- Macron said that he doesn’t think that Trump will change its mind on the Iranian deal.

- Trump is believed to not renew the Iranian deal on May 12 and oil market are not pricing that in according to analysts.

Crude oil West Texas Intermediate benchmark is trading at around 68.19 up 0.19% on Thursday as the market is undecided on the Iranian deal outcome.

The Iranian deal, which forces Iran to limit its nuclear program in exchange for the suspension of economic sanctions might be at risk on May 12 as Trump repeatedly said he is not willing to renew it. Trump wants to create a harsher version of the deal going against France, Germany and UK’s approval.

French President Macron went to Washington this week to discuss the issue with Trump, but the US President still appears decided to pull out of the deal. "My view, I don't know what your President will decide, is that he will get rid of this deal on his own, for domestic reasons," said Macron.

On the other hand, Iran said it will not accept a different version of the current deal and if any changes are made to it Iran threatens to resume its nuclear activity.

Oil markets are strongly underestimating what would be the impact of the US not renewing the Iranian deal on May 12, according to Ehsan Khoman, head of research at MUFG. The Iranian oil disruption can lead to a supply squeeze of about 350,000 barrels a day and the market might not have priced that in. If anything unexpected happens with the Iranian deal the analyst sees WTI crude oil above $75 a barrel.

"High geopolitical tensions between the U.S. and Iran certainly don't bode well for oil markets. Our base-case scenario is that Donald Trump will not sign the nuclear waiver agreement on May 12. He has been articulating that in tweeting policy and through other statements." according to Ehsan Khoman.

Meanwhile, on Thursday, two major oil companies reported their earnings for the first quarter of 2018 which showed a strong increase stemming from higher oil and gas prices. Shell reported a 42% increase in profits at $5.322 billion while, French oil major, Total, also reported above-consensus first-quarter earnings with net adjusted profit of $2.9 billion versus $2.77 billion expected by analysts.

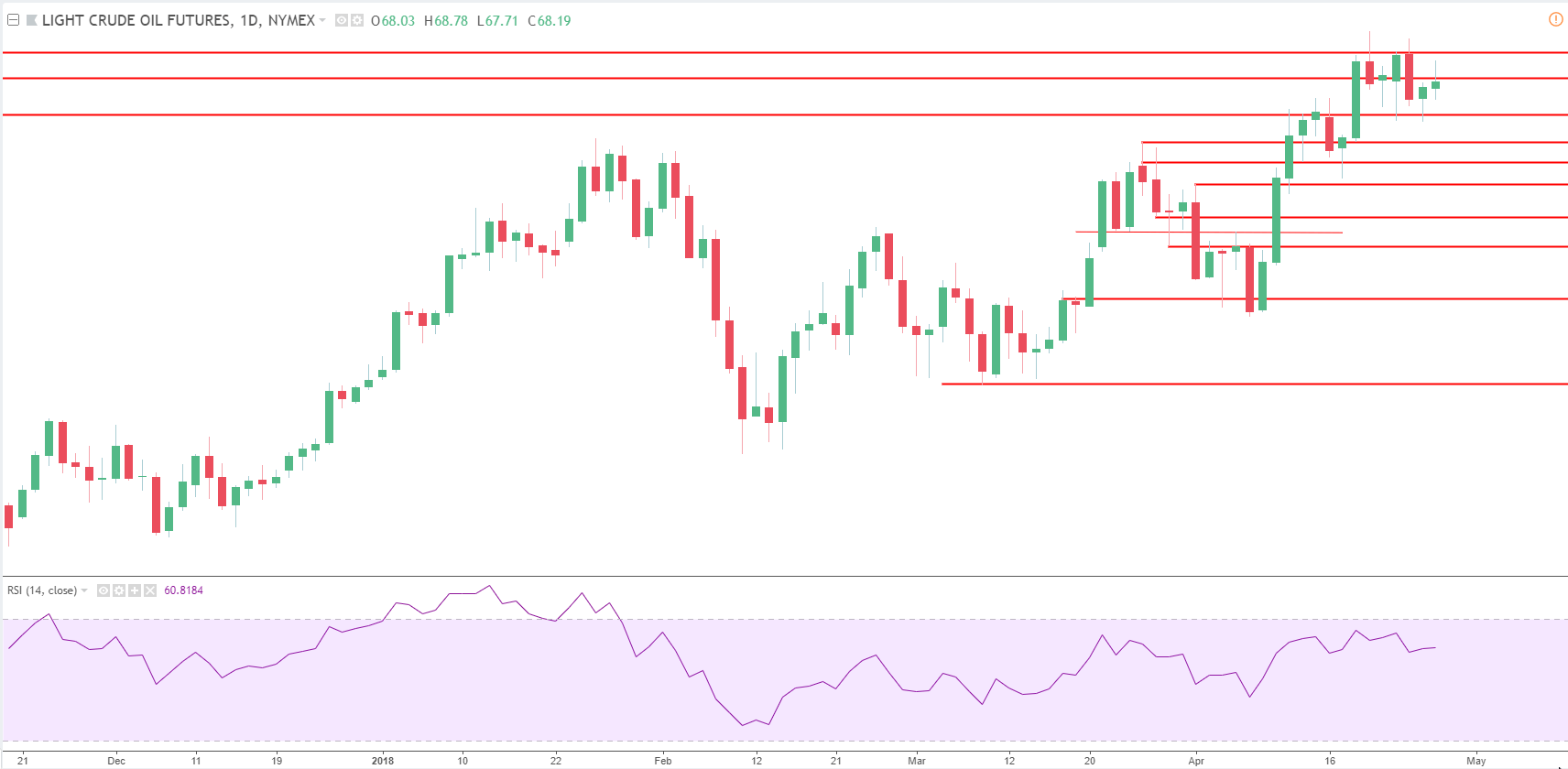

Crude oil WTI daily chart

The trend is bullish. Supports are seen at 67.30 demand level and 66.55 swing high while resistances are seen at 68.30 pivot level and the 69 figure.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.