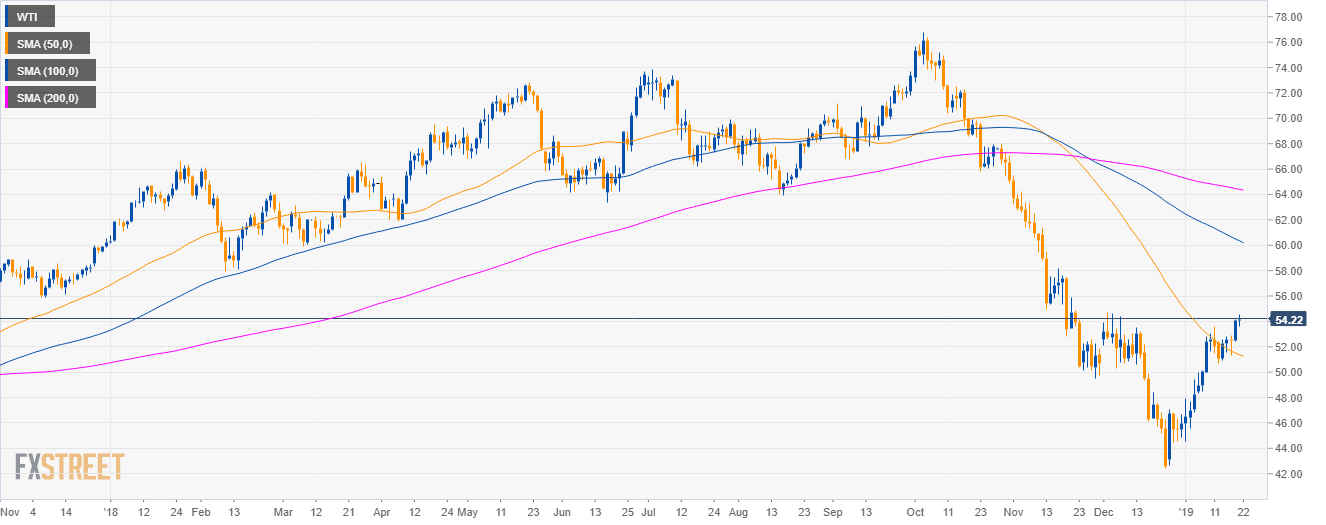

Oil daily chart

- Crude oil WTI is in a bear trend below the 100 and 200-day simple moving averages (SMAs).

- However, bulls broke above the 54.00 figure and the 50 SMA.

