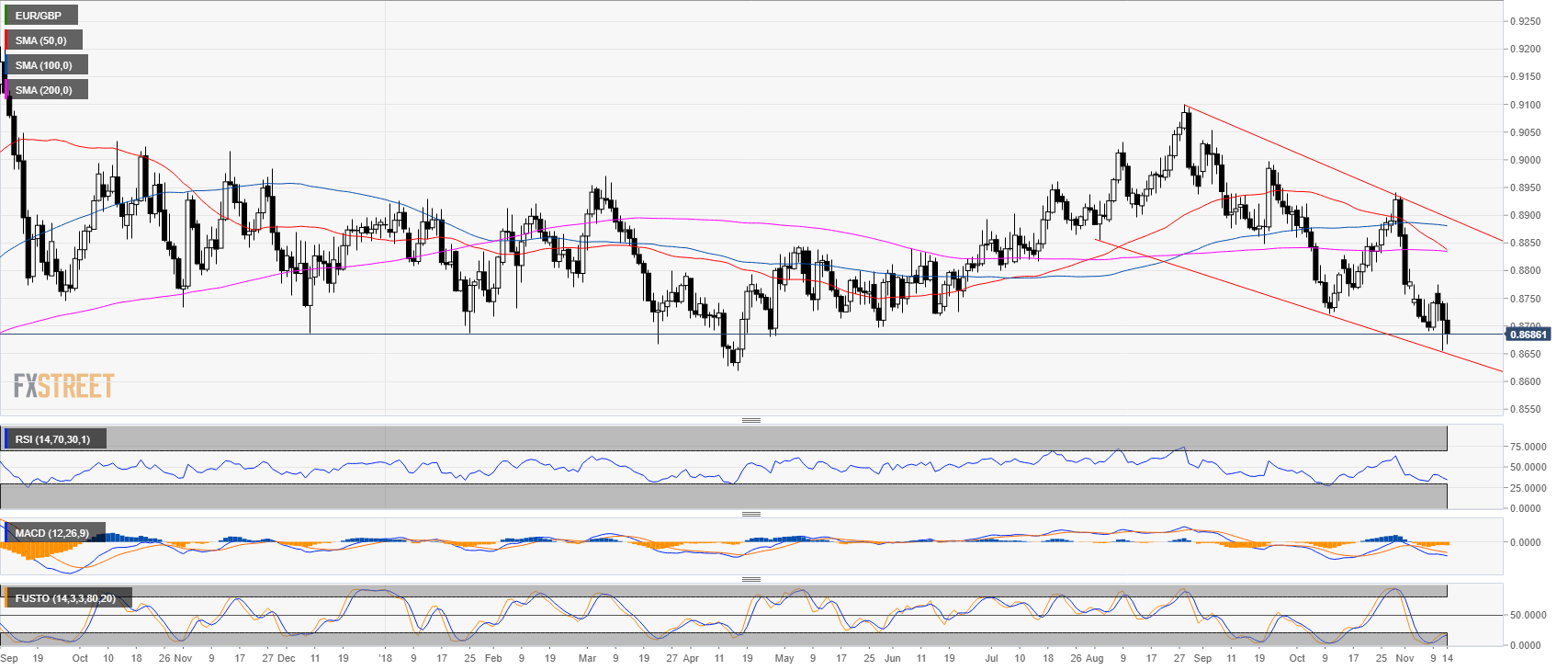

EUR/GBP daily

- EUR/GBP is trading at the bottom of a bear channel.

EUR/GBP 4-hour chart

- EUR/GBP is trading below its main simple moving averages.

- Technical indicators are in negative territories.

