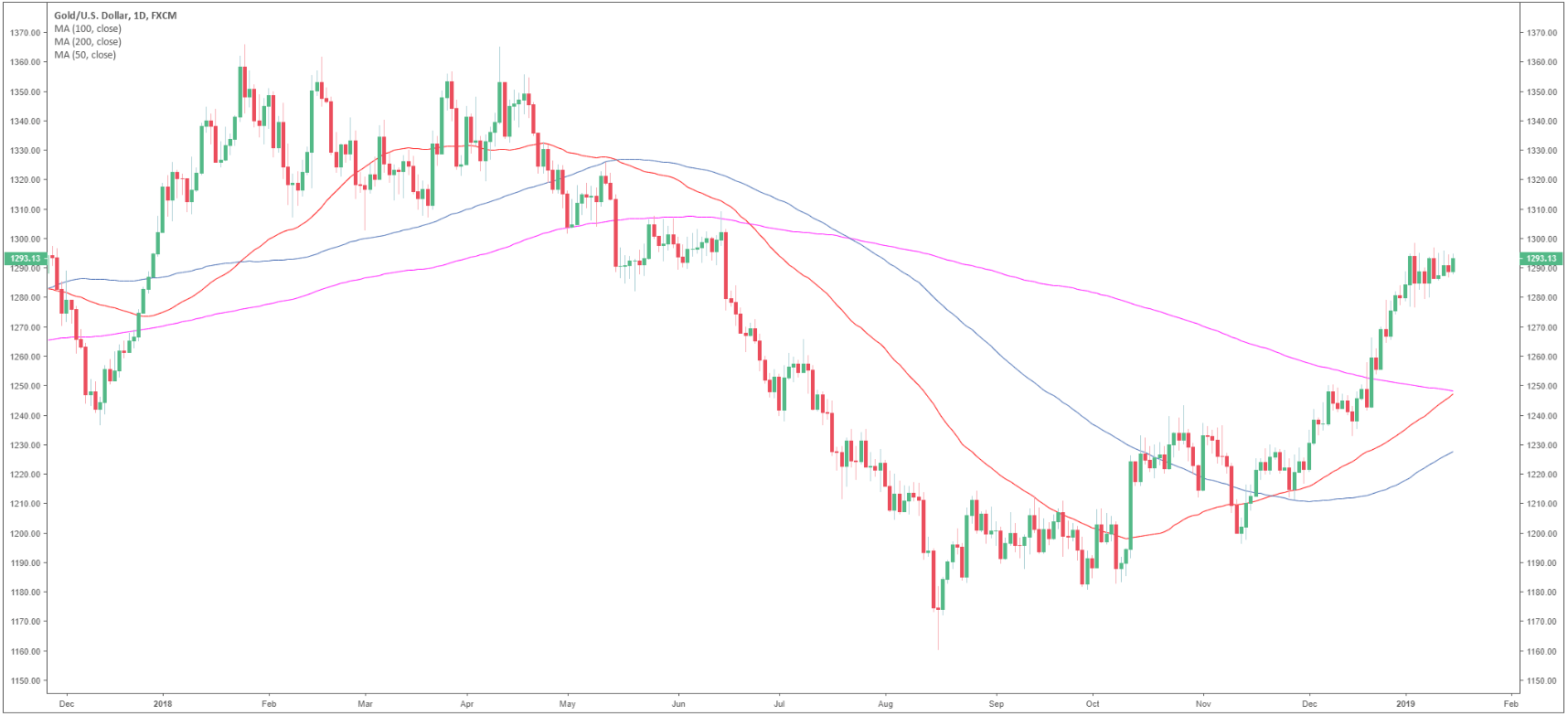

Gold daily chart

- Gold is trading in a bull trend above its main simple moving averages (SMAs).

- The last bearish target at the 1,287.00 level has been hit to the pip.

