Asia Pacific Market Open Talking Points

- GBP/USD already fell before third vote on May’s Brexit deal was blocked

- Sentiment improved, placing the S&P 500 closer to achieving record highs

- Risks for AUD/USD tilted to the upside on RBA minutes, Yen may weaken

Find out what the #1 mistake that traders make is and how you can fix it!

Key FX Developments Monday

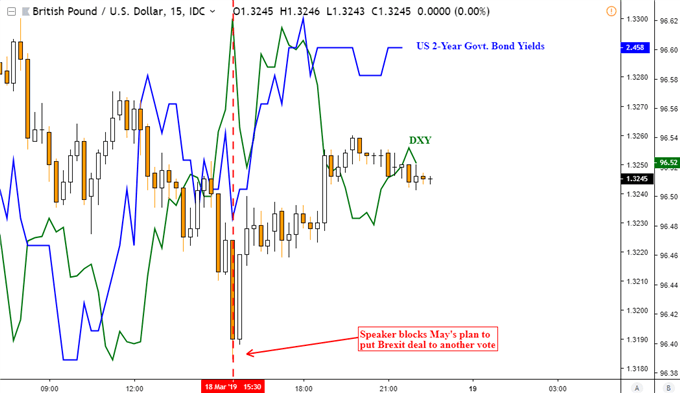

The British Pound was the worst-performing major currency on Monday. Newswires attributed this to John Bercow, the Speaker in the House of Commons, blocking a third vote on Theresa May’s Brexit deal unless there are major changes to it. Looking at the immediate chart below reveals the full story behind volatility in Sterling.

GBP/USD vs. US Dollar and US Bond Yields

Chart Created in TradingView

When Mr Bercow’s block crossed the wires, GBP/USD had already been drifting lower. This was partially due to a slightly higher US Dollar that trimmed losses from earlier in the session. The Greenback appreciated alongside front-end government bond yields, suggesting ebbing dovish bets ahead of this week’s highly-anticipated FOMC meeting. In fact, the risk for USD on the Fed may be tilted to the upside, posing as a risk for certain ASEAN currencies.

The S&P 500 still edged higher, building on top of a major resistance break from Friday’s session. Now that there is confirmation of a second close above 2824, the index is another step closer towards achieving a new record high. Still, negative RSI divergence persists which shows fading upside momentum. This may precede a turn lower. Gains in equities on Monday bolstered the pro-risk Australian and New Zealand Dollars.

Tuesday’s Asia Pacific Trading Session

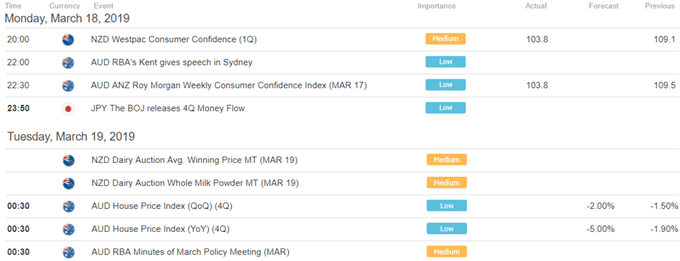

As Tuesday gets underway, AUD/USD looks to the RBA minutes from the March policy meeting. Markets are becomingly increasingly confident that the central bank may deliver a cut by the end of this year. Earlier this month, Governor Philip Lowe underpinned confidence in the economy despite rising concerns over a property slump.

Like with the US Dollar, the risks for Aussie seem to be tilted to the upside if the minutes of the text show more confidence in the economy than what overnight index swaps are pricing in. Looking at sentiment, S&P 500 futures are pointing cautiously higher. We may see APAC equities follow Wall Street higher, sapping the appeal of the anti-risk Japanese Yen.

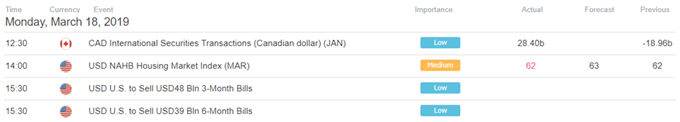

US Trading Session Economic Events

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter