Trading the News: Canada Consumer Price Index (CPI)

Updates to Canada’s Consumer Price Index (CPI) may curb the USD/CAD advance following the Federal Reserve interest rate decision as the headline reading for inflation is expected to hold steady at 1.4% per annum in February.

Signs of sticky price growth may boost the appeal of the Canadian dollar as it puts pressure on the Bank of Canada (BoC) to further embark on its hiking-cycle, and another 1.4% print may push Governor Stephen Poloz and Co. to endorse a hawkish forward-guidance at the next meeting on April 24 as the central bank ‘expects CPI inflation to be slightly below the 2 per cent target through most of 2019, reflecting the impact of temporary factors.’

However, an unexpected slowdown in Canada’s CPI may fuel the recent advance in USD/CAD as it dampens bets for a BoC rate-hike, and a below-forecast print may encourage Governor Poloz and Co. to alter the outlook for monetary policy as officials warn ‘it will take time to gauge the persistence of below-potential growth and the implications for the inflation outlook.’

Impact that Canada’s CPI had on USD/CAD during the previous release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

JAN 2019 | 02/27/2019 13:30:00 GMT | 1.4% | 1.4% | -10 | +10 |

January 2019 Canada Consumer Price Index (CPI)

USD/CAD5-Minute Chart

Canada’s Consumer Price Index (CPI) narrowed to 1.4% from 2.0% per annum in December, while the trimmed core reading for inflation held steady at 1.9% for the third consecutive month. A deeper look at the report showed the weakness was largely driven by a 3.1% decline in energy prices, with the cost for Transportation also slipping 1.0% in January, while food prices increased another 0.8% after rising 1.0% the month prior.

The Canadian dollar gained ground following the stickiness in the core CPI, but the reaction was short-lived, with USD/CAD bouncing back from a low of 1.3118 to close at 1.3156. Review the DailyFX Advanced Guide for Trading the News to learn our 8 step strategy.

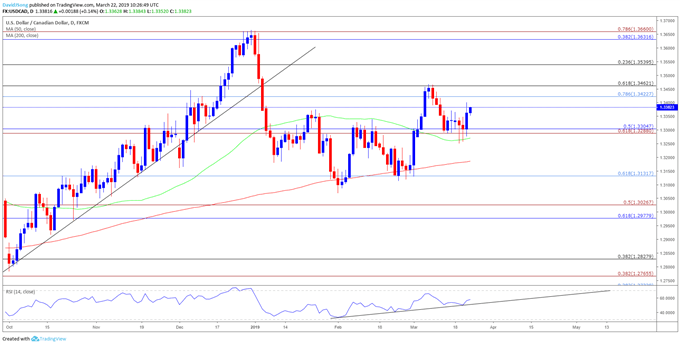

USD/CAD Rate Daily Chart

- USD/CAD appears to be making a run at the monthly-high (1.3467) following the string of failed attempts to close below the Fibonacci overlap around 1.3290 (61.8% expansion) to 1.3310 (50% retracement), with the Relative Strength Index (RSI) highlighting a similar dynamic as the oscillator comes off of trendline support and looks to extend the bullish formation from earlier this year.

- With that said, the 1.3420 (78.6% retracement) to 1.3460 (61.8% retracement) region is back on the radar, but need a break/close above the overlap to open up the next topside area of interest around 1.3540 (23.6% retracement).

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Additional Trading Resources

New to the currency market? Want a better understanding of the different approaches for trading? Start by downloading and reviewing the DailyFX Beginners Guide.

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.