Crude Oil Weekly Technical Outlook – WTI Plunges To Fresh Yearly Lows

In this series, we scale-back and take a look at the broader technical picture to gain a bit more perspective on where we are in trend. Oil prices have continued to plummet with crude attempting its sixth consecutive weekly decline into a critical support confluence at the yearly lows. Here are the key targets & invalidation levels that matter on the Crude Oil (WTI) weekly chart.

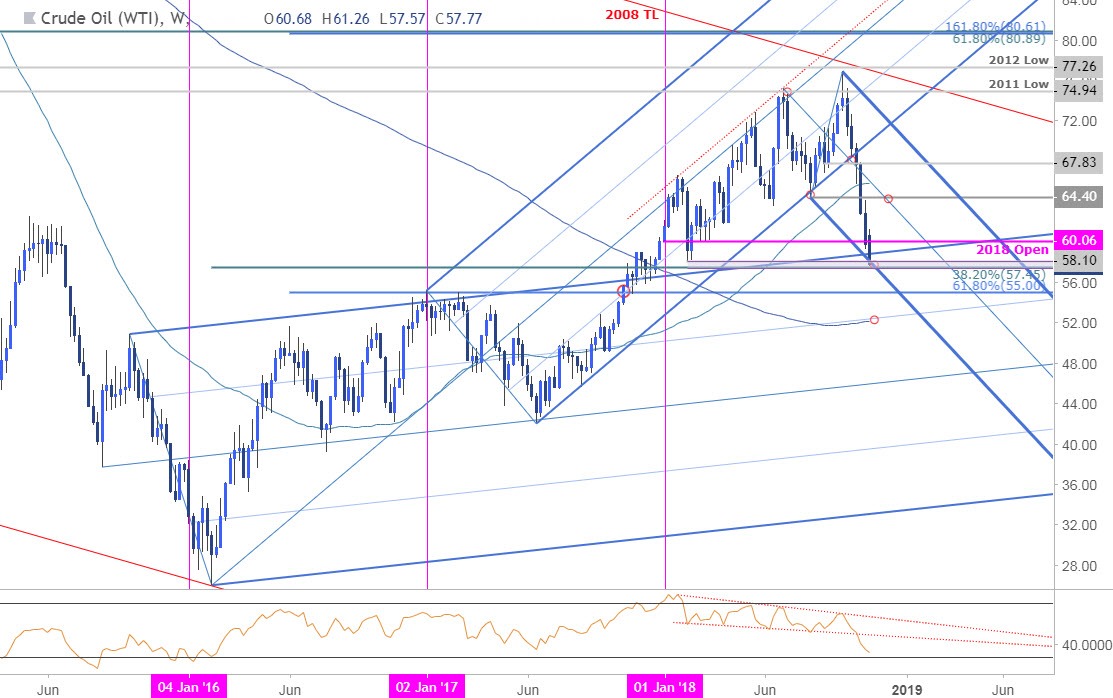

CRUDE OIL WEEKLY PRICE CHART (WTI)

(Click on image to enlarge)

Notes: In last month’s Crude Oil Weekly Technical Perspective we highlighted a critical support confluence at the lower bounds of a multi-year formation in price around 67.83. A break lower in late-October has fueled a decline of more than 23% from the yearly highs with price now targeting the next major support hurdle at 57.45-58.10 – a region defined by the 38.2% retracement of the 2016 advance, the 2018 opening-range low and the lower parallel of the descending pitchfork extending off the yearly highs.

The focus is on this critical range with the immediate short-bias at risk near-term while above 57.45. Initial resistance stands at the yearly open at 60.06 backed by the median-line / August low at 64.40 (near-term bearish invalidation). A break / close lower from here risks accelerated losses in crude prices with such a scenario targeting the 55-handle backed by the 200-week moving average around ~52.25.

Bottom line: Crude Oil is approaching the first major support confluence at 57.45-58.10. We’re looking for a reaction here with a break/close below targeting subsequent objectives towards the 200-day moving average. From a trading standpoint, a good spot to reduce short exposure / lower protective stop – be on the lookout for a possible near-term exhaustion low. That said, this is a make-or-break level for crude at downtrend support; watch the weekly close for guidance.

CRUDE OIL TRADER SENTIMENT

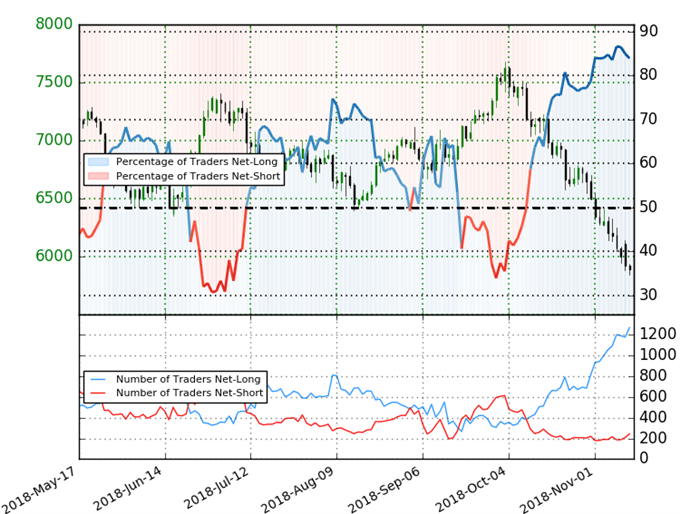

- A summary of IG Client Sentiment shows traders are net-long Crude Oil - the ratio stands at +5.21 (83.9% of traders are long) – bearish reading

- Traders have remained net-long since October 11th; the price has moved 20.2% lower since then

- Long positions are3.5% higher than yesterday and 18.1% higher from last week

- Short positions are 14.0% higher than yesterday and 19.6% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Crude Oil prices may continue to fall. Yet traders are less net-long than yesterday & compared with last week and the recent changes in sentiment warn that the current Crude Oil price trend may soon reverse higher despite the fact traders remain net-long.

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more