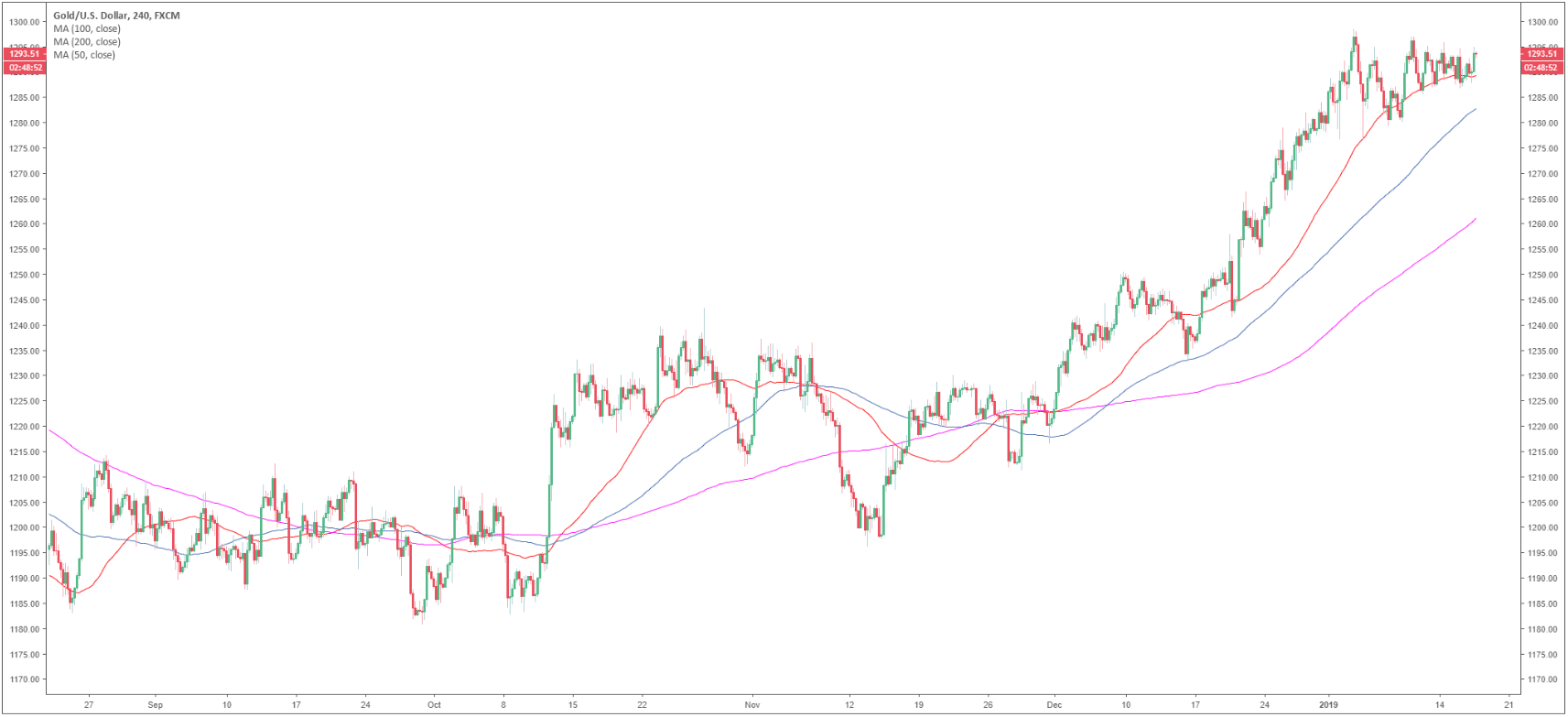

Gold 4-hour chart

- Gold is trading above its main SMAs suggesting bullish momentum in the near-term.

