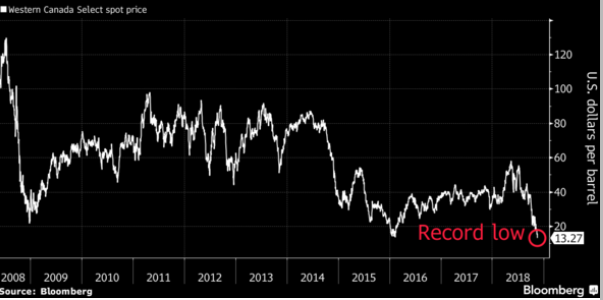

The Perfect Storm Hits The Canadian Oil Sector

As with all storms it usually is building up slowly, but when it hits it can be quite devastating. Yesterday, Canadian oil prices hit a record low of $13.27 bbl as the full brunt of the storm hit western Canada. The price of Canadian Western Select dipped below that experienced during the 2008 financial crisis and the world collapse of oil prices in 2014. The price represents a $43 /bbl discount to the West Texas Intermediate and all but assures that Canadian producers are unprofitable. Storms eventually do pass through and usually last a short while, so the real questions facing Canadian producers are: what caused the storm and how long will it last? The answer may not be very reassuring to Canadian producers.

Canadian oil producers face challenges on both the demand and supply side of the industry. Canadian exports face a rising U.S. production and stockpiling. U.S. production is just shy of 12m bbl/d, a record high, placing the United States as the largest producer in the world. U.S. crude inventory levels just exceeded 10m bbls last week, the highest level since January 2017. The oversupply situation is a reflection of projected lower domestic demand and record levels of production. As long as the United States continues to pump record levels of oil out of the ground, Canadian export prices will remain depressed.

Western Canadian exports are constrained by pipeline shortages. As a consequence, major producers, such as Canadian Natural Resources Ltd. and Cenovus Energy Inc., have instituted production cutbacks and there is a growing chorus calling for the Alberta government to impose mandatory production cuts across the province to prevent further price erosion.

These developments suggest that we can expect prolonged price weakness. Canadian pipeline companies have been contending with the regulatory authorities and environment groups opposing pipeline expansion for a decade or more. The proposed Trans Mountain pipeline between Alberta and the B.C. coast was dealt another blow when a Federal court required that the Federal government undertaken more extensive consultations with indigenous groups in Canada. And, a U.S. court in Montana put the XL pipeline on hold last week when it ruled that the U.S. State Department had not fully considered potential oil spills and other environmental impacts and ordered a full review to be undertaken by the government. Canada cannot count upon any quick resolution to these pipeline debates anytime soon and so the supply constraints will continue to depress prices.

From a macroeconomic perspective, the oil price collapse puts pressure on the Bank of Canada to respond. In 2014 when world prices dropped from around $100/ bbl to $40 /bbl, the Bank of Canada responded quickly by slashing the bank rate twice to a record low of ½ percent. Now, facing a similar energy crisis, not only has the Bank remained silent on the impact of the oil price collapse, but it has, as yet, not wavered from its stated goal of continued rate increases. To the extent that oil prices have every reason to remain at these depressed levels for the foreseeable future, the Bank of Canada will have to re-consider its stated goal of pushing up interest rates.