The market is obsessed with the geopolitical issues that surely impact the trend, up or down, for crude pricing. Will the U.S./Iran sanctions kerfuffle turn in to something more? Will the U.S. and China learn to play “nice” on the trade front? And, finally, will U.S. shale production continue its relentless rise in months and years to come. Those are the big three. The key drivers that have the strongest impact on the direction crude prices take currently.

As an analyst, part of my job is to look down the road a bit and check for other factors that might play a role in oil and oil-related equities prices. It’s easy to document the day to day changes in the big three mentioned above. I honestly could write several articles a day, as the pace of events makes one out of date almost as soon as it’s published. That said, there have been a couple of things niggling at me, that may play a greater role in the future, and I thought now might be the time to trot them out for inspection.

Two things that I think are worth putting on the “sticky-note parking lot”, are crude quality and the impact of IMO 2020. These will soon start to have an impact on crude economics, as relates to the price we pay at the pump. Our focus in this article will be on the impact of crude quality, with just a brief word on IMO 2020.

First, a brief word on what is meant by “crude quality”

If you are a novice to the industry (Unlikely for…

The market is obsessed with the geopolitical issues that surely impact the trend, up or down, for crude pricing. Will the U.S./Iran sanctions kerfuffle turn in to something more? Will the U.S. and China learn to play “nice” on the trade front? And, finally, will U.S. shale production continue its relentless rise in months and years to come. Those are the big three. The key drivers that have the strongest impact on the direction crude prices take currently.

As an analyst, part of my job is to look down the road a bit and check for other factors that might play a role in oil and oil-related equities prices. It’s easy to document the day to day changes in the big three mentioned above. I honestly could write several articles a day, as the pace of events makes one out of date almost as soon as it’s published. That said, there have been a couple of things niggling at me, that may play a greater role in the future, and I thought now might be the time to trot them out for inspection.

Two things that I think are worth putting on the “sticky-note parking lot”, are crude quality and the impact of IMO 2020. These will soon start to have an impact on crude economics, as relates to the price we pay at the pump. Our focus in this article will be on the impact of crude quality, with just a brief word on IMO 2020.

First, a brief word on what is meant by “crude quality”

If you are a novice to the industry (Unlikely for a reader of OilPrice.com, but you never know.) here is a brief overview of what I am referring to when I use the term, “crude quality.”

Oil is a complex molecule made up of mostly carbon chains of various lengths, with associated hydrogen, nitrogen, oxygen, sulfur, and metallic ions of various sorts. The elements all combine to give it weight, as compared with fresh water, and that is referred to as “Gravity.” A little more information will come along later in the article. For now it is enough for you to know that for the purpose of this article, crude quality and gravity are synonymous.

Crude Quality

Crude quality, or API gravity matters when it comes time to turn oil into products that we use. American oil production has been getting much “lighter” due to the shaley source of much of it, dating from the early 2000’s and the dawn of the frac revolution. As I will discuss in the commentary that follows, the API gravities have been rising, requiring the importation of “heavier” grades as blend stock. This has worked fairly well up in a fairly benign global market over the last few years. There are problems on the horizon that may or may not have a near term impact on oil prices. They will definitely impact prices longer term.

IMO 2020

January, 1st 2020. This is a hard date-meaning that the IMO governing body will not grant waivers, for global shipping to adopt this low sulfur standard for residual oil bunker fuels. If a carrier chooses to continue to use bunkering fuel, as opposed to installing scrubbers, or in an extreme case switching to LNG, it is going to encounter a couple of scenarios.

There may be issues with availability as the limitation of acceptable blending crudes manifests itself. Many of the countries in the table below are having trouble maintaining their output, as an example of one difficulty in meeting this standard that may come to pass.

(Source)

So, IMO 2020 is on the sticky-note parking lot now, as mentioned previously. We will now shift our focus to the crude quality story as I think it will have a sooner impact on oil prices going forward.