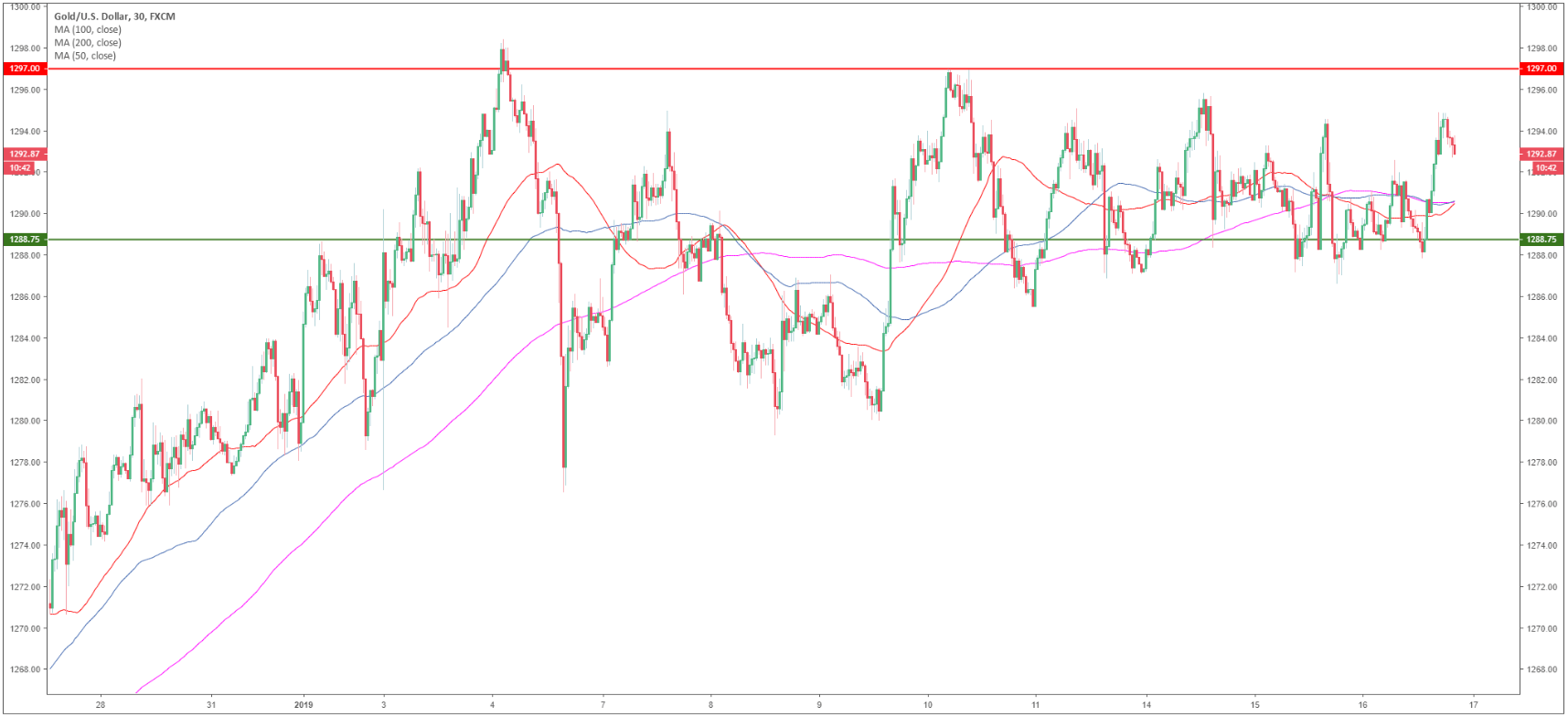

Gold 30-minute chart

- The market is set to decline to the 1,288.75 target.

- Resistance is seen at the 1297.00 level.

Additional key levels

XAU/USD

Overview:

Today Last Price: 1293.91

Today Daily change: 4.9e+2 pips

Today Daily change %: 0.376%

Today Daily Open: 1289.06

Trends:

Previous Daily SMA20: 1278.53

Previous Daily SMA50: 1247.69

Previous Daily SMA100: 1230.43

Previous Daily SMA200: 1228.94

Levels:

Previous Daily High: 1294.75

Previous Daily Low: 1286.95

Previous Weekly High: 1297.15

Previous Weekly Low: 1279.35

Previous Monthly High: 1284.7

Previous Monthly Low: 1221.39

Previous Daily Fibonacci 38.2%: 1289.93

Previous Daily Fibonacci 61.8%: 1291.77

Previous Daily Pivot Point S1: 1285.76

Previous Daily Pivot Point S2: 1282.45

Previous Daily Pivot Point S3: 1277.96

Previous Daily Pivot Point R1: 1293.56

Previous Daily Pivot Point R2: 1298.05

Previous Daily Pivot Point R3: 1301.36

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.