Bitcoin Forecast: Market To Rally From Support

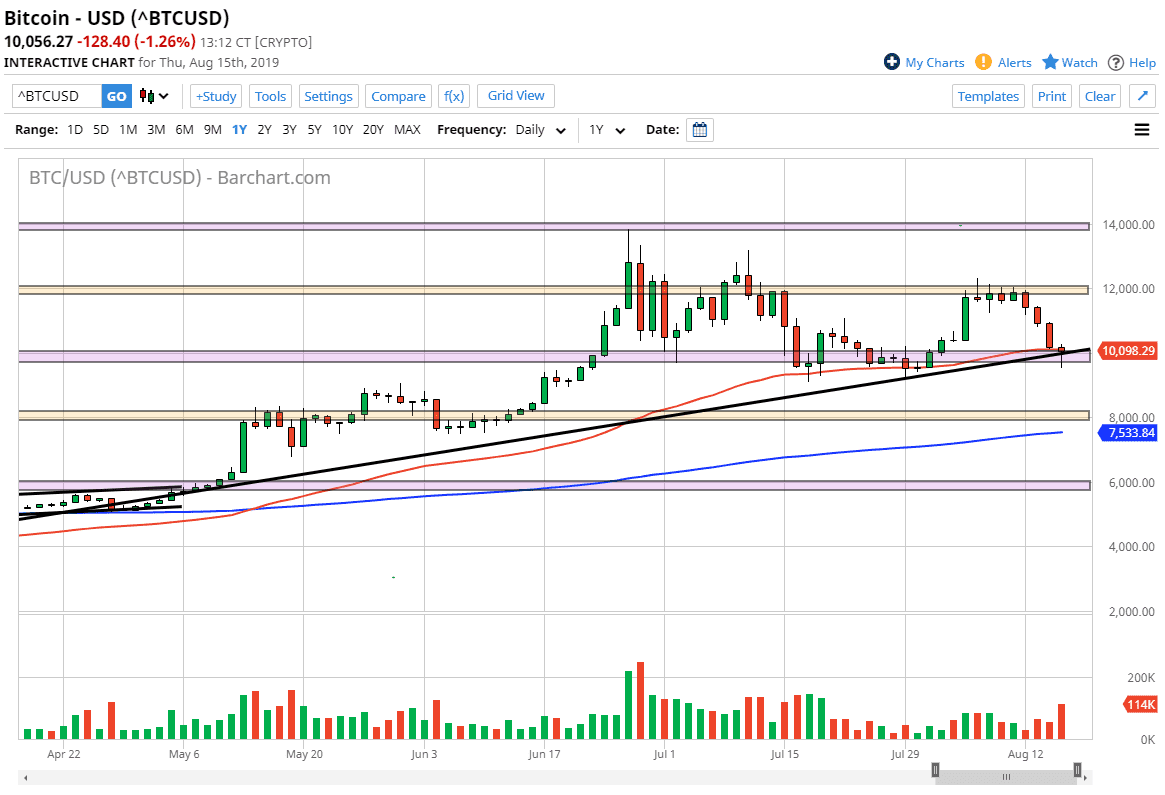

The Bitcoin markets fell initially to kick off trading on Thursday but found buyers to come in and pick the market back up above the $10,000 level. By doing so, we ended up forming a bit of a hammer and that is a very bullish sign. Ultimately, this is a market that looks very likely to continue to find buyers longer term, as we are at a crucial juncture of the chart that brings in a lot of interests.

Looking at the uptrend line that slices through the hammer that formed during the trading session on Thursday, it’s easy to see that a lot of buyers will be willing to come in and pick up a bit of value. After all, there is a lot of concern out there when it comes to the central banks around the world looking to get involved and start loosening monetary policy. Ultimately, I believe that this market will continue to see a lot of interest due to the fact that money is trying to flow out of places like China, Venezuela, and Iran. Ultimately, the market is likely to continue to favor crypto as there are a lot of concerns about monetary policy.

Ironically, gold and Bitcoin are moving in the same direction, despite the fact that gold traders and Bitcoin traders tend to be at odds most of the time. This is simply a runaway from fiat currency, and as a result Bitcoin is being used as protection. Ultimately, the market looks as if it moves in $2000 increments, so it doesn’t surprise me to see the people would be interested in this area. A break above the high of the trading session for Thursday should send this market looking towards the $12,000 level above in what would be a simple bounce and continuation of what we have seen previously.

Alternately, if we were to break down below the hammer from the candle stick on Thursday, then it could open up the move down to the $8000 level, but that is the least likely of scenarios now that we have seen the market react in a supportive manner in this area. Ultimately, I think that the market will eventually find a reason to go higher, so therefore I am a buyer of this market in general and believe that we will continue to grind to the upside.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more