Tuesday October 23: Five things the markets are talking about

Global stocks have swung sharply lower overnight, amid growing fears about the health of the Chinese economy and a slew of geopolitical concerns – U.K, Italy and Saudi Arabia.

In Italy, the populist-led government has indicated that they plan to proceed with their spending plans despite the opposition from E.U lawmakers. Markets are awaiting the formal E.U decision on Italy’s budget.

In the U.S, President Trump indicated late Monday he wanted more information about the death of Jamal Khashoggi before the U.S proposed an official reaction.

In the U.K, the ‘no-confidence’ threat to PM Theresa May leadership over Brexit discussions has, thus far, come to nought, but not before pushing sterling to three-week lows earlier this morning.

All this heightened geopolitical risks is pushing investors to seek shelter in safe-haven assets – pushing up prices of the yen (¥112.31), gold ($1,235) and U.S Treasuries (10’s 3.15% -5 bps).

1. Stocks fail miserably

Global equities have failed to gain a third consecutive session reprieve after China announced Monday new measures to ease the funding worries of private companies, as they sought to restore confidence in China’s economy.

In Japan, stocks fell on Tuesday, with the broad Topix index retreating to a seven-month low as subdued corporate earnings and a pullback in global equities weighed on investor sentiment. The Nikkei closed -2.67% lower, while the broader Topix fell -2.63%.

Down-under, Aussie shares also closed lower as sentiment was hit by domestic and global political uncertainty. The S&P/ASX 200 index closed down -1.1%, a third consecutive session of losses, following Monday’s -0.6% drop. In S. Korea the Kospi index fell -2.3% to its lowest level in over two-years. The potential for U.S tariffs on Korean cars and auto parts has been stocks biggest blight for months now.

In China, the Shanghai Composite Index and the Shenzhen A Share dropped -2.3% and -2.1%, while Hong Kong’s Hang Seng was dragged down -2.8% by sinking financial stocks. The overnight losses marked an end to the regions sharpest two-day rise in nearly three-years.

In Europe, regional bourses trade lower across the board tracking weaker Asian indices and lower U.S futures, again pressured by underwhelming corporate earnings.

U.S stocks are set to open deep in the ‘red’ (-1.1%).

Indices: Stoxx600 -1.38% at 354.78, FTSE -0.90% at 6,979.19, DAX -2.16% at 11,275.03, CAC-40 -1.43% at 4,981.00, IBEX-35 -1.19% at 8,702.00, FTSE MIB -1.02% at 18,773.50, SMI -1.12% at 8,762.50, S&P 500 Futures -1.21%

2. Oil falls as the Saudi’s say they will be ‘responsible,’ gold higher

Oil prices has eased a tad ahead of the U.S open after Saudi Arabia said it would play a “responsible role” in energy markets.

Nevertheless, the underlying market sentiment remains somewhat nervous ahead of new U.S. sanctions on Iran’s crude exports that begin on Nov 4.

Brent crude oil is down -55c a barrel at +$79.28, while U.S light crude is -35c lower at +$69.01.

Investors had been worried that Saudi Arabia would cut crude supply in retaliation for potential sanctions against it over the Jamal Khashoggi murder.

The Saudi’s have given assurance that it intends to keep markets well supplied despite its increasing isolation by the western hemisphere.

Saudi Energy Minister Khalid al-Falih stated Monday that they would play a “responsible role” in world energy markets. Basically, the Saudi’s don’t want to lose market share to other world exporters.

OPEC agreed in June to boost supply to make up for the expected shortfall in Iranian exports, however, recent data suggests that OPEC is struggling to add barrels as an increase in Saudi supply was offset by declines elsewhere.

Nevertheless, relief may come from the U.S, where offshore drillers added four oilrigs in the week to Oct. 19, bringing the total count to 873, according to Baker Hughes data last Friday. After months of stagnation, U.S crude production is expected to rise.

However, undermining sentiment is weaker China growth data and the ongoing Sino-U.S trade dispute. The full impact of the trade war is expected to hit markets early next year and provide a considerable drag on oil demand.

Ahead of the U.S open, gold prices have jumped higher overnight as global equities see ‘red,’ weighed down by geopolitical tensions. Spot gold is up +1.1% at +$1,235.95 an ounce, while U.S. gold futures have edged + 1.2% higher to +$1,233.20 an ounce.

3. Central banks monetary policy decisions

Last Friday was a disappointing end to the week for Canadian numbers, as consumer spending and inflation data both dropped into negative territory. The disappointing headlines are not expected to affect the Bank of Canada’s (BoC) plan to hike rates tomorrow (10:00 am EDT) by +25 bps to +1.75% – it would mark the third rate increase in 2018.

Current market consensus believes that Italian budget worries are unlikely to influence the ECB’s upcoming decisions on Thursday – the ECB is expected to stay on track to end net asset purchases in December and raise the deposit rate by +20 bps in Q3, 2019. Draghi and company will certainly be worried about the potential implications of escalating market tensions and true to form, markets can expect the ECB to intervene “if and when” a further escalation raises the chances of a systemic problem.

Sweden’s Riksbank meets tomorrow and the focus will be on whether the central bank will forecast a December or a February rate increase – market expectations are for a Dec hike. Expect little movement to SEK if the Riksbank guides on a December rate increase. Norway’s Norges Bank meets Thursday and no rate announcement is expected.

The Central Bank of the Republic of Turkey (CBRT) is expected to hold its main interest rate steady at its meeting on Thursday. At its September meeting, the CBRT raised its main interest rate by +625 bps to +24%. Having an influence on higher rates was the volatility and negativity of TRY. However, the TRY has recently rallied on the back of Turkey releasing American priest, Andrew Brunson, leading to a softening of diplomatic tensions.

4. Safe haven flows dominate

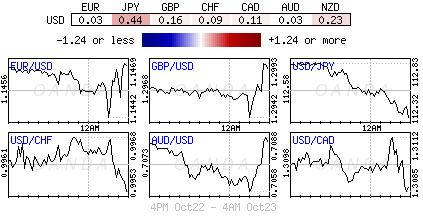

The ‘sea of red’ in stocks across the board has the market bulling up on the historical go to safe haven flows – CHF, JPY, USD, gold and Treasuries.

The market is waiting for the E.U’s formal decision on Italy’s budget, but both parties are looking to sort out their material differences. Investors expect a market-friendly outcome from S&P Ratings on Italy this coming Friday (Oct 26th), similar to Moody’s announcement last week.

EUR/USD (€1.1483) began the session on back foot, but hope expressed by Italy that the ECB would stand by with support has helped to calm any volatility and push the single currency towards the psychological €1.15 handle.

GBP/USD (£1.2989) main focus is Brexit negotiations. PM May is meeting her cabinet today and no leadership challenge appears to be on the horizon, for the moment at least. The pound is handily off its three-week lows regarding May’s tenure.

5. German producer price inflation highest in a year

Data earlier this morning showed that Germany’s producer prices rose the fastest pace in a year in September.

Producer prices grew +3.2% year-on-year in September, after rising +3.1% in the previous month. The market was looking for a +3.0% gain.

The inflation rate was the highest in 12-months, when prices advanced +3.2%.

Digging deeper, on a month-on-month basis, producer prices climbed +0.5% after a +0.3% increase in August. The market was looking for an unchanged at +0.3%.

Ex-energy, PPI remained unchanged m/m, while rising +1.6% on the year.

Note: Energy prices have rallied +8.5% y/y.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.