best analysts with the highest success rates.

Let’s dive in now:

Nvidia

Themes: Future mobility, robots, millennials, safety, smart cities, virtual reality/augmented reality/mixed reality

Chip maker Nvidia (Nasdaq:NVDA) has multiple drivers up its sleeve including graphics and video processing chips, “supercomputing” chips and high-speed GPU processing. Based on our data, we can see that the Street is cautiously optimistic about the stock’s outlook. However NVDA does have its committed fans.

Take five-star RBC Capital analyst Mitch Steves. He has just reiterated his buy rating with a $285 price target (15% upside potential) up from $280 previously. On gaming, Nvidia’s largest segment, he says “we are bullish long-term”. This is down to the complexity of video games, virtual reality and the potential for customers to shift from AMD’s GPU gaming products to NVDA. Plus “with triple-digit year-over-year growth in the Data Center segment, we see potential for robust growth from Data Center along with Virtual Reality.”

And if we look at his NVDA track record on TipRanks, the results are mind-blowing. On Nvidia stock especially Steves boasts a 93% success rate and 90% average return.

ForeScout Technologies Inc

Themes: Safety, smart cities

ForeScout (Nasdaq:FSCT) is a pure-play leader in the attractive Network Access Control (NAC) security market. As the name suggests, network access control is all about implementing policies for controlling devices and user access to a company’s networks.

According to Bank of America, as network security risk increases due to endpoint diversity and complexity, security investment should increasingly shift to NAC products.

“The combination of a high-growth market and ForeScout’s leading position should drive sustainable high growth for ForeScout. We also expect leverage in the operating model to improve with growth and inflect to profitability in late 2019,” explains top Bank of America analyst Tal Liani. He has a $36 price target on FSCT.

Only one other top-performing analyst has rated FSCT in the last three months. Five-star KeyBanc analyst Rob Owens also published a buy-rating on the stock with a $37 price target two months ago.

Yandex NV

Themes: Future mobility, millennials

Leading Russian search engine Yandex (Nasdaq:YNDX) is the equivalent of China’s Baidu. In Russia, it’s Yandex, not Google, that rules the internet.

And it’s not just the internet either. Yandex is also making big advancements in the auto sector with self-driving cars and its own taxi-hailing service. Indeed, Yandex has already held a public pilot of its self-driving test car in Moscow. The car successfully navigated heavy snowfall, pedestrians and high traffic volume.

Following a tie-up with Uber’s Russia business, Yandex Taxi alone could grow to $50 per share by 2023 in a “blue sky scenario,” says top Deutsche Bank analyst Lloyd Walmsley. He sees “meaningful upside” to the shares over the next three years as the ride share business scales. Right now, Walmsley has a $50 price target on Yandex (upside of over 17%).

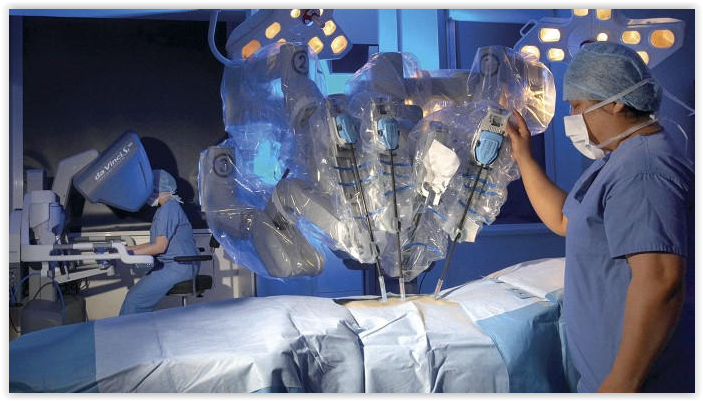

Intuitive Surgical

Themes: Aging, obesity, and smart cities

Robo surgery pioneer Intuitive Surgical (Nasdaq:ISRG) was the best-performing large-cap medtech stock in 2017 (+74%). The company manufactures both capital equipment systems and disposable instruments for robotic surgery. In fact, it’s da Vinci system remains the only commercially available system for robotic surgery in the world. The extreme precision and control of robotic surgery enables ‘major’ surgery to be carried out with minimal invasion.

Four-star Cantor Fitzgerald analyst Craig Bijou says the company is demonstrating ‘clear momentum’ and sees shares rising to $490. Most of all, he likes “its top-line growth profile (double-digit vs peer median growth in mid-single digits), the building momentum of robotic surgery and a pipeline that can significantly expand its addressable market.”

This is because both U.S. hernia repair and other U.S. general surgery procedures are only at the early stages of adoption. Plus there is significant room for international expansion. Bijou expects sustainable 20+% procedure growth as countries expand the types of robotic procedures and acceptance of robots increases.

Microsoft

Themes: Big data, education, robots, millennials, smart cities, virtual reality/augmented reality/mixed reality

Last but not least we have tech giant and market leader Microsoft (Nasdaq:MSFT). The company has invested heavily in artificial intelligence, as well as augmented and virtual reality. In 2016, Microsoft established an AI group as the fourth engineering division at the company, alongside Office, Windows and Cloud & Enterprise. In the first year, that group grew by 60 percent to 8,000 people.

For Bank of America, MSFT ticks the following boxes: “Leading global software co, augmented/mixed reality, HoloLens headset for multiple verticals, digital learning (Windows software), LinkedIn acquisition (#1 professional network), #1 global K -12 classroom operating system, global leader in PC software.”

Given Microsoft’s leadership status in so many fields, it’s not surprising that this stock has a ‘Strong Buy’ rating on TipRanks. In the last three months, 18 analysts have published buy ratings on the stock vs just 2 hold ratings and 1 sell rating. On average these analysts see the stock rising 11% from the current share price. You can click on the screenshot below for further insights into the latest ratings.

Other key stocks highlighted by the report include: Alphabet (GOOGL); Alibaba (BABA) and Amazon (AMZN).

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more