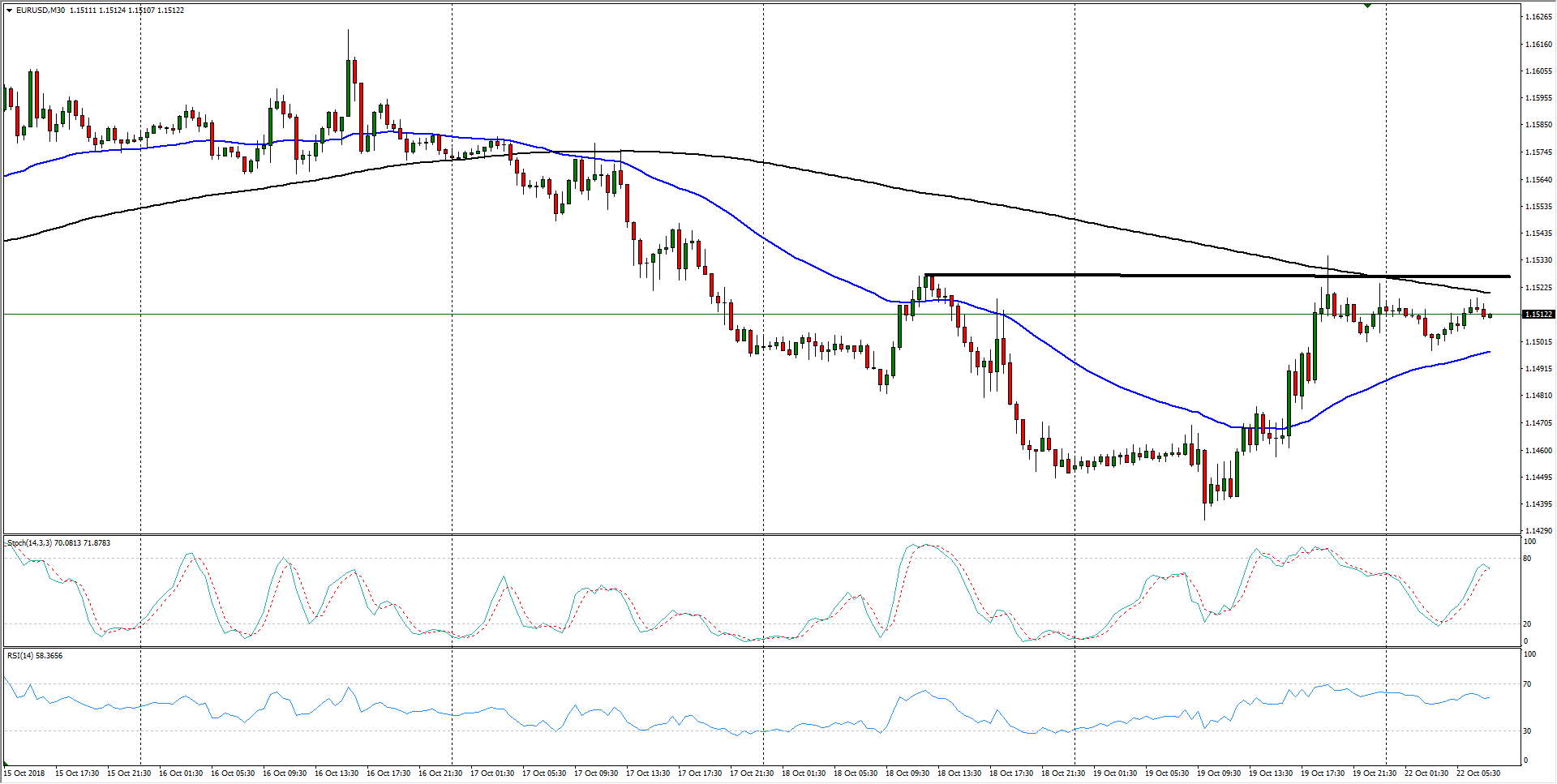

- The previous twenty-four hours of chart activity has the EUR/USD testing into Friday's highs near 1.1535, but the pair's bullish momentum continues to see downside risks as the 50-period moving average keeps the pair from running ahead of itself, and the supporting 200-period moving average is beginning to draw prices back into its trap.

