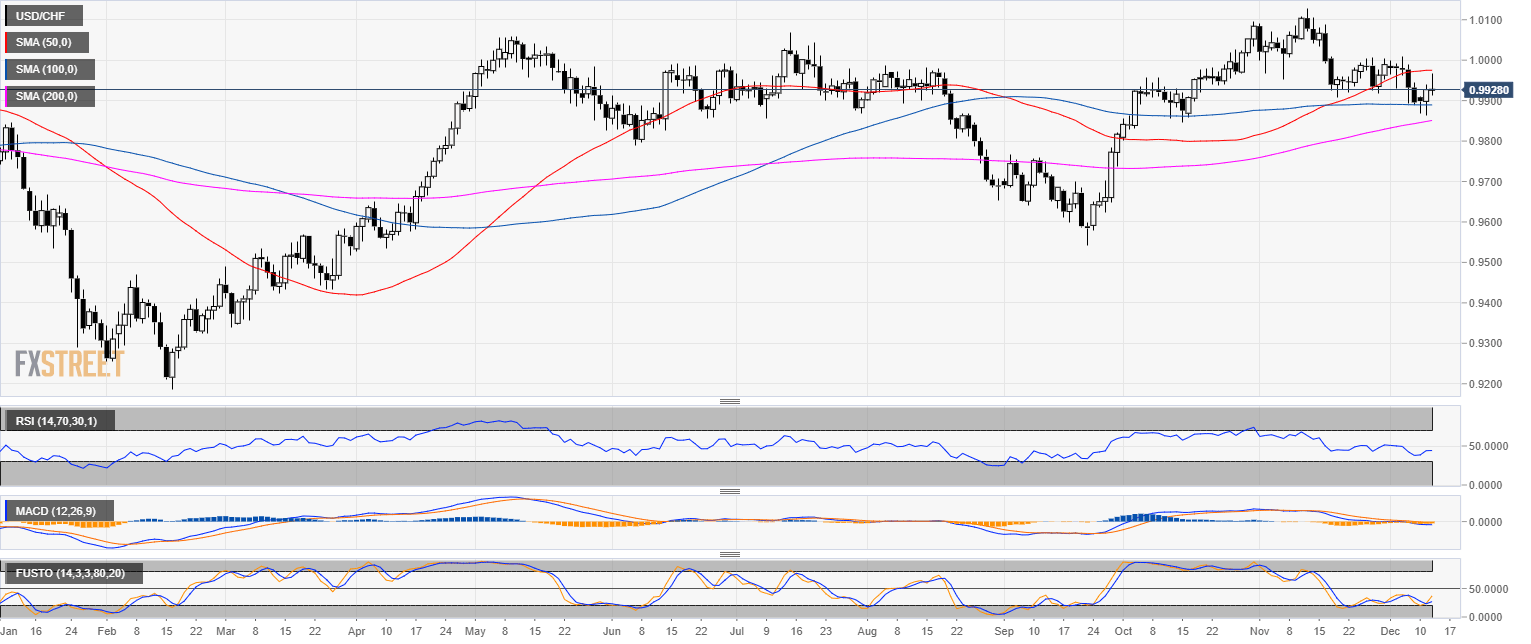

USD/CHF daily chart

- USD/CHF is trading in a bull trend above the 200-day simple moving average (SMA).

- USD/CHF rejected the 50 SMA this Wednesday.

