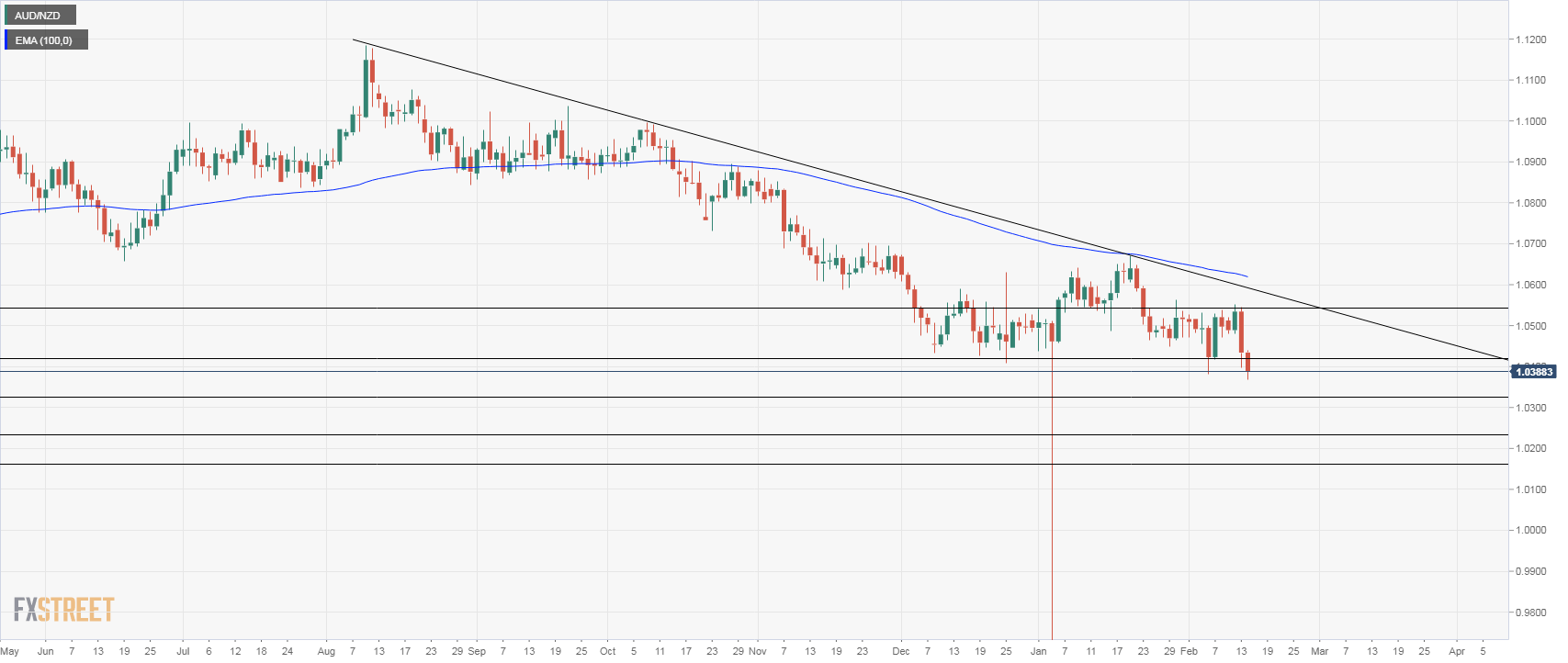

- The Australian dollar dropped sharply against the Kiwi, falling firmly below January and December lows. The consolidation under the 1.0400 area leaves the pair vulnerable to more losses over the next days.

- The next target to the downside could be seen at 1.0320; below a strong resistance is seen at 1.0235.

- A recovery back above 1.0420 would ease the negative tone. The two key levels to watch are 1.0550 (horizontal) and 1.0590 (downtrend line). A close above 1.0600 would strengthen the case for a recovery.

AUD/NZD

Overview:

Today Last Price: 1.0387

Today Daily change: -0.0047 pips

Today Daily change %: -0.45%

Today Daily Open: 1.0434

Trends:

Daily SMA20: 1.0519

Daily SMA50: 1.052

Daily SMA100: 1.0651

Daily SMA200: 1.0775

Levels:

Previous Daily High: 1.0545

Previous Daily Low: 1.0396

Previous Weekly High: 1.0538

Previous Weekly Low: 1.0382

Previous Monthly High: 1.0671

Previous Monthly Low: 0.9631

Daily Fibonacci 38.2%: 1.0453

Daily Fibonacci 61.8%: 1.0488

Daily Pivot Point S1: 1.0372

Daily Pivot Point S2: 1.031

Daily Pivot Point S3: 1.0223

Daily Pivot Point R1: 1.052

Daily Pivot Point R2: 1.0607

Daily Pivot Point R3: 1.0669

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.