SPY & HYG ETF Flows:

- The SPY ETF saw its largest intraday outflow since October on Thursday

- On the other hand, the HYG ETF registered a steady streak of inflows as the appetite for risk mounts

- Interested in stock trading? Read about the relationship between volatility and future returns

SPY ETF Notches Largest Outflow in 2019, HYG Finds Buyers

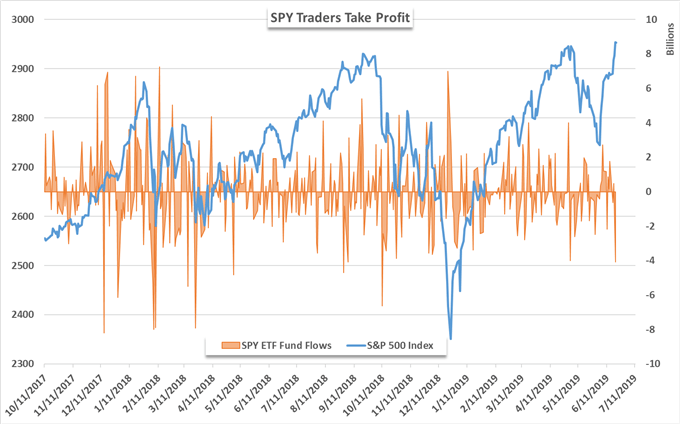

The SPY ETF saw roughly -$4 billion leave its coffers on Thursday as investors looked to take profit after the underlying S&P 500 tagged a record high. While it could be argued the outflow is indicative of waning demand, profit-taking is the more likely culprit as other risk asset-tracking funds saw considerable inflows following the dovish tone put forth by Fed Chairman Powell on Wednesday.

SPY ETF Fund Flows and S&P 500 Price Chart

Data source: Bloomberg

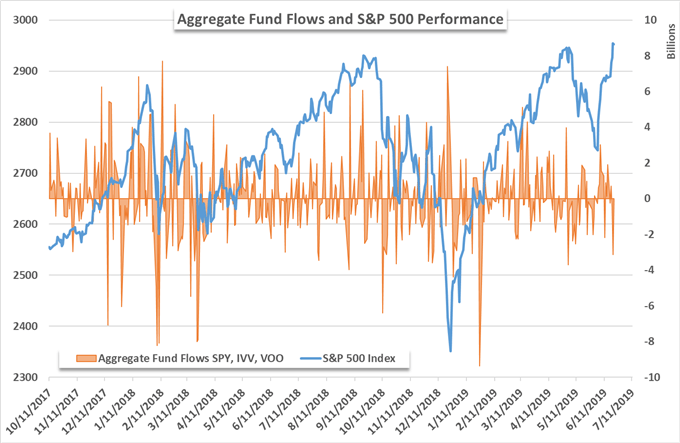

Further, other broad-market tracking ETFs posted flows that were within range and largely insignificant. In aggregate, the SPY, IVV and VOO funds recorded roughly -$3 billion in outflows – with the latter two funds experiencing net inflows for the week. Meanwhile, the high-yield corporate debt ETF, HYG, notched a series of robust inflows.

SPY, IVV, VOO ETF Fund Flows and S&P 500 Price Chart

Data source: Bloomberg

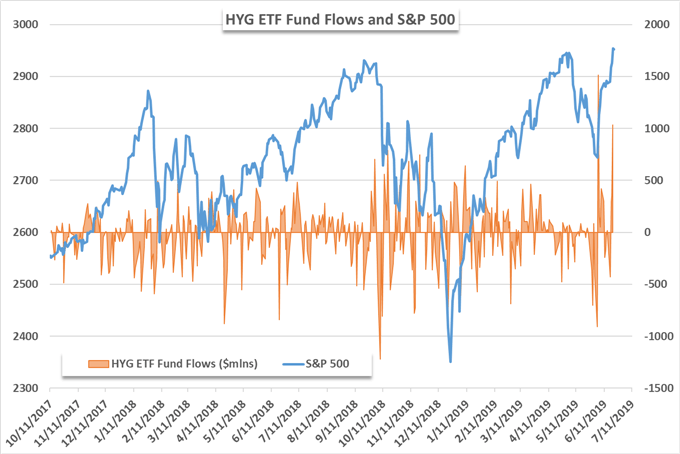

Recording an inflow of $1 billion on Thursday, the HYG ETF added to its considerable capital haul for the week with a weekly net flow of $1.25 billion. As of Friday, the fund posted its largest weekly net inflow since early January when the fund received $1.8 billion in fresh capital. The flows are indicative of a risk-on attitude that would align with the continuation of relaxed monetary policy from the Federal Reserve. Similar sentiment was echoed in the JNK ETF.

HYG ETF Fund Flows and S&P 500 Price Chart

Data source: Bloomberg

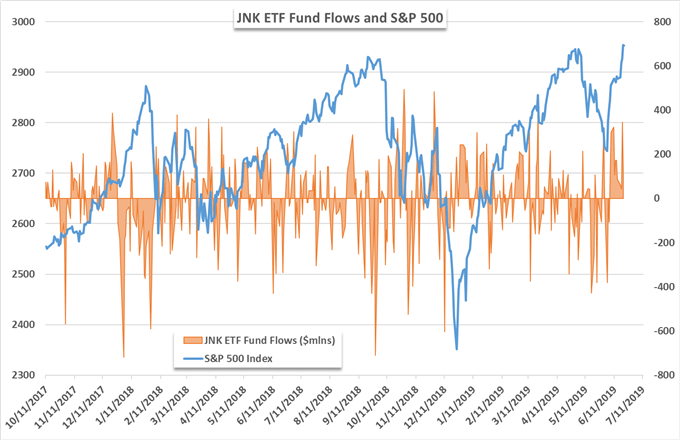

JNK, which also provides exposure to high-yield corporate debt, currently boasts its longest streak of net inflows over the last year and a half. At 11 consecutive sessions, the consistent demand has seen $1.8 billion enter the fund. With the monetary policy path of the Federal Reserve seemingly locked in, investors have expressed a renewed appetite for riskier-allocations. Despite the outflows from SPY, the replenished demand for risk could signal investors’ willingness to continue the recent trend in the S&P 500.

JNK ETF Fund Flows and S&P 500 Price Chart

Data source: Bloomberg

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: S&P 500 Posts Largest Gap Higher in 6 Months, VIX Follows Suit

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.