AMD: Round 2, Buy Again

In a December articleI laid a conservative estimate for what we could expect from AMD (AMD) in 2018 and why the $10 price was a real bargain. After three months the stock is 15%-20% up, and if you sold on the peak, it's probably time to grab back your shares.

The stock is trading at similar or better valuation levels than it was in December. My updated valuation shows that the current price today is only reflecting the beat in earnings for Q4, and while the upside is virtually the same, the downside is much lower.

I like to do pessimistic valuations to ensure even some negative surprises are within the forecast range. Q4 managed to beat my most optimistic forecast, guidance for 2018 was a bit ambiguous, but at this price, the stock has small probabilities of going down and plenty of room to grow.

Valuation

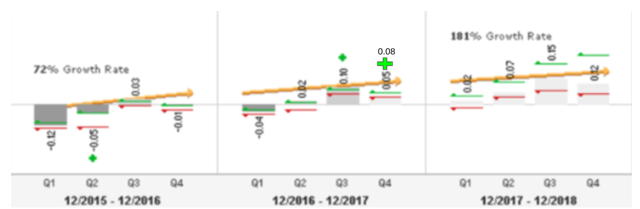

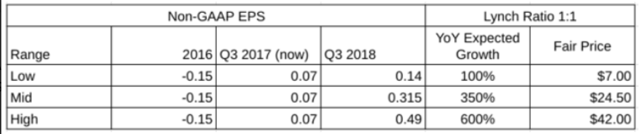

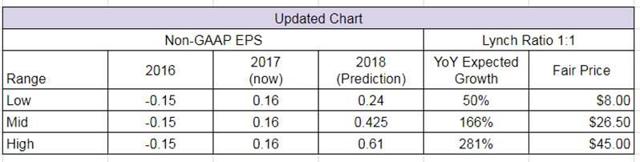

Let’s go back in time three months, and look at the Non-GAAP EPS forecast.

Source: TD Ameritrade + Author's remarks

I used the Lynch method for growth valuation.This method uses the ratio between the expected earnings growth and the P/E of the stock to determine its fair value. A stock that has a 1:1 ratio is fairly priced. The higher the number, the more underpriced the stock is.

Both extremes reflected AMD being at the very top or the very bottom of the expected earnings range four quarters in a row. The bottom prediction by the Lynch method had the fair price falling to a $7 price while the top had it blowing up to 42 dollars, as it can be seen in the chart above.

Q4 delivered an impressive and unexpected beat in earnings, which changes significantly how the same chart would look now.

Source: Author's Charts

The Top range increased only $1, not very exciting, but the bottom valuation is now $11, a considerable improvement. So while the stock has about the same upside, the downside is much less. While in December the stock was trading 3 dollars above the most pessimistic fair price, now it is trading at less than $1 above an arguably fair price.

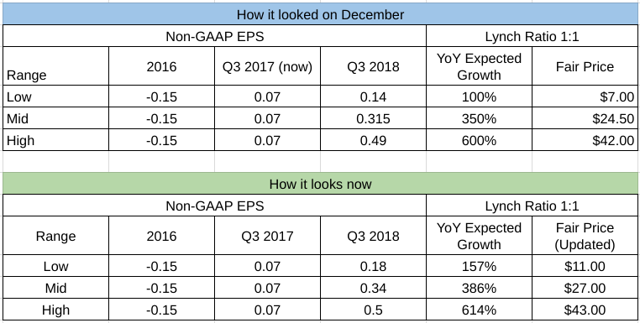

After Q4 results the earnings expectations were updated, as it can be seen from the same source.

Source: TD Ameritrade

Repeating the exercise of the past Quarter we have an updated short-term chart that shows the bottom price for the stock is $8, and the previous top range is now close to the average performance of the stock.

Source: Author's Charts

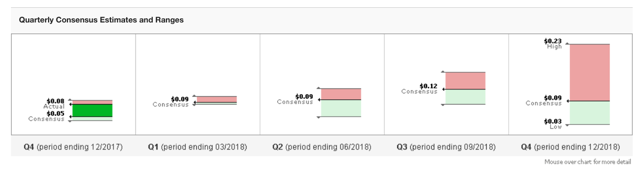

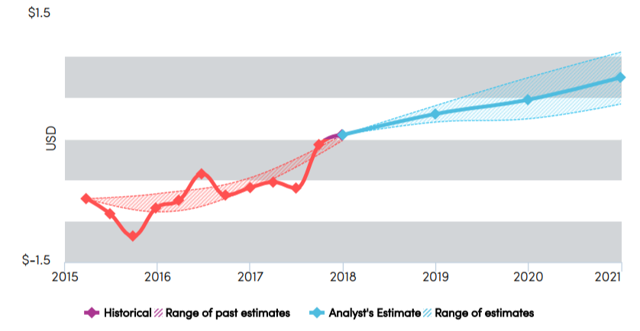

On the long run, the triple-digit growth that AMD could have this year is not sustainable. The below chart shows the earnings expectation of AMD for the next three years.

