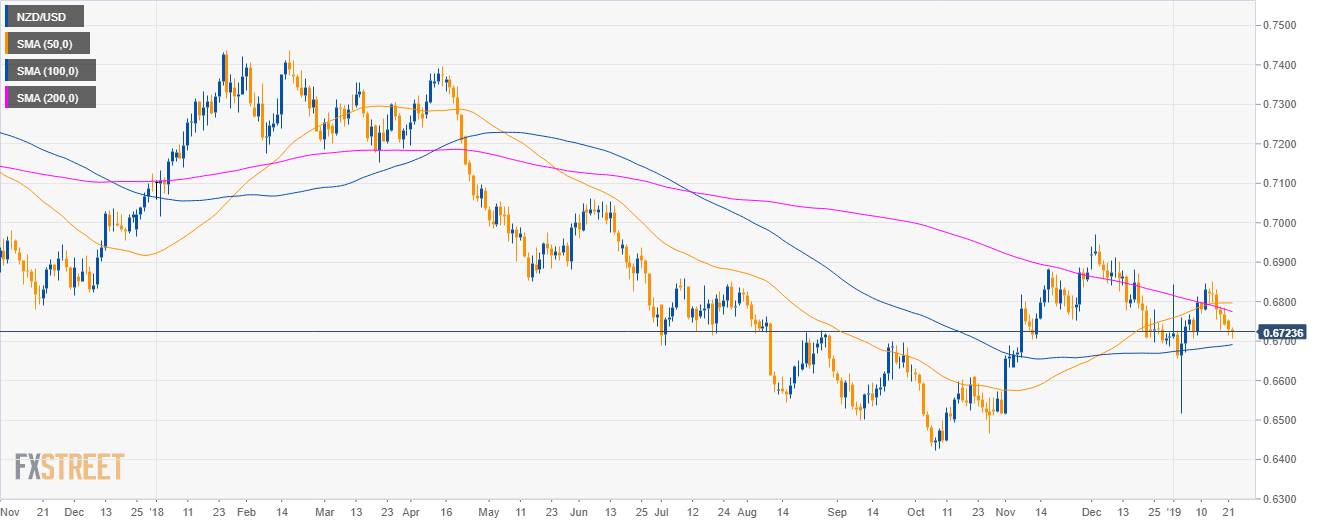

NZD/USD daily chart

- NZD/USD is trading in a bear trend below the 50, 100 and 200-day simple moving averages (SMAs).

- In New Zealand, the Consumer Price Index (CPI) Q4 will be released at 22.45 GMT.

