Wheat World Price May Block 4th Quarter Export Advance To Hit US Goal

Market Analysis

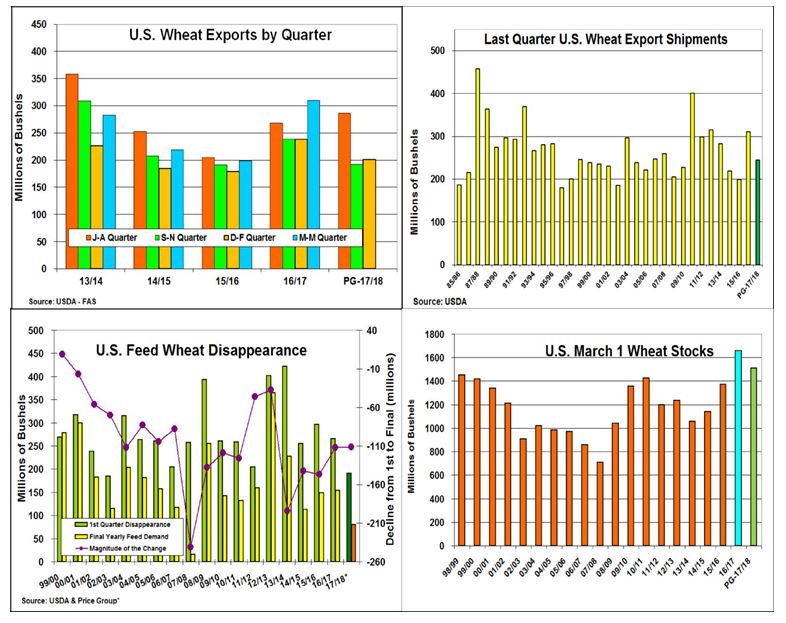

The wheat market’s focus may be split between the up-coming quarterly stocks and the US producers’ prospective planting survey since both USDA reports will be released on March 29. The upcoming March 1 stocks report is important to see if wheat’s current demand trends for exports, feed and food are remaining on their targets as this food grain enters the final quarter of its crop year. After last fall’s minimal drop in US winter wheat seedings (85,000 acres) vs. a 10 million acre decline over 3 years, the trade will be watching to see what N. Plains producers do with their durum and hard red spring seedings.

With the US S. Plains suffering under drought this past winter, export sales have struggled to stay on their 5-year seasonal average pace as competitors capture more business and US shipments remained sluggish at only 201 bu. This prompted the USDA to slice 25 million bu. from its outlook earlier this month leaving exports at 925 million bu. Interestingly, this means US wheat’s final quarterly exports will need to be 245 million bu. to hit the USDA goal which is about mid-point of US shipments (200-300 million bu.) over the last 10 years.

To measure US wheat feeding, the USDA needs to survey commercial and producers inventories on a quarterly basis (similar to corn) to determine wheat’s feed demand. Normally, wheat’s highest unexplained disappearance occurs on its September 1 report when exports are in transit & some spring wheat bushels remain in the fields. This level normally falls through the balance of year. Given HR wheat’s recent 25-40% price premium to corn in the SW, very limited wheat feeding by feedyards has and will likely occur dipping this demand to 80 million for 2017/18. US wheat milling and food demand has been relatively stable on a yearly and quarterly basis over past few years. This suggests wheat’s March 1 stocks will likely be 1.51 billion bu. vs. 1.66 billion bu. last year.

(Click on image to enlarge)

What’s Ahead

After the upcoming March 29 USDA reports, the trade’s focus will likely return to the Southern US Plains and the Black Sea Region’s growing conditions. Currently, more moisture is needed after a dry SW winter while the Black Seas appears in better shape as winter wheat breaks dormancy. Hold sales for now, but utilize July KC strength in the $5.10-$5.20 range to advance sales to 30-40% of a conservative yield.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more