In the aftermath of the global financial crisis, the banking industry was persona non grata with the public, blamed -- and not unfairly so -- for playing a role in causing what would be the worst global recession in 80 years. Few financial institutions were more emblematic of all that was wrong with banking than one of the biggest, Bank of America Corp. (BAC 1.59%).

In the half-decade following America's slow climb out of the depths of the crisis, no other American bank would pay more in fines, lawsuit settlements, or court penalties than Bank of America, which has paid more than $90 billion in damages and fines over the past decade. How bad of a bad actor was BofA? It has been subject to three of the five biggest separate banking fines in history, and all in the past decade.

It may be a stretch to expect BofA alone to make you a millionaire. But it can help you get there. Image source: Getty Images.

But today, Bank of America has made a remarkable comeback. The fines and legal implications have been dealt with. Its balance sheet is much stronger and its asset quality has improved. Furthermore, its operations are improved, as its steadily falling efficiency ratio demonstrates. But is it the kind of stock that can make investors rich?

I'll say this right off the bat: I don't expect Bank of America to be the kind of stock that can turn $10,000 into $1 million over the next 20 years. But I do see it as a great business selling for a reasonable price, that also has a lot of things in its favor. Bank of America alone may not be a millionaire-maker stock, but it's still deserving of a place in a diversified portfolio.

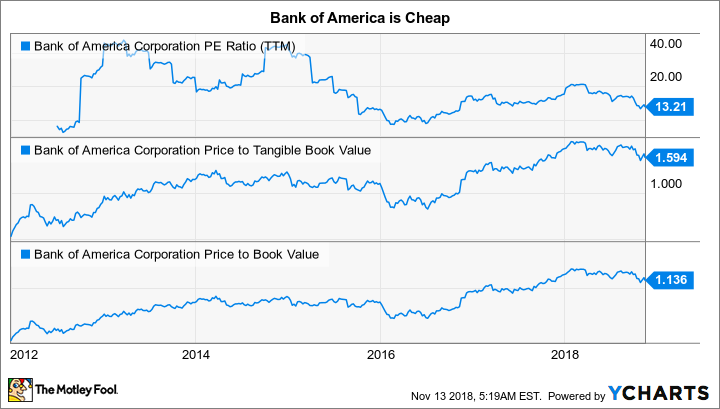

Bank of America is a good value

While it may not be priced at the dirt-cheap valuations it has sold for in the past, Bank of America stock still represents a solid value:

BAC PE Ratio (TTM) data by YCharts.

This is particularly true when we consider the historical context. When BofA shares sold for less than book value, the bank was still dealing with significant uncertainty surrounding its legal risks. There were still ongoing lawsuits from multiple states related to its mortgage-related sins, and its balance sheet was also a bit of a mess.

Fast-forward to today, and the improvements under CEO Brian Moynihan have resulted in a more stable and more profitable business. Yet even as investors have steadily shown a willingness to pay a higher premium -- best demonstrated by the steady increase in its price-to-book value -- Bank of America is still cheaper than other big-bank peers:

BAC PE Ratio (TTM) data by YCharts.

Its improving results could make it a steal

To some extent, BofA should trade for a lower book value multiple. After all, it has produced lower returns than all of its better-valued peers for years now:

BAC Return on Equity (TTM) data by YCharts.

But that argument alone ignores how much BofA has improved its returns:

BAC Return on Equity (TTM) data by YCharts.

Getting back to 10% and 1% returns on equity and assets, respectively -- two key benchmarks for banking returns -- is a major accomplishment. Furthermore, I think investors can expect its returns to continue getting better. BofA is likely to continue to lower expenses as it invests in more online banking and closes banking centers, helping improve returns.

But more importantly, BofA has a huge mix of noninterest-bearing deposits -- over $400 billion at last count -- which should allow it to benefit in a bigger way from rising interest rates. Management says 100 basis points in rising interest rates -- we've already seen 75 BPS this year -- would add nearly $3 billion in extra net interest income.

Not a millionaire maker, but a solid value that can be part of a millionaire-maker portfolio

If you're lucky enough to invest in a single stock that eventually makes you a millionaire, that's awesome. But it's unlikely and I wouldn't count on it happening. But what you can count on helping you reach millionaire status is regularly investing a portion of your income into high-quality companies at reasonable prices, and holding for the long term.

Today, Bank of America meets the criteria as high-quality and good price. It sells for a reasonable valuation, and under Brian Moynihan it has become a very good business with solid prospects that's built to survive the inevitable ups and downs of the banking and economic cycles.

I'll make no promises that a BofA investment will make you rich, or that it will even be profitable in three or five years. But I fully expect making a long-term investment in the bank across multiple credit cycles will pay off. As a shareholder, I'm personally counting on it.