NZD/USD Technical Strategy: FLAT

- New Zealand Dollar attempting to resume advance after support retest

- Monthly chart positioning warns against bets on upside follow-through

- Opting for the sidelines until better-defined trade setup presents itself

See our free trading guide to help build confidence in your NZD/USD trading strategy !

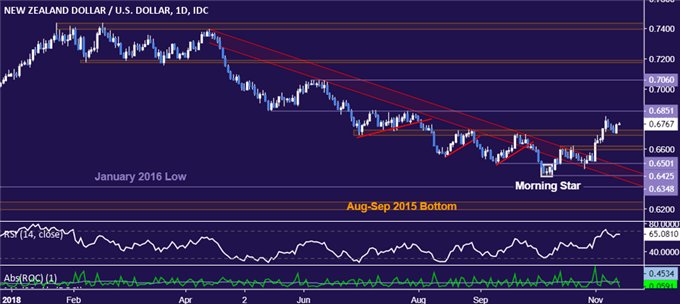

The New Zealand Dollar is attempting to revive upward momentum after retesting resistance-turned-support in the 0.6688-0.6726 area. Immediate resistance is at 0.6851, with a break above that confirmed on a daily closing basis opening the door for a test of the June 6 high at 0.7060.

Alternatively, a turn back below 0.6688 paves the way for another challenge of former range top resistance in the 0.6592-0.6619 zone. This followed by a more potent threshold at the 0.65 figure, marked by a chart inflection point in play since mid-September and former falling trend line resistance (now recast as support).

While daily chart positioning seems to make a compelling case for the upside scenario, turning to the longer-term setup undermines conviction. Prices appear to be retesting a broken two-year range floor as sellers test the bounds of a rising trend established in October 2000.

While the structural uptrend remains intact for now, it is clearly under pressure. If nothing else, prices are pushing up against major resistance, with a confirmed breakout needed to make a compelling case for upside follow-through.

This seems to argue against taking up the long side on risk/reward grounds. Entering short without a defined bearish reversal signal does not appear to be any more attractive however. On balance, opting for the sidelines seems most prudent for now.

NZD/USD TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the Comments section below or @IlyaSpivak on Twitter