If Sears fails to emerge from bankruptcy court, Best Buy may see a hearty influx of customers and a boost its bottom line, Loop Capital said Tuesday.

Sears filed for bankruptcy protection Monday, an event Loop Capital analyst Anthony Chukumba said "is likely to eventually result in a complete liquidation." This puts Best Buy in a very good position to reap the benefits of Sears' customers, according to Chukumba. He noted that about 85 percent of Sears' stores are within five miles of a Best Buy store.

"We think Best Buy will pick up its fair share — particularly on the consumer electronics side given the fact Best Buy is the 'last man standing' in terms of dedicated national brick-and-mortar retailers," Chukumba said. "We believe Sears' bankruptcy filing is a major positive for Best Buy."

When the Sears liquidation will happen is Loop's only unanswered question. Chukumba said the firm believes the only thing stopping Sears from liquidating "is how much longer ESL Investments continues funding the company." ESL Investments is the hedge fund run by former Sears CEO Eddie Lampert. It owns about 19 percent of Sears shares outstanding, in addition to the 31 percent Lampert personally holds, according to the latest FastSet filing.

Loop especially expects Sears to liquidate as a result of its bankruptcy filing due to historical precedent. "The vast majority of large retail bankruptcy filings over the past several years have resulted in liquidations," Chukumba said.

If Sears liquidates, Best Buy could see an additional 47 cents a share in adjusted annual earnings from the additional customers. The additional profit would come even as Best Buy competes with several other retailers for Sears and Kmart customers, according to Loop.

J.C. Penney and Walmart will also be looking for a boost from Sears foot traffic, according to Gordon Haskett Research Advisors. Both of those chains have the next closest stores to Sears after Best Buy. Haskett also estimated Kohl's, Macy's and Target should see a bump up in sales.

Loop has a buy rating on Best Buy stock with a price target of $88 a share.

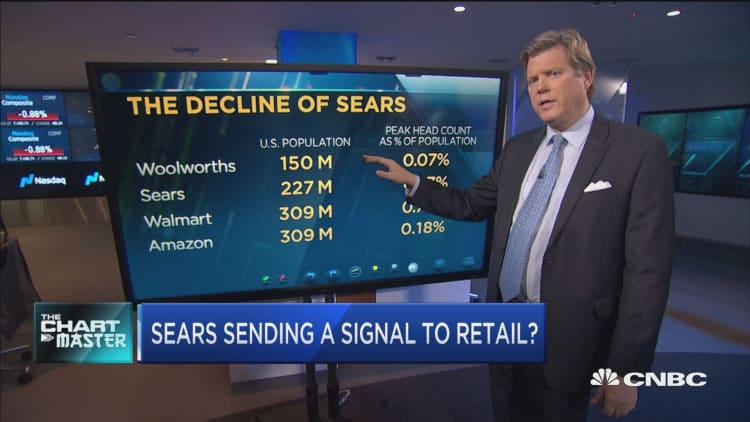

WATCH: Sears just declared bankruptcy--top technician explains what that means for major retailers