- Crude finds support at $70.52 a barrel after losing more than $2 in the last two days.

- Oil has been easing from its 2018 top as OPEC says it intends to raise production to compensate the potential loss from Venezuela and Iranian output.

Crude oil slides for the third day in a row and finds support at $70.52 a barrel. Indeed, oil has retreated from its 2018 high at 72.83 on talks that OPEC could raise its oil production to compensate the potential loss from Venezuela and Iranian output.

Venezuela is in the midst of a deep crisis and its oil output is at a 70-year low while impending sanctions on Iran can materialize in a supply squeeze of up to 500,000 barrels per day, according to analysts.

Meanwhile, it has been reported that the International Maritime Organization (IMO) will enforce new emissions standards in order to reduce the pollution from ships. It is set to enter into effect on January 1, 2020, and according to analysts, this can be another major driver for oil prices over the next two years as the energy and shipping industries are not quite ready for the incoming change.

More specifically, the IMO is looking to cut sulfur emissions which are found in acid rain which damage wildlife, vegetation and is also responsible for respiratory illnesses.

Looking further investors will pay attention to the weekly rig count on Friday at 17:00 GMT which can provide short-term trading opportunities but is highly unlikely to provide any long-term directional clues.

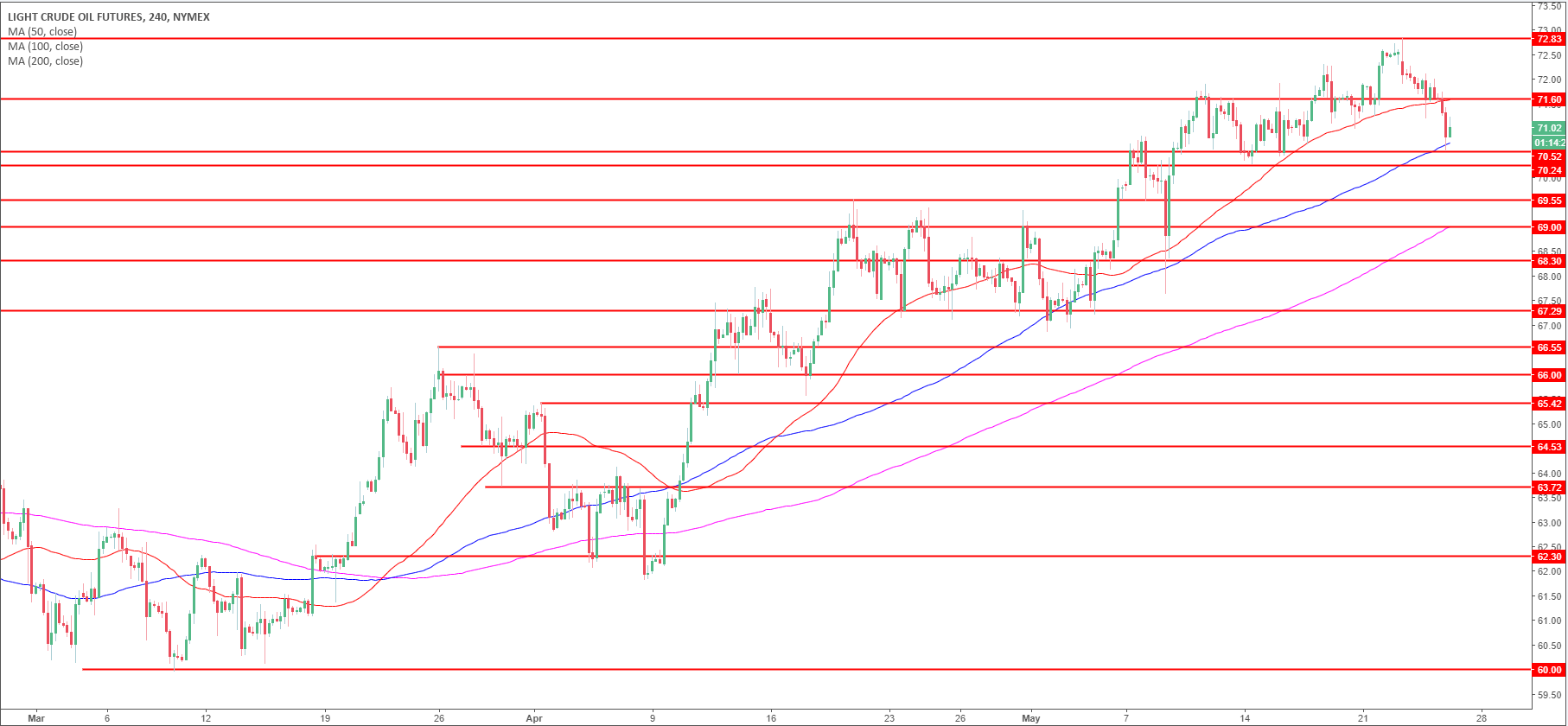

WTI crude oil 4-hour chart

Oil is trading above its 100 and 200-period simple moving averages (SMA) on the 4-hour time-frame while it is trading below the 50-period SMA. Although black gold fell for the last two days, the trend remains strong and the market is back into familiar ranges. Bulls will try to keep the market above the 70.24 swing low and if they fail the next support is seen at 69.55 swing high. Bulls are also finding support at the 100-period SMA and will try to drive the market back to the 71.60 resistance and possibly to the 72.83 level which is the high of 2018.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.