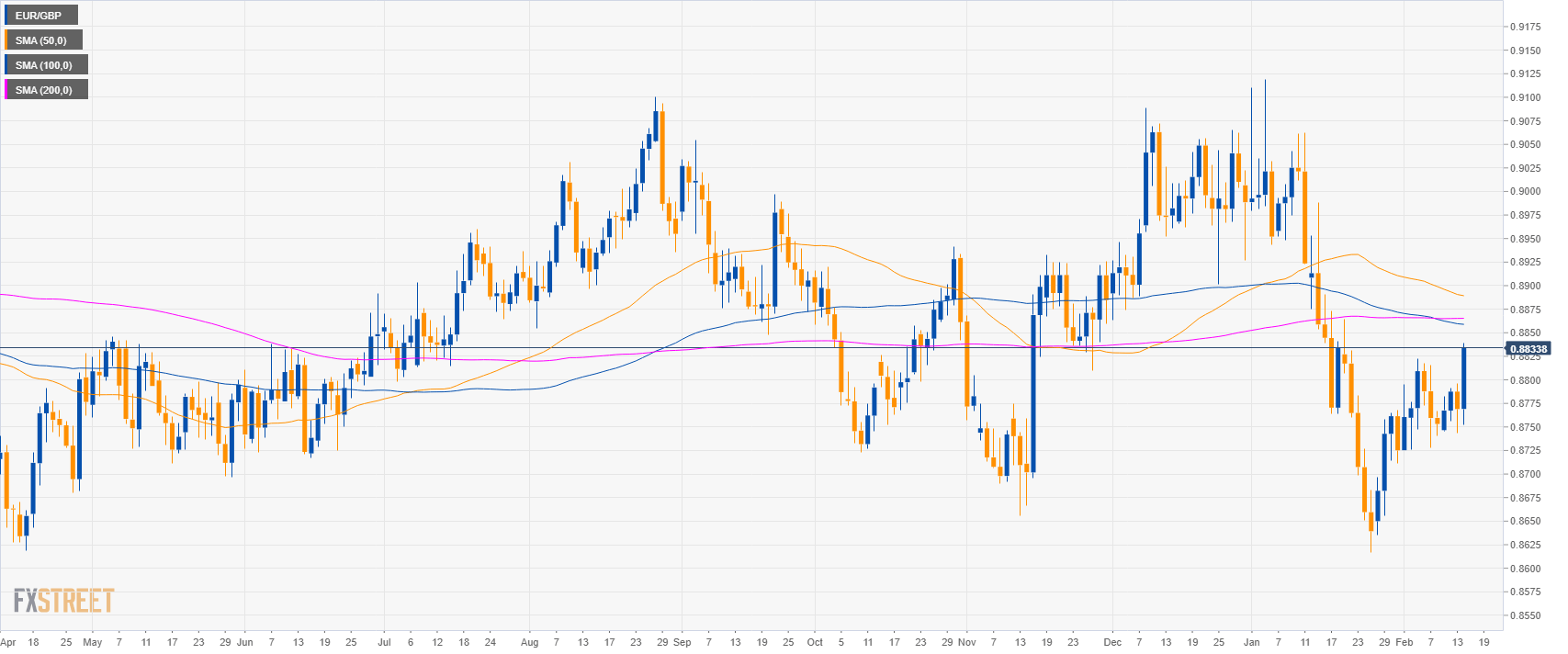

EUR/GBP daily chart

- EUR/GBP is trading in a sideways trend below the 200-day simple moving averages (SMAs).

