In just the span of a few days, Advanced Micro Devices (AMD) stock skyrocketed more than 20% as Google and Twitter both announced they would use or were already using the just-released 7nm EPYC server processors.

The new chip has been at the center of AMD’s game plan this year, and estimated to produce as much as 100% stronger performance than a comparable Intel chip, while at a fraction of the price. The EPYCs are expected to help boost AMD’s server chips market share, currently dominated by the aforementioned Intel.

Cheering the company’s achievements, 5-star Northland analyst Gus Richard maintained an Outperform rating on AMD, with a $36 price target, which implies about 10% upside from current levels.

As always, we like to give credit where credit is due. According to TipRanks, which measures analysts’ and bloggers’ success rate based on how their calls perform, Richard has yielded a yearly average return of 21.6% with a 65% success rate. Richard has achieved an average return of 133% when recommending AMD and is ranked #133 out of 5,239 analysts.

While Intel has been the largest force in the server market over the past few years, Richard believes AMD has caught up. The analyst believes AMD now has a significant performance advantage over Intel in the market, and Intel can do “little” for at least two years. Richard continues, saying “AMD highlighted superior performance and as much as 4x performance per dollar” at the product launch, as he believes the company share will rise to double-digit by next year.

Besides the new technology, the recent launch saw twice the amount of platforms at launch relative to their prior EPYC processor at launch, which indicates that customers are extremely excited about the processor. Richard says, Google, which has already deployed the processor, is “seeing great performance from high core count processor,” while it also announced it would be offered to customers on its cloud.

While the EPYC is clearly finding success in its first week of launch, Richard thinks the company delivering the “EPYC server processor on time in CY17…and [as] promised performance” is also reason for celebration. But the server products is not the end of the line for AMD. The company expects to launch its line of CPUs next year, dubbed Milan. Richard says the company “has completed the Milan design and …expect[s] this product to sample in early 1H:20.” Regardless of this, Richard believes the “key point is that AMD is building credibility,” and does not expect Intel to “catch up anytime soon.”

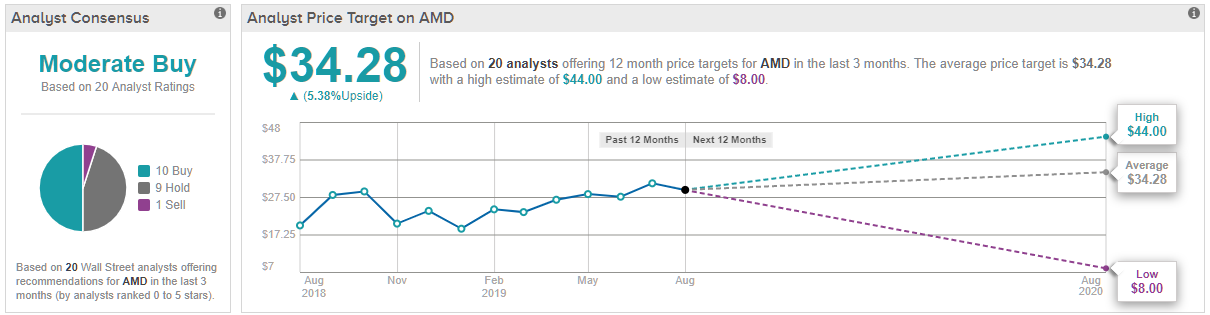

All in all, AMD has a cautiously optimistic Moderate Buy consensus rating from the Street. This breaks down into 10 ‘buy’, 9 ‘hold’ and 1 ‘sell’ ratings in the last three months. We can also see from TipRanks that the average analyst price target is $34.28, suggesting the can rise only 5% and a change from the current share price. (See AMD’s price targets and analyst ratings on TipRanks)