- GBP/USD is switching from a bearish to a bull trend on the daily chart.

- GBP/USD has erased the weekly gains as UK Prime Minister Theresa May warns on a potential ‘no deal’ scenario.

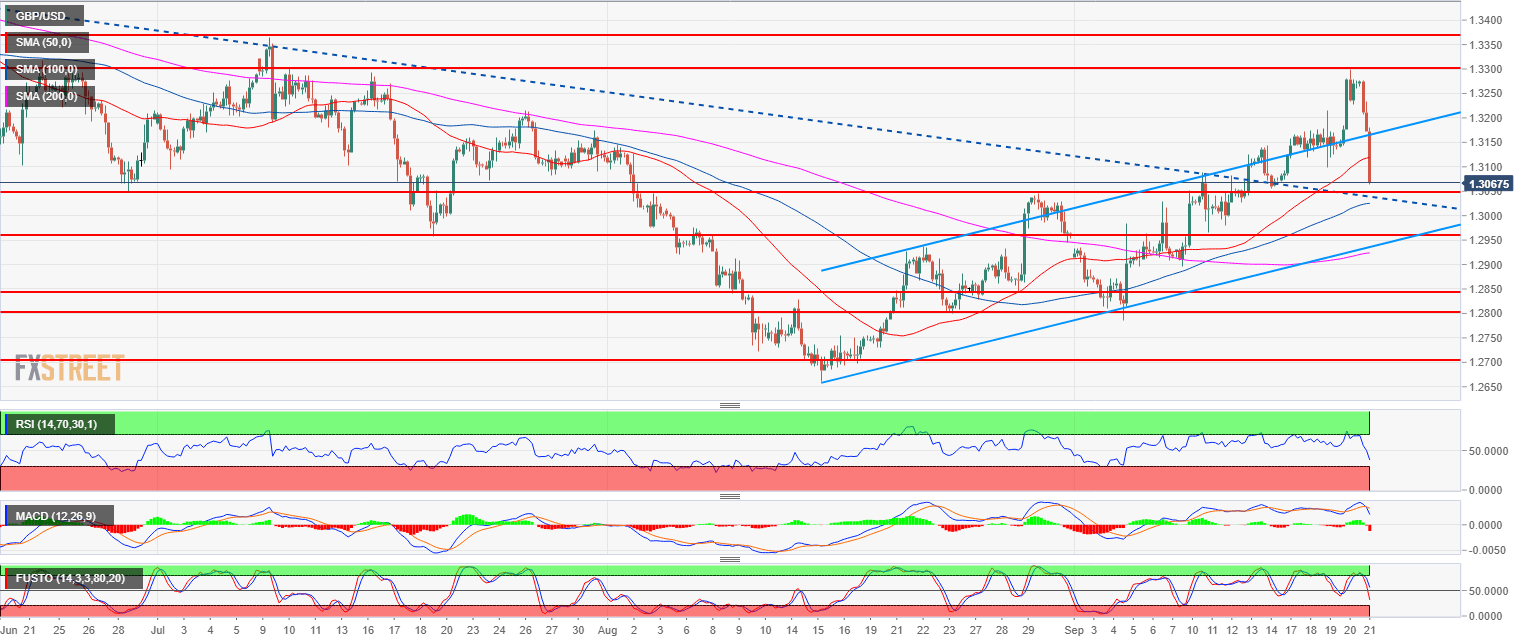

- GBP/USD is trading below its 50-period simple moving average as the market is re-integrating the bull channel (blue lines). Bears made quite some damage and further downward consolidation is to be expected as the RSI, MACD and Stochastics are gaining bearish traction. The main supports are 1.3050 (August 30 swing high, key level) and 1.2957 July 19 swing low.

Spot rate: 1.3070

Relative change: -1.48%

High: 1.3276

Low: 1.3063

Main trend: Bullish

Resistance 1: 1.3082-1.3100 supply/demand level and figure

Resistance 2: 1.3144 last week high

Resistance 3: 1.3200 figure (key support/resistance)

Resistance 4: 1.3300 figure

Resistance 5: 1.3363 July high

Resistance 6: 1.3472 June 7 high

Support 1: 1.3050 August 30 swing high, key level

Support 2: 1.3000 figure

Support 3: 1.2957 July 19 swing low

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.