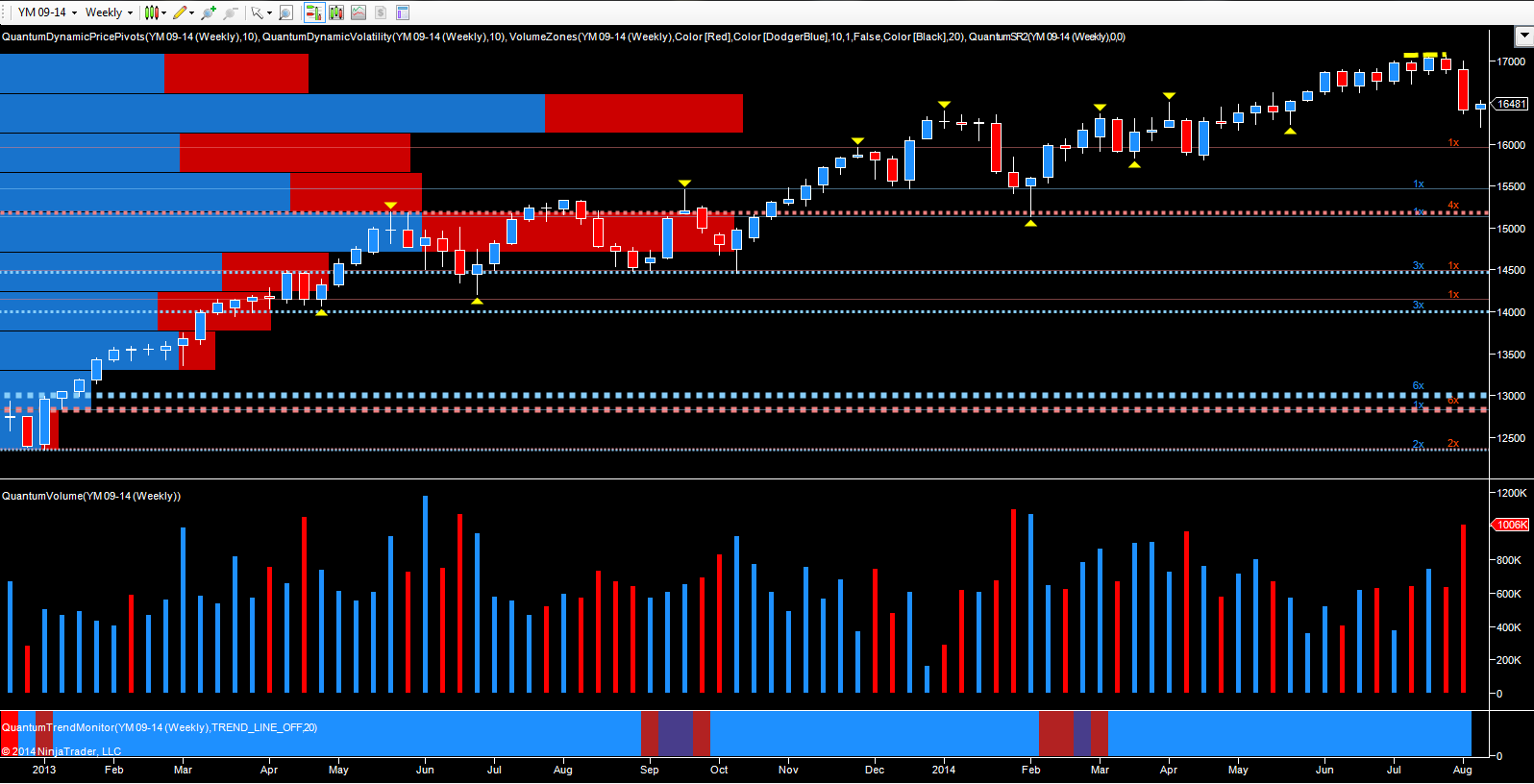

They say a week is a long time in politics, and in the financial markets, the same sentiment could be applied to equity markets, which ended the evening in positive tone, and in sharp contrast to the sharp move lower of two weeks ago. At the time, market commentators were forecasting the ‘end is nigh’ with the big short now underway. I was not one of them and indeed nailed my colors firmly to the mast in a post earlier this week, suggesting that this was simply a long overdue correction, and not a wholesale change in trend. This week’s price action for the major indices has proved the point, with early negative sentiment promptly reversed in today’s bullish price action, with the September futures contract on the YM Emini bouncing back in grand style and closing at 16,479 having tested the 16,500 level towards the close of the session. The weekly chart for the Emini YM neatly encapsulates the last two weeks, with the wide spread down candle of two weeks ago suggesting structural weakness, promptly snuffed out with the hammer candle of this week, which is now suggesting further bullish sentiment to follow in the short term.