Source: Simply Wall St

According to Simply Wall St, the growth rate for the next three years is 57.3%. With the current $0.16 Non-Gaap EPS it would mean that the fair price for AMD is $9.17. So, however, one chooses to look at the prospects of AMD it is a compelling risk-reward position.

The CTS report vs. Spectre and Meltdown

The CTS-Labs report portrays vulnerabilities of the AMD architecture with scary sounding names like "MASTERKEY," "RYZENFALL" and "CHIMERA" these flaws are as meaningless as the acquisition rumors that happened earlier in the month. The "flaws" require administrative access to the system to be exploitable and are not comparable with specter and meltdown because the correction of the flaws will not impact performance, its severity abysmally lower and for most users its a non-issue.(this video briefly explains Spectre and Meltdown)

"There is no immediate risk of exploitation of these vulnerabilities for most users. Even if the full details were published today, attackers would need to invest significant development efforts to build attack tools that utilize these vulnerabilities. This level of effort is beyond the reach of most attackers"

Source: Trail of bits report

These particular vulnerabilities seem to be easily resolved since AMD has stated the BIOS patch will happen in the "coming weeks" according to their blog.

Preparing for April

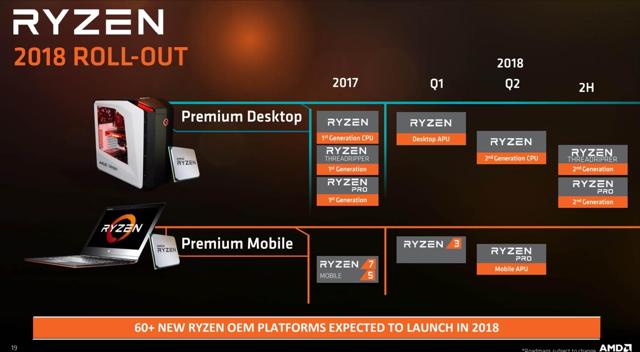

Ryzen mobile has not been exactly flying off the shelves, as it is available in a small sample of laptops that offered Ryzen 5 and 7. The launch of Ryzen Mobile 3 could start reflecting on Q1 and will undoubtedly increase the number of notebooks that carry AMD.Ryzen 3 desktop version showed the real strengths of AMD. Hopefully, the same will go for the mobile version.

Source: AMD investor relations

Although Ryzen mobile is not showing breaking performance, it is important to remember that Intel dominates almost wholly sectors like Ultralight and Chromebooks, so it is natural that the market reaction is not so quick to jump on AMD. Slow and steady wins the race.

After the Q4 beat, the stock followed a familiar pattern; it went way up and the plummet after profit taking. No one who has followed the stock for a while was surprised by this behavior, and probably some of you either sold your position close to the $14 price or used calls an puts to get the benefit from this all too familiar pattern. Both fine strategies that have proven to be very profitable in the past.

However, the stronger fundamentals that AMD has achieved might break this pattern and give a path to a more stable stock. I cannot advocate in favor or against this strategies since it's plain speculation, but it wouldn't hurt to be extra cautious in the coming earnings season.This might be an unwanted warning for fundamental investors and an exciting factor to watch over the next earnings season.

Conclusions

AMD is getting better and better, the probabilities that the stock goes below $11 are slim, and the potential upside is still the same. This is the year for AMD. Intel's (INTC) security flaws were pure gold for AMD EPYC and Ryzen sales and will probably drive AMD earnings for Q1 to the upper range. While Ryzenfall and the rest of CTS flaws in the report are meaningless the price drop was real.

And once again, as Warren Buffett said, "Be fearful when others are greedy and greedy only when others are fearful."

Disclosure: I am long on AMD. If there is anything in this article you agree or disagree with or would like me to expand further, I would sincerely appreciate you leaving a comment, and I will ...

more

Sounds promising. $AMD