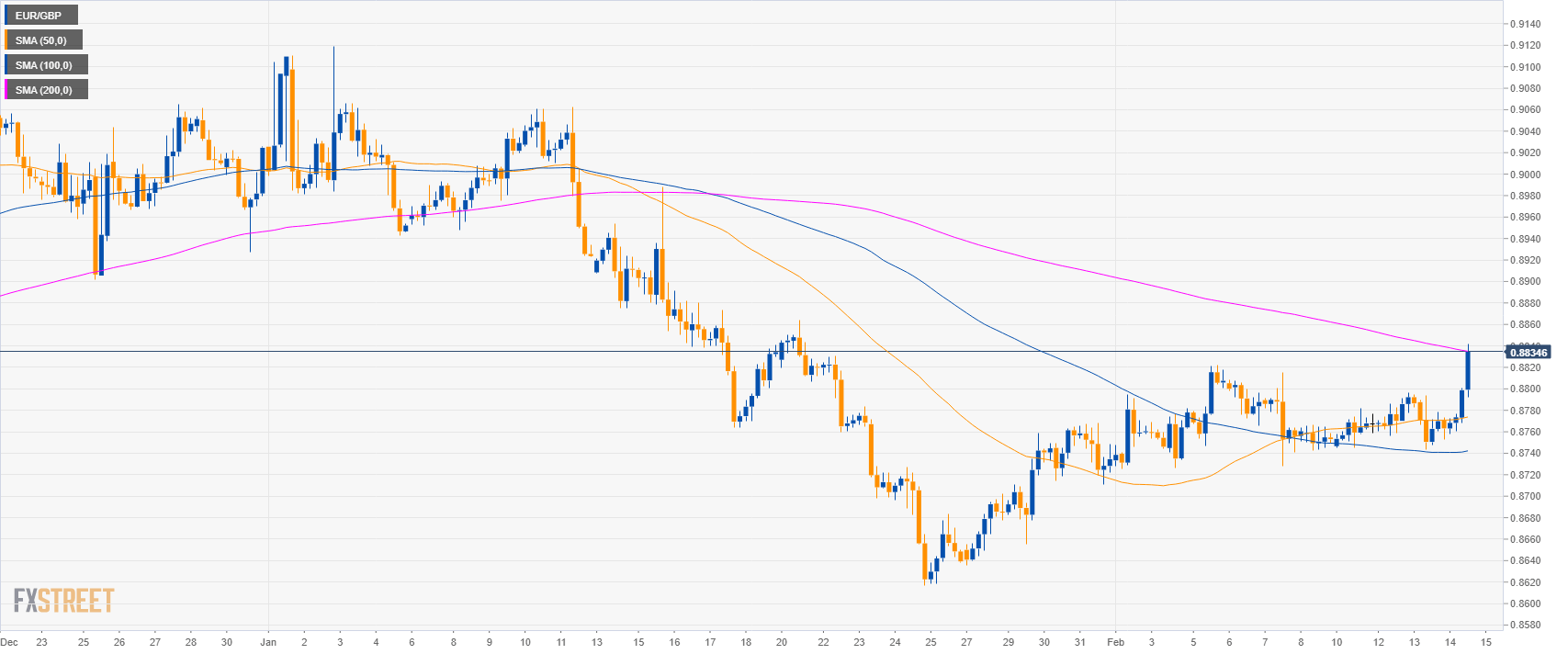

EUR/GBP 4-hour chart

- EUR/GBP is trading between the 100 and 200 SMAs on the 4-hour chart suggesting a sideways market in the medium-term.

