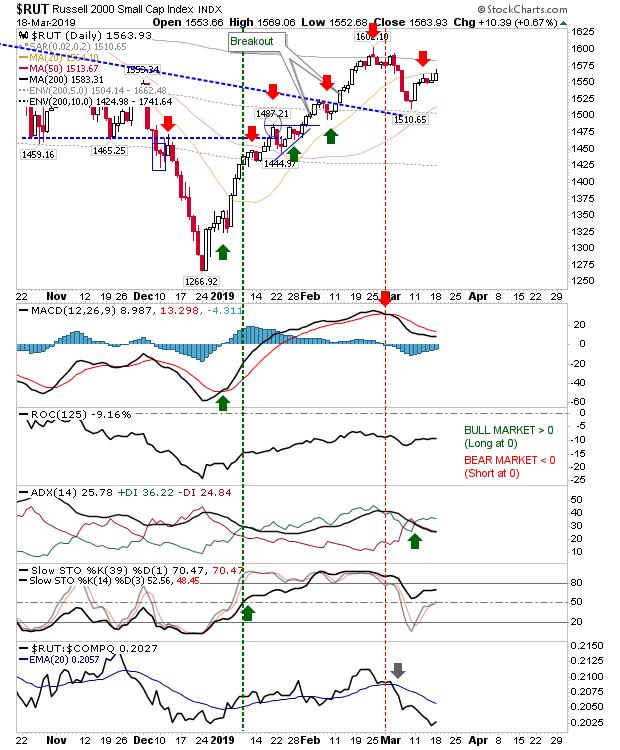

Nasdaq 100 At Resistance? Russell 2000 Pushes Against 20-Day MA

Another day of small gains keeps the rally moving for another day. The Russell 2000 probably got the most out of today as the index closed at its 20-day MA and is now in a position to negate prior spike high tags of the latter moving average. If there was a short play on the initial tag of the 20-day MA it looks done now. The MACD is in recovery mode but is on course to trigger a 'buy'.

For the Nasdaq 100, I redrew the channel to account for the slower ascent. With that redraw, there is a potential short play/swing trade with the small doji at resistance. However, technicals are all bullish so aside from the possibility of channel resistance there is no clear support fora short trade - so if opting one, keep the stop tight (or alternatively, buy a break of the channel).

The Semiconductor Index consolidated its breakout with a small candlestick at the upper end of yesterday's candle. A MACD trigger 'buy' looks to be just a day away - if this comes through then I would expect the Nasdaq 100 to break upside beyond its channel.

The S&P posted a new closing high as it moves into a challenge of October all-time highs. You can see on a weekly chart how important this break of resistance is.

For tomorrow, watch the Nasdaq 100 and Russell 2000 for leads; bears will be looking for a push down from the channel in the Nasdaq 100; bulls will want a strong move through the 20-day MA of the Russell 2000.

It was a good day for the stocks featured in invest4success as six of the seven posted gains.