Daily U.S. Domestic Production

If all we look at is the total production from U.S. domestic sources the picture is fairly clear. Over the past few years we’ve added several million barrels to our daily output. After a little blip down for the week of June 21st, the most recent report for June 28th, has us back to 12.2 mm BOEPD. As I’ve highlighted, one thing that hasn’t gotten a lot of attention is the “quality” of this crude. Not all crude is created equal. The term “crude quality” refers to its API gravity, as discussed.

Average gravity of U.S. produced crude

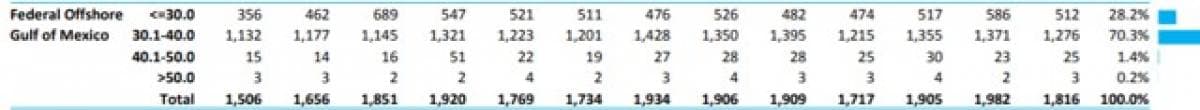

In the graphic below we can see the quality of crude being produced in the U.S. as a function of its API gravity. API gravity classifies oils on their weight as compared with water.

One key takeaway from this chart is the most of the production growth in the lower 48 over the last four years has been in gravities well above API 30°. In fact, most lower 48 crude is now (68%) is above 30°. This is a problem for one key reason. Most U.S. refineries aren’t set up to process this oil efficiently, making it a darn good thing we are allowed to export this “light” oil, or the shale boom would hit a snag.

For the month of April 2019, the last month tracked above, the average is 32.97°. You can see there is quite a disparity between the oil we are producing and the oil we are refining currently. So where is the blending oil coming from to reduce the average gravity to what these refineries can process efficiently?

The chart above strongly suggests that when it comes to keeping our refineries humming along at full steam, cranking out all the gasoline and diesel our economy needs, low gravity imports are imperative. The next chart highlights a potential concern. Traditional sources for this low gravity oil, OPEC and Mexico are reducing output to the U.S. OPEC for political and economic reasons, and Mexico from inefficient management of its petroleum resources. Of the major suppliers to the U.S., only Canada is now shipping more over the time period covered.

Discussion

There is a potential disconnect emerging between U.S. refinery needs and global production trends. Oil companies have been heavily investing in shale acreage over the last several years, and ignoring-largely, the conventional fields, now primarily found in deepwater due to the development cost.

Complicating this scenario is the decline of international sources of the heavier crudes our domestic refiners have been using as blend stock. Much of OPEC production is in decline, and the Saudis are voluntarily restricting their production to try and shore up the price. Venezuelan production has fallen 75% over the last 20 years, and given its current political situation, cannot be considered a candidate for increasing supplies any time soon.

One outcome of this disconnect could be an increasing rate of return of capex, (It is already occurring but at a very much reduced rate from a few years ago), to the deepwater sector. The conventional reservoirs found in deepwater, typical yield a much more usable crude.

Your takeaway

The market is right to be obsessed with the “big three” oil market movers I’ve mentioned in the beginning of this note. They are the big three for a reason. However, that doesn’t mean that other factors can be safely ignored when putting together an investing strategy. It’s often said that, “It’s the things you don’t know, that come back to bite you in the…posterior.”

Now we‘ve put sticky-notes for two of them on the bulletin board parking lot, where we will be reminded to check on them periodically!

Longer-term, if the scenario discussed in this article plays out in the way I have imagined, two domestic producers I have discussed in recent oil price articles, W&T Offshore, (WTI), and California Resources, (CRC) could see some additional lift from their present prices. Here are some links to those articles if you think these two companies might fit into your portfolio.

I am looking to add WTI at around $4.00 and CRC below $16.00. CRC took a nice pop higher toward $19.00 last week, so we may not see my strike price for that one anytime soon.

Worth mentioning also is the deepwater sector, where much of the conventional reservoirs lie, as shown in the EIA outtake above. Will companies like BP, (BP) start putting additional money toward developing these fields, as they look to increase their crude quality? And, if they do, will companies like Transocean, (RIG) reap a reward, as these new fields are explored and proved out? Certainly food for thought!