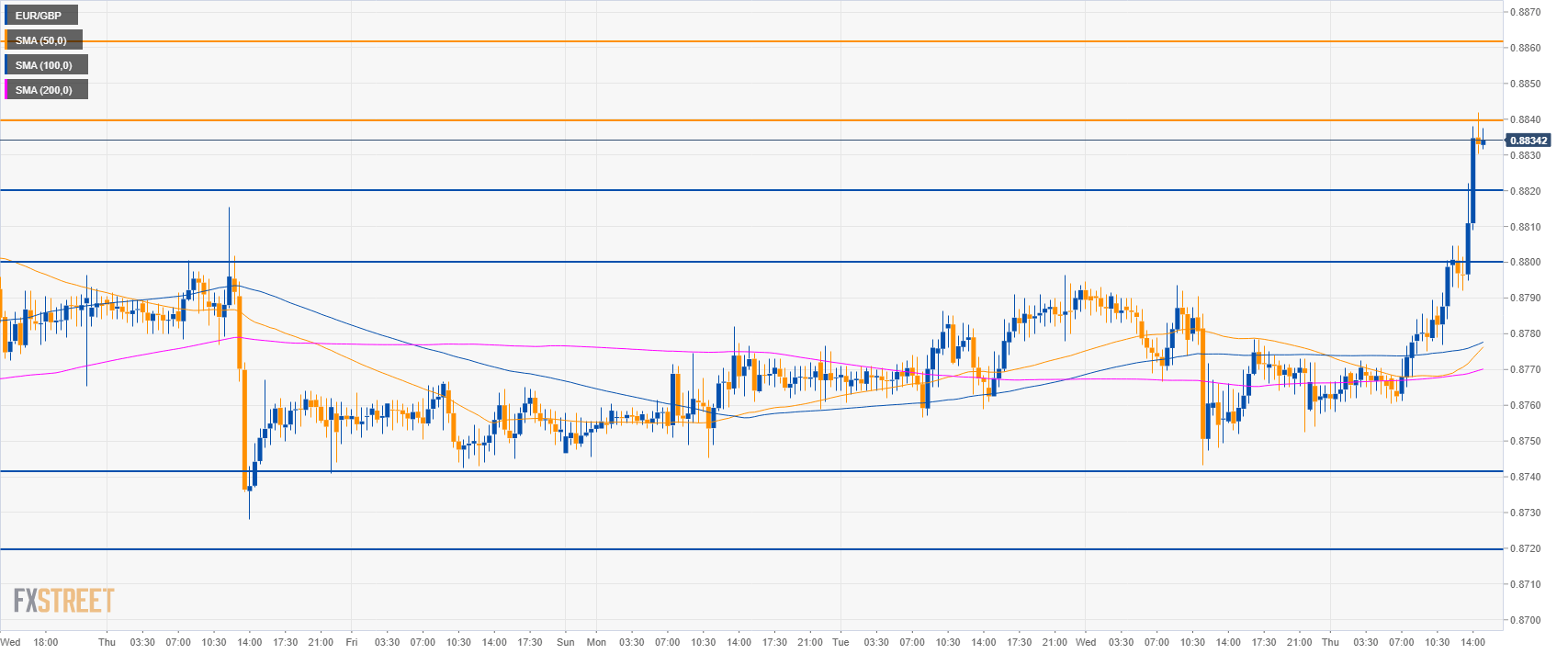

EUR/GBP 30-minute chart

- EUR/GBP is trading above the main SMAs suggesting bullish momentum in the short-term.

- The level to break for bulls is 0.8840. The next level of resistance is seen at 0.8860.

- On the flip side, supports are seen near 0.8820 and 0.8800 figure.

Additional key levels

EUR/GBP

Overview:

Today Last Price: 0.8833

Today Daily change: 64 pips

Today Daily change %: 0.73%

Today Daily Open: 0.8769

Trends:

Daily SMA20: 0.8753

Daily SMA50: 0.8891

Daily SMA100: 0.886

Daily SMA200: 0.8865

Levels:

Previous Daily High: 0.8796

Previous Daily Low: 0.8743

Previous Weekly High: 0.8822

Previous Weekly Low: 0.8726

Previous Monthly High: 0.9119

Previous Monthly Low: 0.8617

Daily Fibonacci 38.2%: 0.8764

Daily Fibonacci 61.8%: 0.8776

Daily Pivot Point S1: 0.8743

Daily Pivot Point S2: 0.8716

Daily Pivot Point S3: 0.8689

Daily Pivot Point R1: 0.8796

Daily Pivot Point R2: 0.8823

Daily Pivot Point R3: 0.8849

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD pressured as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.