A bad month got worse for General Electric (GE) yesterday when a whistleblower report was released by a forensic accountant alleging that accounting fraud will cause GE to go bankrupt. Shares plunged 11% after the report went public.

However, today the stock climbed nearly 10% on the back of news that GE CEO Larry Culp bought $2 million worth of shares after yesterday’s drop.

William Blair analyst Nicholas Heymann remains unfazed by the bearish report, supporting Culp’s huge vote of confidence, as he reiterates an Outperform rating on GE stock. Although Heymann does not have a price target on the stock, his calculations imply an intrinsic value between $14 and $16 per share. He thinks that range “could be a plausible valuation for GE’s shares over the next 12-18 months.” (To watch Heymann’s track record, click here)

The report, led by Harry Markopolos, alleges that GE has been overstating its financial strength. The most significant aspect of the report is that it predicts that GE will need to “contribute $18.5 billion in cash and take a $10.5 billion non cash charge to comply with accounting changes that become effective in the first quarter of 2021 for GE’s Long Term Healthcare Reinsurance (LHTR) legacy business.” This goes beyond the $15 billion of cash reserve contributions GE already announced early on in 2018. If these changes were made to GE’s financial statements, GE would be in a financially weak position.

Heymann finds it hard to believe that GE, which has been engaged with several regulator reviews of its accounting and financial disclosures for over two years, has fraudulently misrepresented its financial reporting.

GE’s CEO raised the company’s full-year guidance in July, so the stock’s disappointing month comes as a surprise to management. In addition to buying shares after the 11% drop yesterday, the CEO called the allegations false and accused the accounting firm of trying to manipulate the share price.

The transformation under newly installed CEO Larry Culp will be a long and complex process. Heymann believes that the worst has passed, and GE’s financial health is “gradually beginning to improve.”

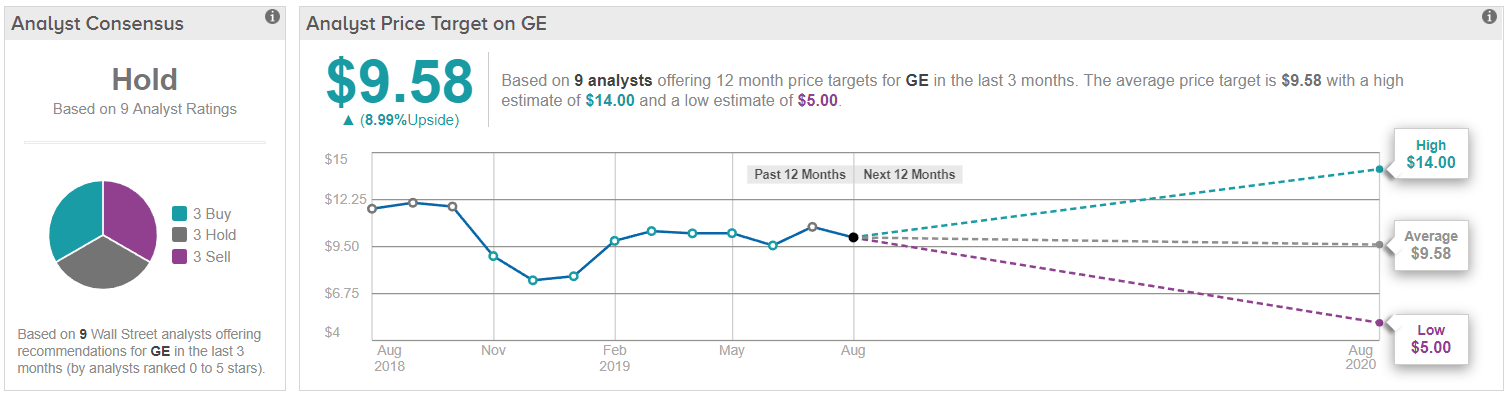

All in all, Wall Street is pretty evenly split between the bulls, bears, and fence sitters. Based on 14 analysts polled by TipRanks in the last 3 months, 3 rate GE a ‘buy’, 3 issue a ‘hold’, while 3 suggest to ‘sell’ on the stock. The 12-month average price target stands at $9.58, marking a nearly 9% upside from where the stock is currently trading. (See GE’s price targets and analyst ratings on TipRanks)