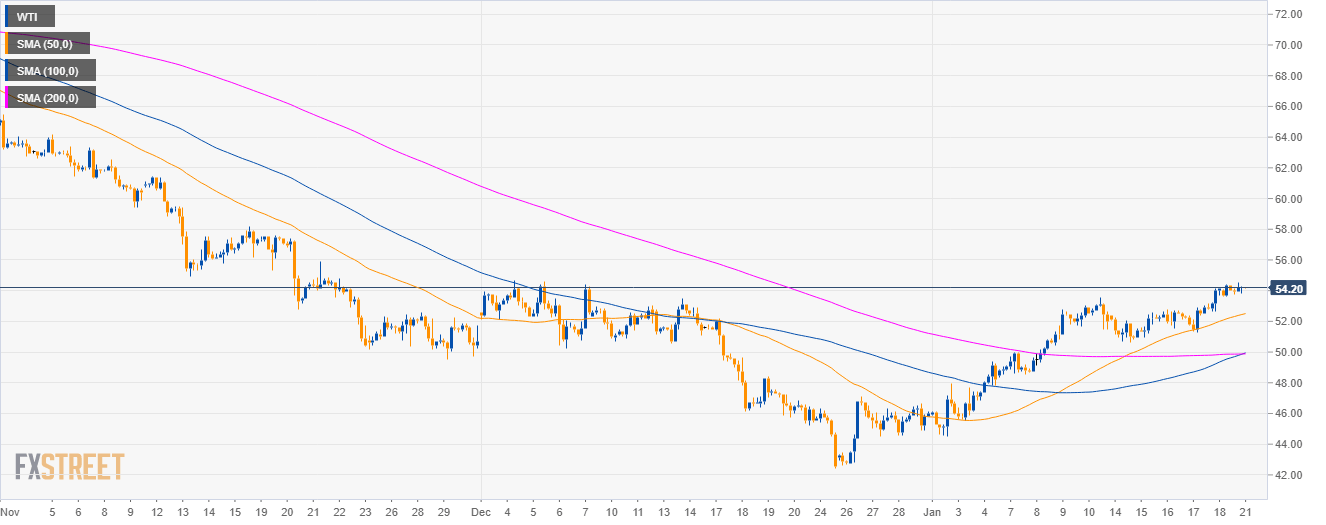

Oil 4-hour chart

- WTI bulls have reclaimed the main SMAs suggesting bullish momentum in the near-term.

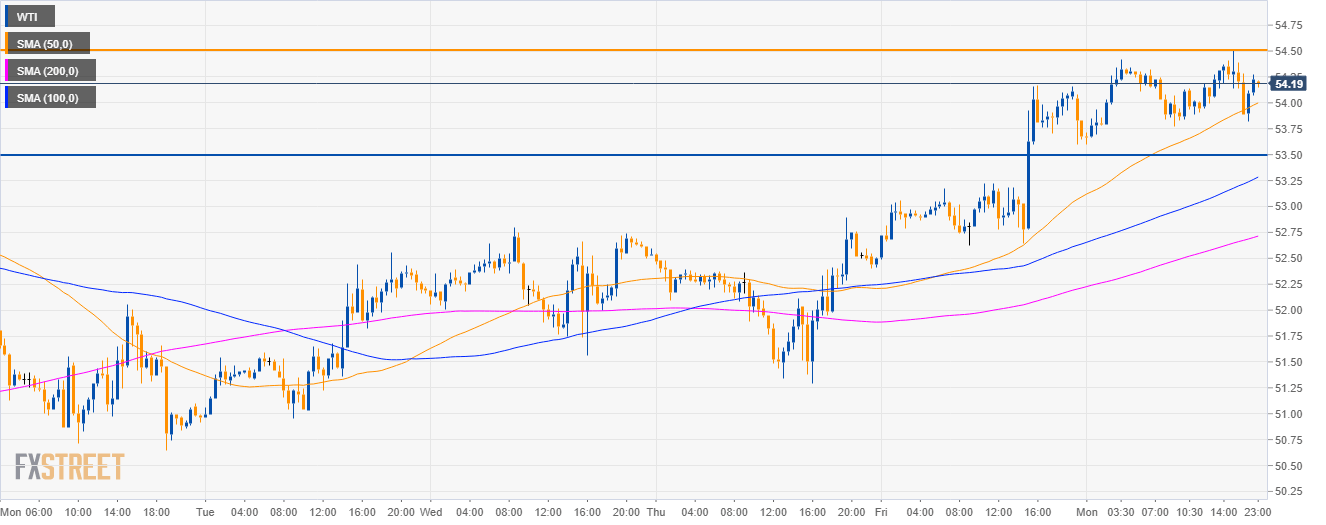

Oil 30-minute chart

- WTI is set to depreciate below the 54.50 resistance as bears might lead the market to 53.50 support.

Additional key levels

WTI

Overview:

Today Last Price: 54.23

Today Daily change: 0.12 pips

Today Daily change %: 0.22%

Today Daily Open: 54.11

Trends:

Daily SMA20: 49.2

Daily SMA50: 50.93

Daily SMA100: 59.71

Daily SMA200: 64.11

Levels:

Previous Daily High: 54.17

Previous Daily Low: 52.4

Previous Weekly High: 54.17

Previous Weekly Low: 50.65

Previous Monthly High: 54.68

Previous Monthly Low: 42.45

Daily Fibonacci 38.2%: 53.49

Daily Fibonacci 61.8%: 53.08

Daily Pivot Point S1: 52.95

Daily Pivot Point S2: 51.79

Daily Pivot Point S3: 51.18

Daily Pivot Point R1: 54.72

Daily Pivot Point R2: 55.33

Daily Pivot Point R3: 56.49

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD regains 1.2350 ahead of UK PMIs

GBP/USD is recovering ground above 1.2350 in the European session, as the US Dollar comes under fresh selling pressure on improving risk sentiment. The further upside in the pair could be capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.