ASEAN Weekly Outlook – US Tariffs, Emerging Markets, USD PHP, ASEAN, US Dollar

- Most Southeast Asian currencies rose versus USD as trade war concerns relaxed for the most part

- US President Donald Trump pushing again for $200b Chinese tariffs threaten those gains ahead

- MSCI Emerging Markets ETF could revisit September lows, but upside break still holds for now

Check out the ASEAN Technical Outlook to see where the fundamentals could drive prices for USD/MYR, USD/PHP, USD/IDR and USD/SGD!

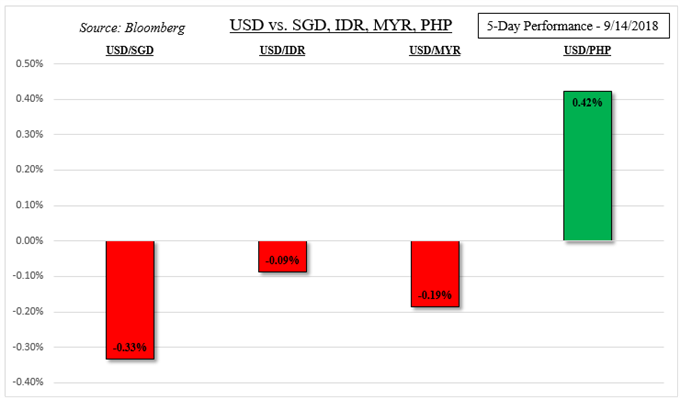

The pullback in the US Dollar as threats of a trade war between the US and China cooled for the majority of last week allowed most Southeast Asian currencies to gain against it. The Singapore Dollar made the most notable progress with USD/SGD falling over 0.33 percent. Meanwhile the Philippine Peso still suffered despite general US Dollar weakness with USD/PHP rising over 0.42%.

The Peso may have been under pressure as the trade deficit widened with imports rising by the fastest since May 2016. This could send the current account further into negative territory as a weakening currency makes paying off external debt more difficult. In addition, the Philippines Stock Exchange Index fell 2.44 percent last week as concerns agriculture may be severely impacted by Typhoon Mangkhut gained.

Ahead, emerging markets and stocks could be in for a rough week. Last Friday, US President Donald Trump said he wants to move forward with $200b in Chinese tariffs. This was despite efforts from Treasury Secretary Steven Mnuchin to revive trade talks with Beijing. This could as a result weigh against ASEAN currencies such as the Malaysian Ringgit and Indonesian Rupiah.

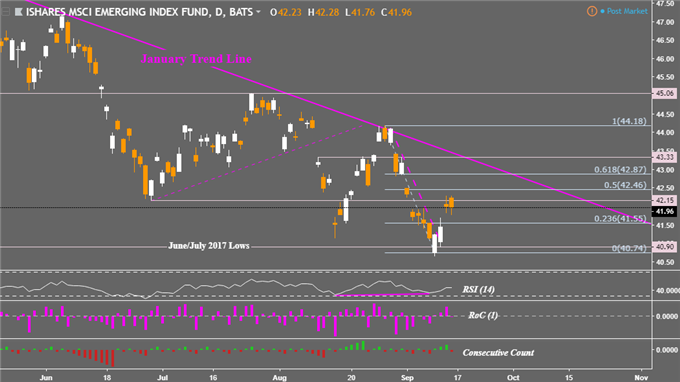

The MSCI Emerging Markets ETF has pulled back last week and rising trade war concerns could once again push it back to bear market territory. See the technical analysis section below for a closer look at where the index could go next.

Meanwhile the US Dollar faces an economic calendar filled with mediocre-tier event risk. Interestingly, last week’s softer-than-expected US CPI report failed to offer lasting USD weakness as Fed rate hike bets were ultimately left unchanged. This may result in the greenback brushing off weaker data as it has been doing for some time and trade relatively flat.

As far as domestic economic events are concerned for ASEAN currencies, the Indonesian Rupiah looks to next week’s trade balance which is expected to become a deficit. USD/IDR did rise above Asia Financial Crisis highs in recent weeks and we shall see if the Rupiah’s depreciation could boost exports instead. The Malaysian Ringgit eyes August’s CPI report where mild disinflation is expected.

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

MSCI Emerging Markets ETF Technical Analysis

After positive RSI divergence warned that downside momentum was ebbing in the MSCI Emerging Markets ETF, the index clocked in a recovery last week gaining almost one percent. It also rose above a near-term descending resistance line from late August. This still leaves the index open to testing the descending trend line from January.

At the moment, the MSCI Emerging Markets ETF holds just under the June 28th low at 42.15 which has acted as both support and resistance since then. A push higher exposes the 50% Fibonacci retracement at 42.46 followed by 42.87. Meanwhile, near-term support is the 23.6% retracement at 41.55 before it eyes the September 11th low at 40.74.

MSCI Emerging Market ETF Daily Chart

Chart created in TradingView

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter