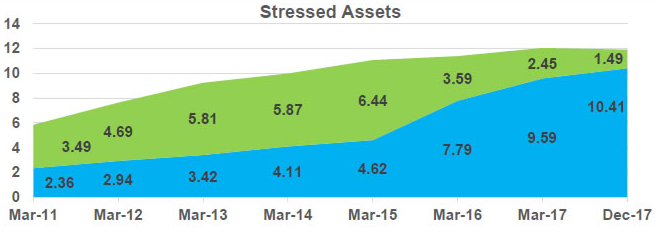

India’s bad loans are fifth highest in the world and surged dramatically after March 2015. While at face value it would seem like the quality of assets deteriorated after Narendra Modi came to power, the reality is completely different. The NPA chart shared by Reserve Bank of India’s Deputy Governor N S Vishwanathan during his speech shows that India’s bad loans were only 2.36% in 2011, which kept surging, rather slowly, until March 2015 when it rose dramatically.

Reason: The RBI tightened norm for NPA recognition in 2015, after which banks had to recognise some assets as NPA, which otherwise were considered ‘standard assets’. This growth in stressed assets was, in turn, the outcome of rapid credit growth during 2006-2011, N S Vishwanathan said in his recent speech.

While the surge in NPAs is problematic, it’s surge since 2015 is a good sign — that banks are acknowledging NPAs than concealing them through what’s called in banking parlance ‘evergreening’. “The resulting recognition of true asset quality at banks largely explains the spurt in NPAs during the last three years,” the deputy governor said.

And even as reporting of NPAs rose since 2015, the RBI suspected that banks were still underreporting them. In April last year, the central bank asked all banks to reflect in their notes if their NPAs differed from that of regulator’s. As a result, we witnessed massive NPA divergence in banks like the State Bank of India, HDFC Bank, Axis Bank, Yes Bank, IndusInd Bank.

Some of these banks were fined heavily for underreporting bad loans. Yes Bank was fined Rs 6 crore, Axis Bank and IndusInd were fined Rs 3 crore, and IDBI Bank was fined Rs 2 crore.

While the central bank tightening the noose over banks, the newly-adopted Insolvency and Bankruptcy (Code) laid down the process of dealing with these NPAs. First, ‘Dirty Dozen’, a list of twelve biggest corporate defaulters was released, which went for bankruptcy resolution immediately. Second, another list of 28 companies was released that will also undergo insolvency process. Third, the RBI, this February announced a complete overhaul of the asset resolution process, setting a strict timeline and criteria for reporting NPAs and resolving them.