- RBNZ rate decision is scheduled on Wednesday at 20.00 GMT.

- The AUD/NZD regains the range as AUD bears failed to trigger a breakout.

The AUD/NZD is currently trading at around 1.0670 up 0.38% on Tuesday so far as the pair bounced back off the 1.0650 level earlier in the Asian session.

Coming up next is the RBNZ rate statement, scheduled on Wednesday at 20.00 GMT with the central bank widely expected to leave rates unchanged.

Earlier in the day, the Reserve Bank of Australia’s minutes offered little new information: “GDP growth is expected to exceed potential growth over 2018, further progress on jobless rate, and CPI to likely be gradual. Yet, household spending and wage growth outlook are still uncertain, warranting" careful monitoring"

According to analysts at Nomura, they think that the labor market is on the right path. They, however, have an interesting stance on monetary policy: “Aussie Treasurer Morrison, who doesn’t set interest rates off course, has just publicly stated that the RBA is unlikely to follow the US Fed in tightening policy. I agree: the RBA is far too late to this global party, and by the time they are finally ready to hit that rate-hike dance-floor and shake their OCR thang, everyone else will be leaving.”

In New-Zealand the Global Dairy trade came in at -1.2%. “A solid dairy auction (GDT-TWI -1.2%; WMP 0.1%), which will support underlying farmer earnings despite a difficult production year.” according to ANZ.

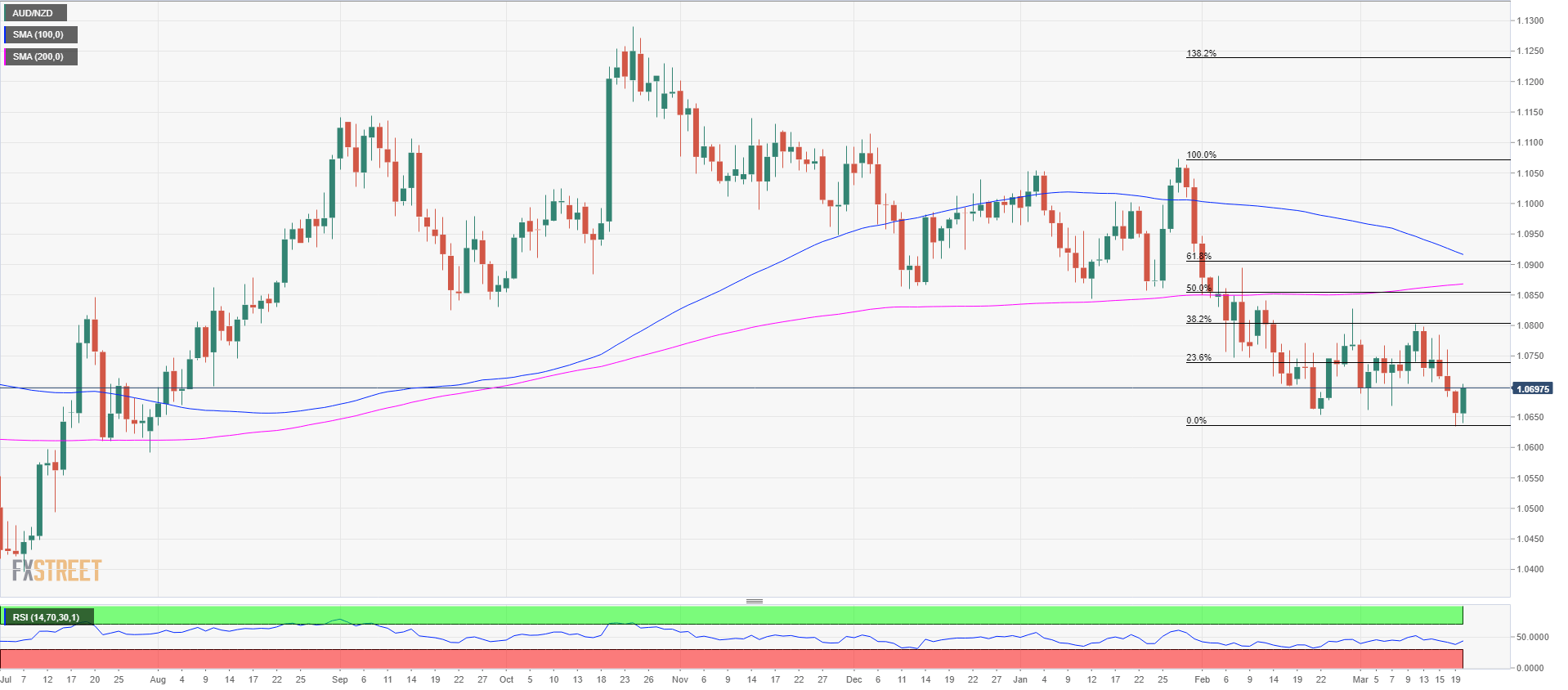

AUD/NZD daily chart

After a bear attack at the 1.0650 level, the bulls took the upper and managed to bring the AUD/NZD cross back into the trading range with the price now trading above Monday’s highs. By doing so, the bulls are preventing the bears to create a trend, at least momentarily. Support is the infamous 1.0650 level which has been holding the price for the last month. If this level is broken to the downside and the bears manage to get a daily close below it then the 1.0600 figure should come into play as the next support. Resistance is seen close to the current level price (1.0700 figure) and then 1.0750 close to the 23.6% Fibonacci retracement from the January-March down move.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.