- The BoE's Mark Carney will be speaking before parliament today, and traders will be keeping a close eye on the central bank ahead of August's rate call.

- The following US session sees a Senate testimony from the Fed's Powell, and Tuesday marks a day of central planning focus for market participants.

The GBP/USD is trading just beneath the 1.3250 level ahead of Tuesday's London markets, which sees a showing from two key central bankers in the upcoming sessions.

The Bank of England's (BoE) Mark Carney, alongside the BoE Deputy Governor Jon Cunliffe, will be delivering statements to the UK's Treasury Select Committee regarding the Financial Stability Report, and traders will be keeping their eyes peeled for hints about the central bank's forward-looking plans. Traders are expecting a rate hike from the BoE's next rate call on August 2nd, and bulls are eager to establish an upward trend as Brexit continues to drag the Sterling down.

Prime Minister Theresa May's latest Brexit proposal has seen some key changes made by the House of Commons in voting yesterday, and the move by hard-line Brexiteers within May's own party to introduce changes to the framework could prove lethal for PM May's latest attempt to strike a successful middle ground between Brexiteers in the UK and EU leaders in Brussels, who have so far remained stalwart, providing little in the way of special concessions that the UK leavers have been demanding.

On the US side, the Fed's Jerome Powell will be delivering his testimony to the Senate Banking Committee regarding the Semiannual Monetary Policy Report, and markets will be focused on the central banker's words as the Fed is expected to remain on the hawkish side, keeping closely in-line with the Fed's current gradual policy tightening.

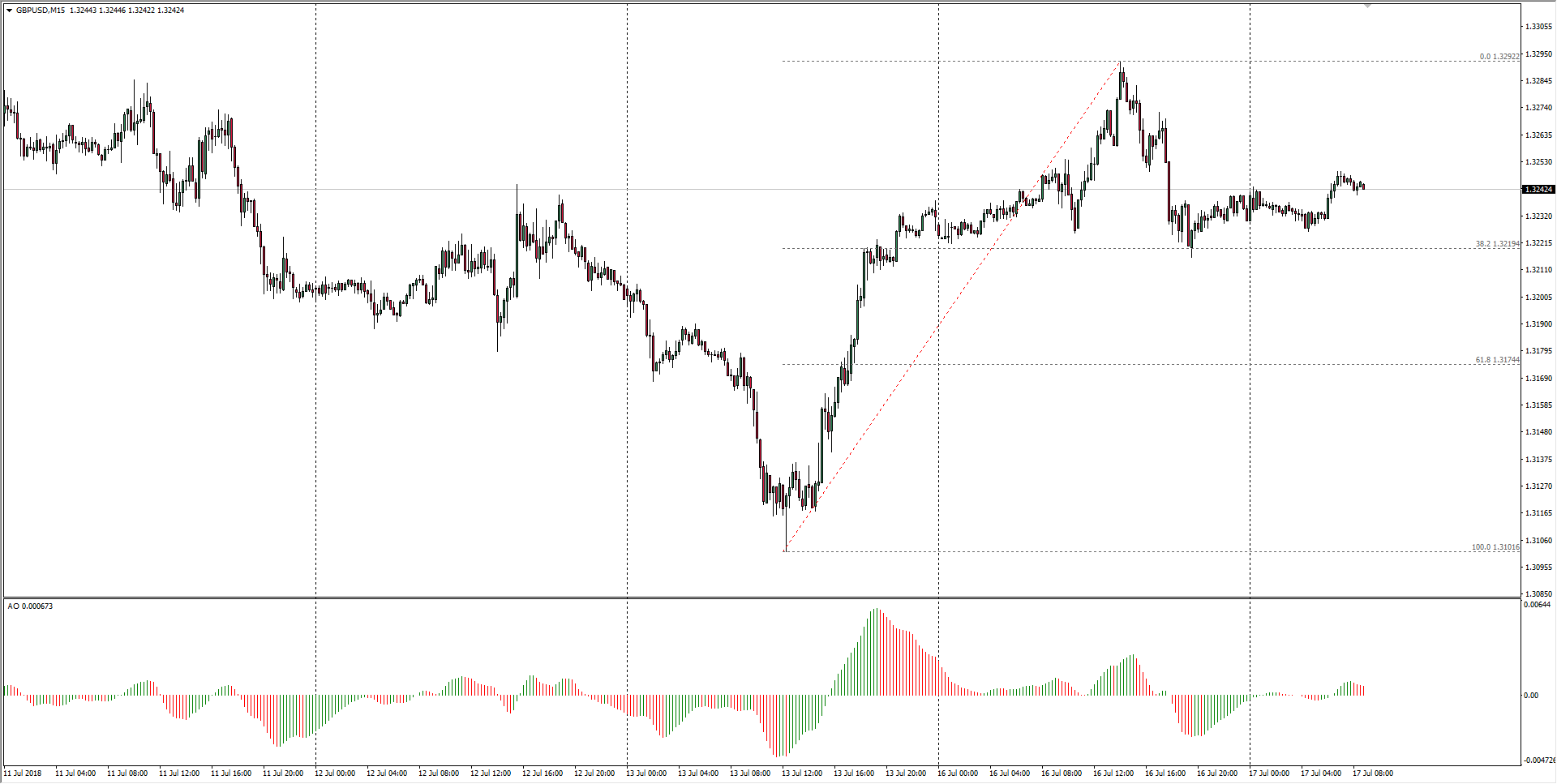

GBP/USD Technical Analysis

Sterling kicking upwards in Tuesday's early trading ahead of the BoE's Carney testimony as GBP bulls look to make a play above 1.3250, but failure to recapture 1.3300 yesterday sees bearish pressure mounting.

GBP/USD Chart, 15-Minute

| Spot rate: | 1.3242 |

| Relative change: | 0.09% |

| High: | 1.3249 |

| Low: | 1.3225 |

| Trend: | Flat to bullish |

| Support 1: | 1.3225 (current day low) |

| Support 2: | 1.3174 (61.8% Fibo retracement level) |

| Support 3: | 1.3101 (one month low) |

| Resistance 1: | 1.3292 (previous week low) |

| Resistance 2: | 1.3325 (R2 daily pivot) |

| Resistance 3: | 1.3361 (July 9th swing high) |

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.