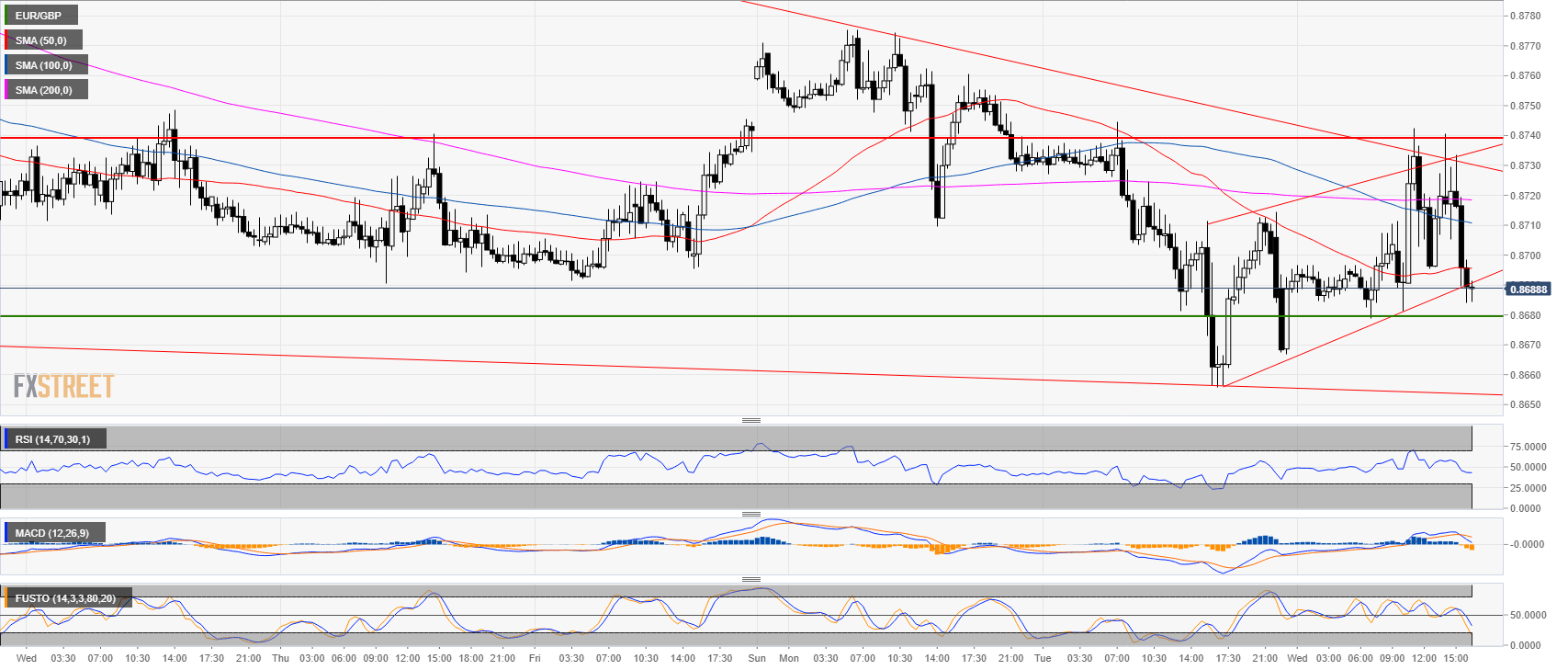

EUR/GBP 30-minute chart

- On the intraday chart, EUR/GBP is displaying indecision with 0.8740 capping price to the upside and 0.8680 to the downside.

- The Brexit headlines have been crossing the wires non-stop creating confusion among investors.

Additional key levels at a glance:

EUR/GBP

Overview:

Last Price: 0.8689

Daily change: -22 pips

Daily change: -0.253%

Daily Open: 0.8711

Trends:

Daily SMA20: 0.8798

Daily SMA50: 0.8844

Daily SMA100: 0.8882

Daily SMA200: 0.8836

Levels:

Daily High: 0.8744

Daily Low: 0.8656

Weekly High: 0.8774

Weekly Low: 0.869

Monthly High: 0.8942

Monthly Low: 0.8722

Daily Fibonacci 38.2%: 0.869

Daily Fibonacci 61.8%: 0.8711

Daily Pivot Point S1: 0.8663

Daily Pivot Point S2: 0.8615

Daily Pivot Point S3: 0.8574

Daily Pivot Point R1: 0.8752

Daily Pivot Point R2: 0.8792

Daily Pivot Point R3: 0.884

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Gold price remains depressed near $2,370 amid bullish USD, lacks follow-through selling

Gold price (XAU/USD) attracts some sellers during the early part of the European session on Tuesday and reverses a major part of the overnight recovery gains from the $2,325-2,324 area, or a multi-day low.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

The Canadian Consumer Price Index is seen gathering some upside traction in March. The BoC deems risks to the inflation outlook to be balanced. The Canadian Dollar navigates five-month lows against the US Dollar.