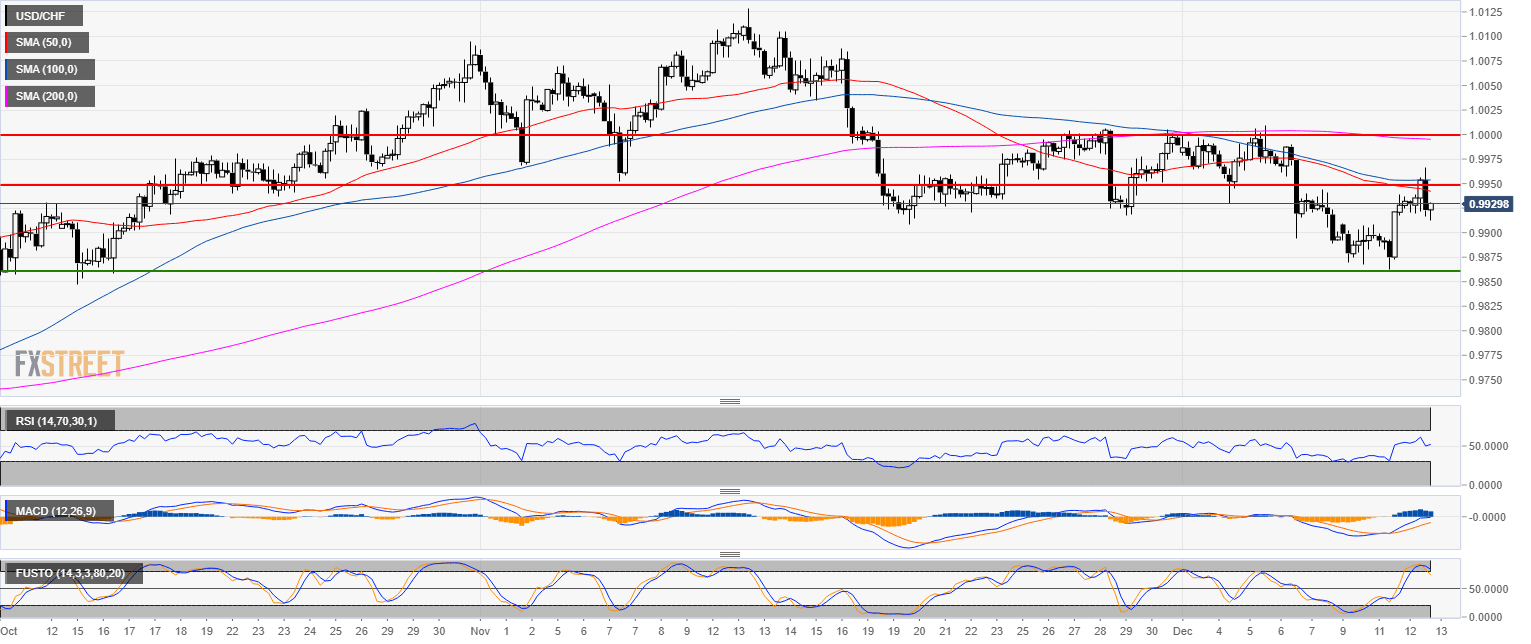

USD/CHF 4-hour chart

- Bulls are ultimately targeting the parity level but 0.9960 resistance must be cleared first.

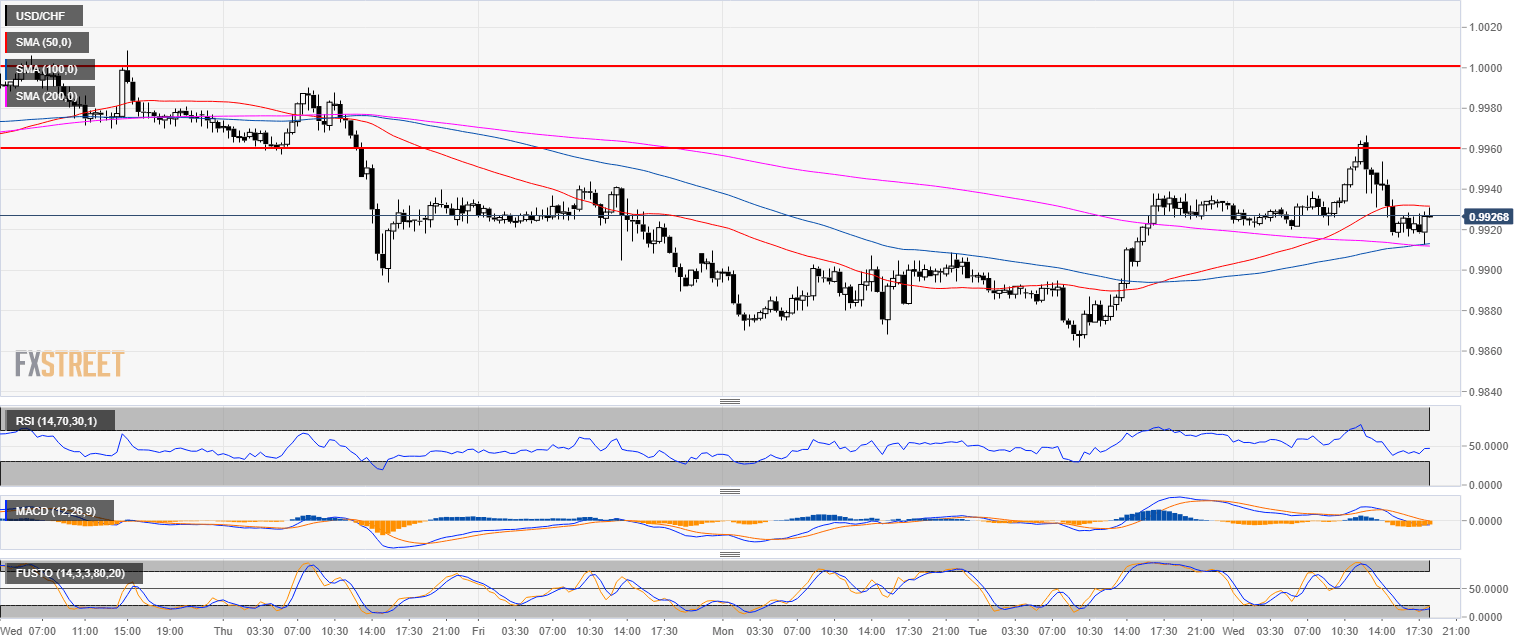

USD/CHF 30-minute chart

- USD/CHF bulls found support at the 100 and 200 SMA.

- Buyers will likely try to get reach the 0.9960 level.

Additional key levels

USD/CHF

Overview:

Today Last Price: 0.9926

Today Daily change: -1.0 pips

Today Daily change %: -0.0101%

Today Daily Open: 0.9927

Trends:

Previous Daily SMA20: 0.9967

Previous Daily SMA50: 0.9975

Previous Daily SMA100: 0.989

Previous Daily SMA200: 0.9845

Levels:

Previous Daily High: 0.9939

Previous Daily Low: 0.9862

Previous Weekly High: 1.0009

Previous Weekly Low: 0.9889

Previous Monthly High: 1.0129

Previous Monthly Low: 0.9908

Previous Daily Fibonacci 38.2%: 0.991

Previous Daily Fibonacci 61.8%: 0.9891

Previous Daily Pivot Point S1: 0.988

Previous Daily Pivot Point S2: 0.9832

Previous Daily Pivot Point S3: 0.9803

Previous Daily Pivot Point R1: 0.9957

Previous Daily Pivot Point R2: 0.9986

Previous Daily Pivot Point R3: 1.0034

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.