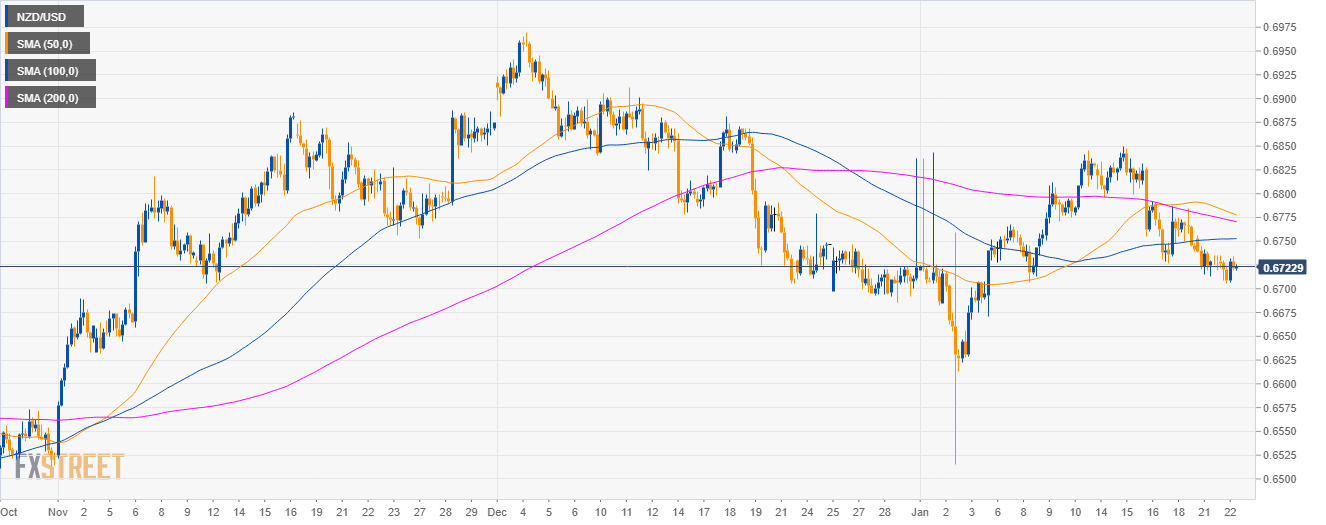

NZD/USD 4-hour chart

- NZD/USD is trading below the main SMAs as the market is testing the 0.6700 figure.

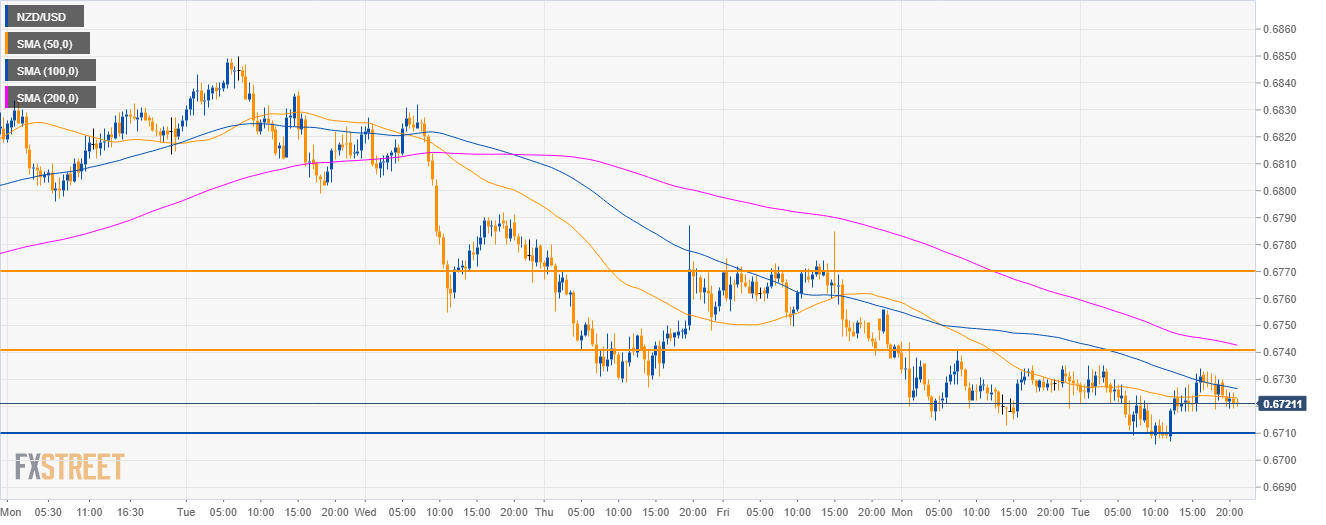

NZD/USD 30-minute chart

- The NZD/USD currency pair is trading below its main SMAs suggesting bearish momentum.

- Support to the downside can come in at 0.6710, 0.6680 and the 0.6640.

- To the upside, resistance is seen near 0.6740 and the 0.6770 level.

Additional key levels

NZD/USD

Overview:

Today Last Price: 0.6721

Today Daily change: -0.0008 pips

Today Daily change %: -0.12%

Today Daily Open: 0.6729

Trends:

Daily SMA20: 0.6747

Daily SMA50: 0.6797

Daily SMA100: 0.6689

Daily SMA200: 0.678

Levels:

Previous Daily High: 0.6756

Previous Daily Low: 0.6713

Previous Weekly High: 0.685

Previous Weekly Low: 0.6727

Previous Monthly High: 0.697

Previous Monthly Low: 0.6686

Daily Fibonacci 38.2%: 0.6729

Daily Fibonacci 61.8%: 0.674

Daily Pivot Point S1: 0.6709

Daily Pivot Point S2: 0.669

Daily Pivot Point S3: 0.6666

Daily Pivot Point R1: 0.6752

Daily Pivot Point R2: 0.6775

Daily Pivot Point R3: 0.6795

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.