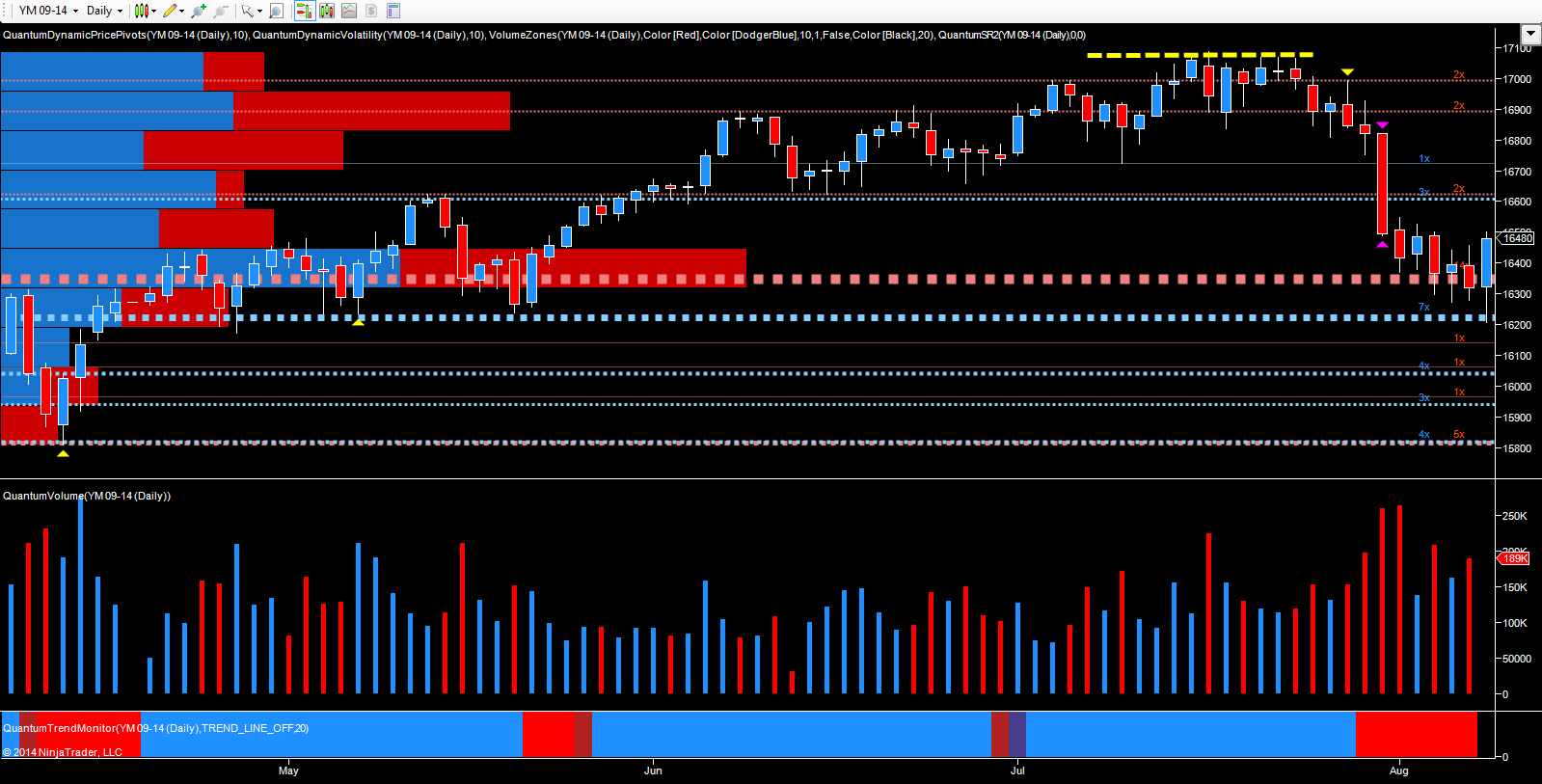

Moving to the daily chart for the YM Emini, today’s price action was a classic in ‘trade what you see and not what you think, with the index falling initially on fears of a US intervention in Iraq and the ongoing tensions in the Middle East and Ukraine, with most traders expecting a further day of heavy selling. Whilst this was certainly true as the European markets opened, later in London, sentiment promptly reversed into the physical open, with initial volumes suggesting only light selling, and duly followed by heavy buying intraday, driving the market higher and recovering the losses of earlier in the week, with the support level at 16,200 providing the springboard for the move higher. With the market now poised to recover its bullish momentum next week, the key resistance level immediately ahead is at the 16,600 region, and provided we see price action supported with strong and rising volumes, then expect to see the index climb higher, and back to test the underside of the deep congestion now sitting in the 16,700 to 17,000 region.