- Early-session bump on NZ business confidence sees the Aussie getting dragged higher alongside.

- Broader markets are entirely focused on the upcoming US FOMC rate hike.

The AUD/USD has been trapped under the 0.7300 handle, unable to venture further north of 0.7250 as the pair runs into the outer wall of a descending triangle, and a thin economic schedule leaves the Aussie-Dollar fully exposed to the upcoming US Fed rate call. Early Wednesday is seeing a brief pop in the Antipodeans thanks to a better-than-expected reading for New Zealand's business confidence, and the knock-on proximity of the two countries is providing the AUD with a mild boost in an otherwise thin day.

The economic calendar sees little meaningful data for the AUD this week, and broader markets are turning their attention to Wednesday's US Fed showing, where markets are forecasting another 0.25% interest rate hike from the FOMC, and investors will be looking for the Fed's updated dot plot on upcoming rate hikes in the future.

Sentiment within Australia remains a tepid affair, with the Reserve Bank of Australia (RBA) firmly entrenched in a wait-and-see mode that has stretched on for over two years, while the Aussie's domestic economy continues to middle, despite some fringe signs of growth, all of which remains contingent on trade both with and outside of China remaining a positive flag, and with the steepening US-China trade war bulls are having a hard time pushing the buy buttons.

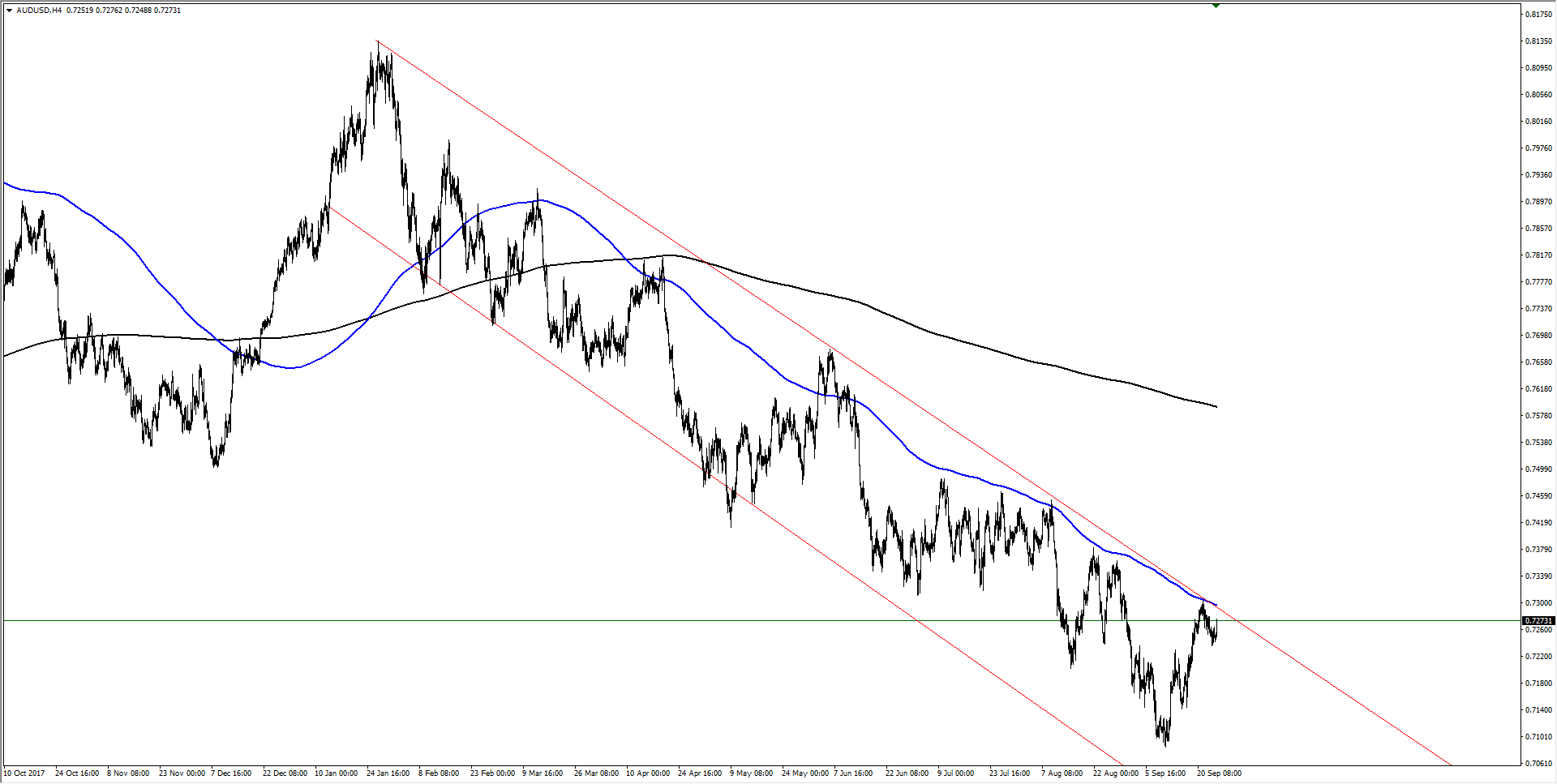

AUD/USD Technical Analysis

The Aussie has remained locked in a firm downtrend for 2018, and the major pair's latest peak just beneath the critical 0.7300 level leaves the long-term chart with another lower high, a pattern that has remained unbroken for nine months. Although the Aussie managed to close in the green for two consecutive weeks against the US Dollar recently, this had more to do with a broad-market sell-off in the Greenback than it did any particular reasons to buy the Aussie, and after the Daily candles dropped a spinning top signal on last Friday's market close, bears will be looking to jump into any confirmable sell-side signals, depending on how the upcoming FOMC rate call drops.

AUD/USD Chart, 4-Hour

| Spot rate | 0.7273 |

| Current week change | 0.18% |

| Previous week high | 0.7304 |

| Previous week low | 0.7141 |

| Support 1 | 0.7233 (200-hour SMA) |

| Support 2 | 0.7141 (previous week low) |

| Support 3 | 0.7085 (major 2018 technical bottom) |

| Resistance 1 | 0.7289 (50-day EMA) |

| Resistance 2 | 0.7304 (four-week high) |

| Resistance 3 | 0.7590 (200-day SMA) |

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.