Advanced Micro Devices’ (AMD) 7nm chips have been all the rage in the processor world this year, and this week the chip giant launched its datacenter “Rome” chip.

The 7nm chips, including the desktop Ryzen, are expected to continue to narrow the gap between AMD and Intel, who continues to struggle with 10nm production. But there is a possible flaw in the Rome chip — the chips are reportedly running at higher-than-normal voltage levels, which may prove dangerous. While tests show Rome running circles around Intel in terms of performance, this voltage problem could prove to be a major issue moving forward.

Even though Rome is running a little hot, 5-star RBC analyst Mitch Steves is focused on the high performance of the chip. The analyst says “there will likely be more hyperscale traction…[with] multiple vendors moving to AMD quickly,” as the new chips are providing a faster, more efficient and more affordable option to Intel products.

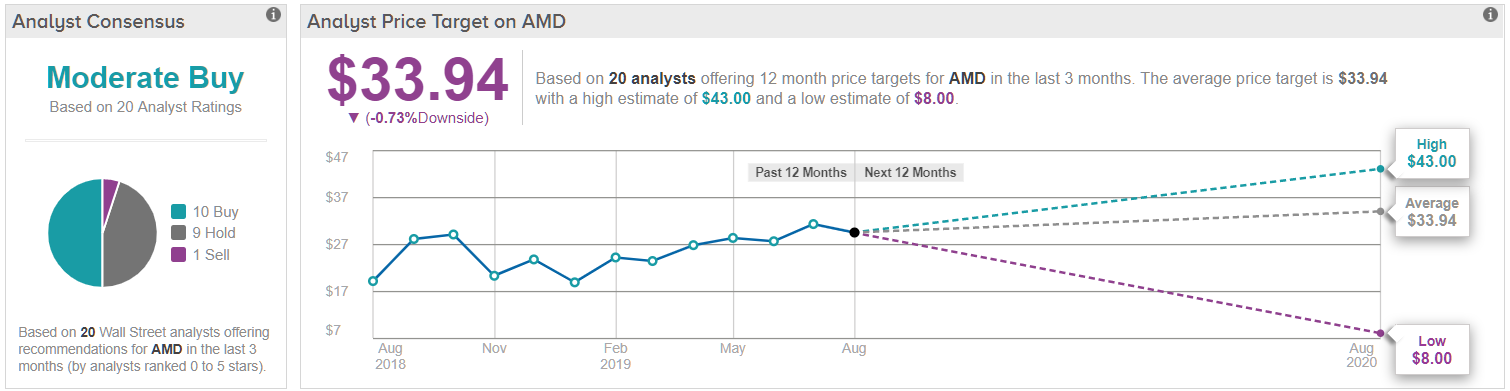

Steves maintained a Buy rating on AMD stock, with a $43 price target, which implies nearly 27% upside from current levels.

As always, we like to give credit where credit is due. According to TipRanks, which measures analysts’ and bloggers’ success rate based on how their calls perform, Steves has a yearly average return of 20.6% and a 74% success rate. Steves is ranked #145 out of 5,247 analysts.

Steves looks at a report from Tom’s Hardware (a tech review site) which lays outs Rome details. Based on the site, the new 7nm chip either outperforms or performs at-level with Intel’s best products, even when performing a task where Intel chips are optimized for. Because of the higher performance and putting this all together, Steves believes “this would lead to a broader adoption of AMD chips.”

Aside from the launch of Rome, AMD has been in the headlines over the possibility of CEO Lisa Su leaving the company. This week on Twitter, Su said “Just for the record, zero truth to this rumor. I love AMD and the best is yet to come!” Indeed, Steves believes the CEO will not “leave in the near future.”

AMD has made headlines for more than just the 7nm chip this year. The company was selected by the US Government to develop the world’s most powerful supercomputer along with Cray. The deal isn’t expected to bring a major revenue boost to the company, but it signals to investors and the tech world that the largest customers in the world are continuing to look at AMD as a go-to for processors. This has strengthened AMD’s image, which has played a role inn share rising nearly 50% this year.

Overall, Wall Street almost evenly split between the bulls and those choosing to play it safe. Based on 20 analysts polled in the last 3 months, 10 rate AMD a Buy, 9 suggest Hold, while only one recommends Sell. Notably, the 12-month average price target stands at $33.94, marking a slight downside from current levels. (See AMD’s price targets and analyst ratings on TipRanks)