- EUR/USD analysis: more uncertainty ahead

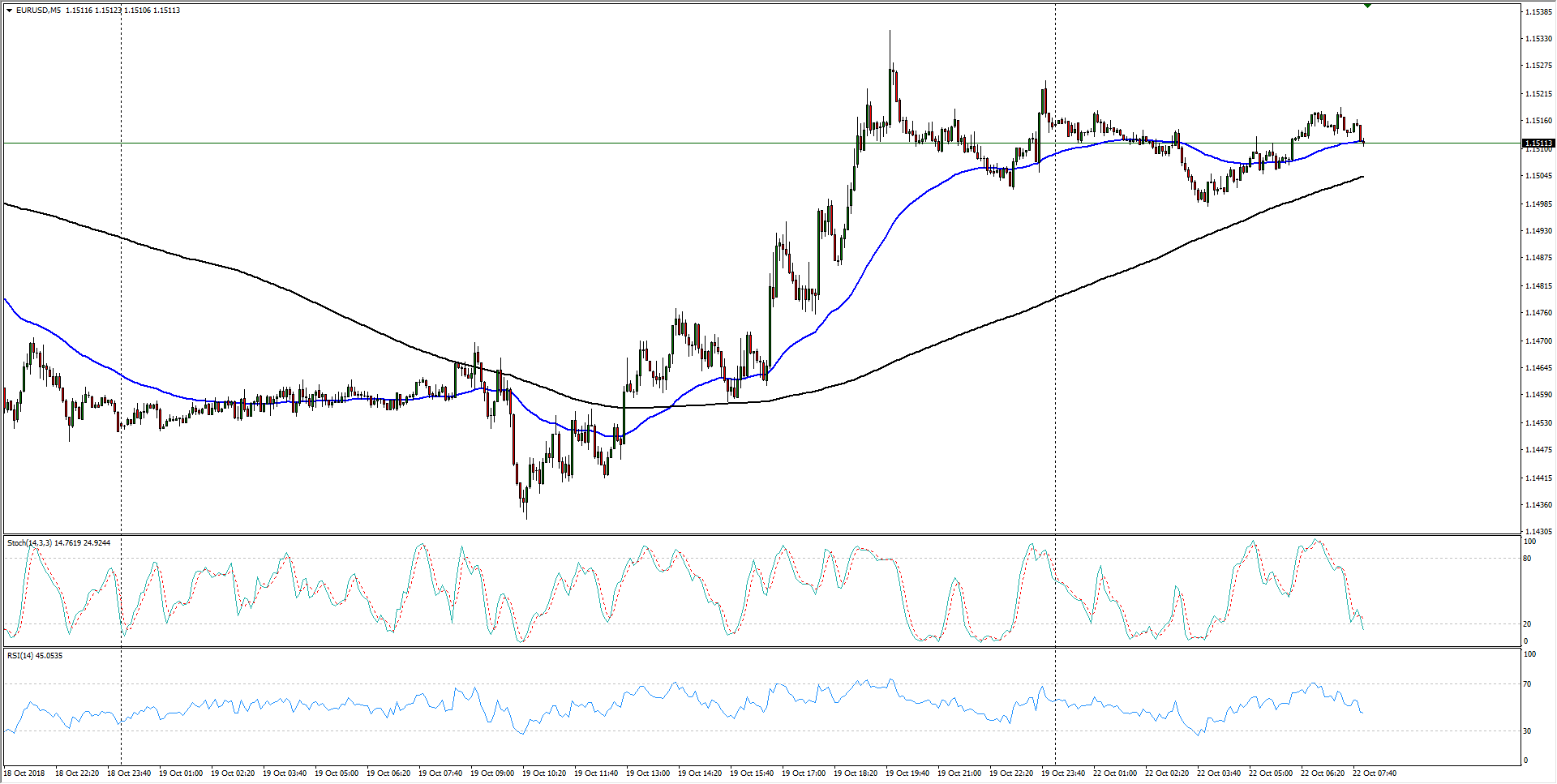

EUR/USD, M5

- The last week has seen the Fiber take a step lower, slipping beneath a previous support level at the 1.1535 region, and resistance is beginning to pile up as the 200-period moving average crosses below the key resistance barrier.

