Slight US Crop Changes Expected With Corn Up & Soybeans Down

Market Analysis

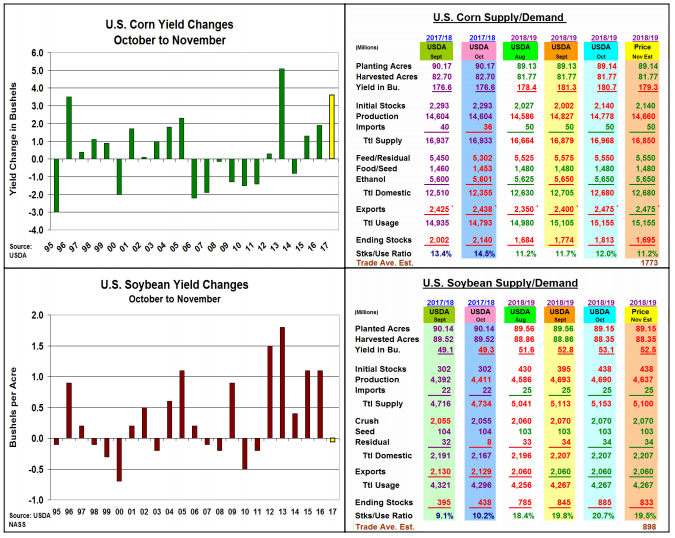

The upcoming USDA’s crop report has the trade anticipating slightly lower US corn and soybean crops resulting in modest changes in each upcoming 2018/19 balance sheets on November 8. A wire service survey is projecting 57 million drop in the US corn output to 14.721 billion bu. crop while this same trade group is expecting a 14 million bu. decline in the US soybean crop to 4.676 billion bu. This will mean a 0.7 bu. drop in the US corn yield to 180.0 while soybeans’ average US yield may slip just 0.2 bu to 52.9 bu. from last month’s 53.1 level.

This year’s US harvest has been two sided. The ECB has processed at or ahead of its normal pace in most places, It has been quite different west of the Mississippi. Excessive rains across northern IA and southern MN delayed planting in May and early June. Above normal heat during summer and heavy rains from last half Sept. into mid-Oct. has impacted corn’s harvest and increased field losses. Recent field updates from this region haven’t been a strong as out East. Despite corn’s Nov yield being higher than Oct in 4 of the last 5 years, we anticipate 1.4 bu. decline to 179.3 bu. this month. This could produce a 118 million smaller crop resulting in similar decline in corn’s US carryover since the USDA isn’t likely to change its demand forecast this month.

In soybeans, recent W. Midwest field reports haven’t been impressive and reports of field losses & seed damage have surfaced from this fall’s excessive rainfall. Despite 6 of the past 10 years of higher Nov US bean yields than Oct, we expect a 0.6 bu. lower yield from the current record 53.1 bu. US level. This 53 million bu. smaller crop will also likely drop soybeans’ carryover level since the USDA isn’t likely to adjust its 2018/19 soy demand levels this early in the year. However, US ending stocks will remain about 400 million higher than last year. With no US wheat update, no US stock change likely.

What’s Ahead

This month’s US production levels remain important. However, the seasonal need to move supplies through our US river system for export before it closes in early December and US/China trade news ahead of Nov 30 G-20 meeting will likely drive US CBOT prices this month. Be prepared to advance sales 20% if action above Dec’s $3.78 and Jan’s $8.95 opens up 10-15 cent rally potential in corn and beans.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more