Down 25% in Tuesday trading — and down another 25% today — power systems supplier DPW Holdings (DPW) stock is in freefall, and it has only itself to blame.

One week ago, DPW published a press release advising investors that in consequence of its stock trading for too long at too low a share price (i.e. about 14 cents), the NYSE American exchange had informed the company that it must either conduct a reverse stock split or be delisted from the exchange.

Faced with this choice, DPW chose Door No. 1, and on August 6 executed a 1-for-40 reverse split (i.e. if you owned 40 shares of DPW before the split, then now you own only 1). Immediately following this split, the company further shook investor confidence by announcing an “at the market” offering of common stock, designed to raise as much as $5.5 million in new capital through issuance and sale of common stock “from time to time” — at whatever price investors might be willing to pay for the stock at such time.

But wait. It gets worse.

On August 6, DPW also filed an 8-K report with the SEC, advising that when it reports its quarterly financial results a week from now, it expects to report only $12.7 million in revenues booked over the first six months of 2019, an increase of just $0.1 million, or less than 1%, from last year’s first half.

Granted, DPW also advised that it expects its net loss to shrink. But given that the company just got finished reporting a 30% increase in sales from Q1 2018 to Q1 2019, the fact that sales for Q1 and Q2 combined will show almost no growth implies that a rather steep decline in Q2 sales is likely. In fact, by my calculations, for DPW to report only $12.7 million in sales for its fiscal first half, after reporting $6.9 million in sales in Q1 alone, Q2 sales will have to fall to just $5.8 million this year — a decline of roughly 22% year over year.

Chances are, it’s this rapid drying-up of sales in Q2 that investors are focusing on today (and yesterday). And viewed in this context, the fact that DPW will lose a bit less money, by making a doing a lot less business, is not being interpreted as particularly “good news.”

So what’s an investor to do in the face of all this? Buy more, or sell?

Let me run a few facts by you and see if you can guess the answer:

DPW is not profitable today, and hasn’t earned a full-year profit since way back in 2011. In the interim, it’s managed to rack up losses of about $46.5 million.

DPW has no profits and no free cash flow. Its revenues are falling, and it’s carrying more than $19 million in debt, with less than $2 million in cash on hand to pay it with. The dilutive stock offering it just announced will raise only enough cash to pay off a fraction of its debt.

So … does that sound like a “buy” argument to you? (Hint: It isn’t).

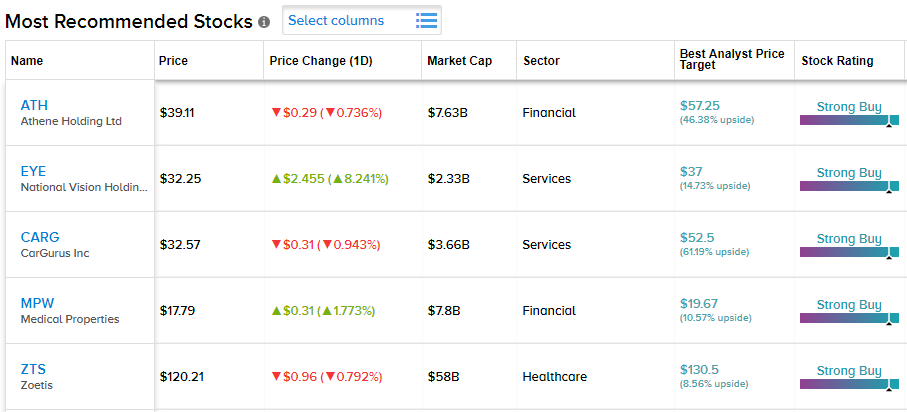

To find the better stocks try TipRanks’ Analysts’ Top Stocks tool. It will help you identify the stocks that have received the most bullish recent ratings from the Street’s top analysts. These are the analysts that consistently outperform the market with the highest success rate and average return.