EUR/USD, M30

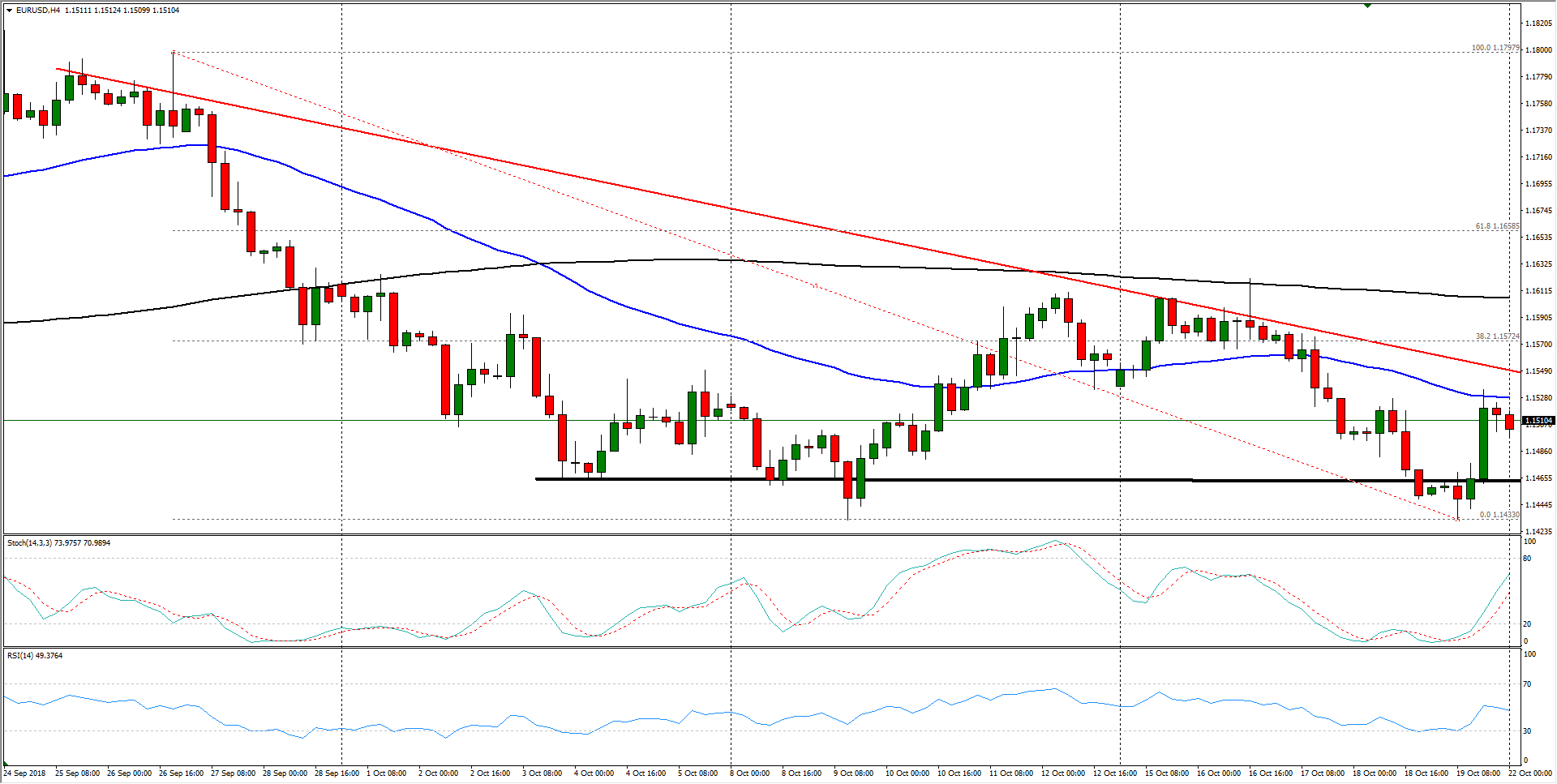

- Over the past month the EUR/USD has slipped from a peak just shy of the 1.1800 major handle, facing declines all the way into 1.1433, and despite support from the 1.1460 zone, the pair has been unable to retake the 38.2% Fibo retracement level of the Fiber's decline, currently sitting at 1.1570, just beyond the declining trendline, currently plotted in as resistance near 1.1550.

EUR/USD, H4

Don't forget to check out FXStreet's Livechart for instant updates about the EUR/USD

EUR/USD

Overview:

Last Price: 1.1511

Daily change: -20 pips

Daily change: -0.173%

Daily Open: 1.1531

Trends:

Daily SMA20: 1.1571

Daily SMA50: 1.1584

Daily SMA100: 1.1623

Daily SMA200: 1.1909

Levels:

Daily High: 1.154

Daily Low: 1.1531

Weekly High: 1.1622

Weekly Low: 1.1433

Monthly High: 1.1816

Monthly Low: 1.1526

Daily Fibonacci 38.2%: 1.1496

Daily Fibonacci 61.8%: 1.1472

Daily Pivot Point S1: 1.1453

Daily Pivot Point S2: 1.1392

Daily Pivot Point S3: 1.1351

Daily Pivot Point R1: 1.1555

Daily Pivot Point R2: 1.1596

Daily Pivot Point R3: 1.1657

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.