Apple (AAPL) received some good news this week from an unexpected place: Trade War. The tech giant has been caught in the crosswinds of the US-China tariff battle, but the US announced it would delay the 10% tariff on about $300 billion of Chinese-made products like phones and laptops until December. While not out of the woods just yet, the delay gives Apple a bit more breathing room and more time for the two countries to come to a resolution.

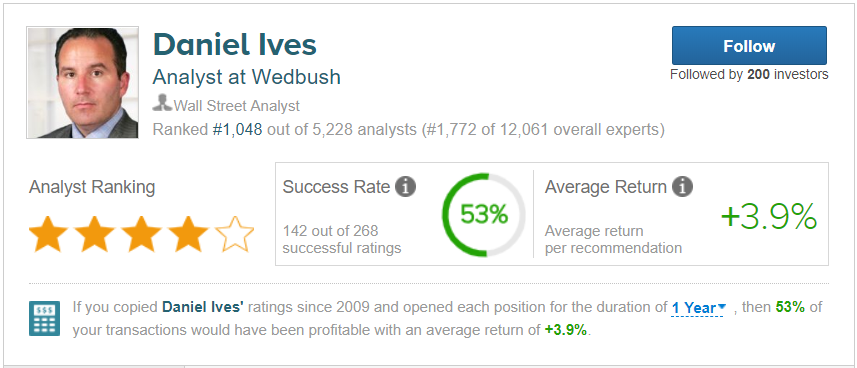

On the news, 4-star Wedbush analyst Daniel Ives maintained an Outperform rating on Apple stock, with $245 price target, which implies about 20% from current levels. (To watch Ives’ stock ratings, click here)

Though investors have expressed concern over US-China and Apple, Apple’s stock has soared in 2019, and is only about 10% off its all-time high set in 2018. The company has faced other challenges over the past year, including the Chinese economy, price challenges on non-iPhone products, as well as iPhone demand.

But in Asia, Ives says he has confidence that Apple will produce “between 75 million to potentially 80 million iPhone 11 units heading into the September launch period.” The analyst says these estimates are “roughly in line with the year ago period,” and backs up his thesis that Apple is seeing stable demand and still feeling confident heading into September.

Further, even though the US-Chinese battle has contributed to blossoming success for Huewei — as Chinese customers are opting for Chinese-made products over US-made — Ives says Heuwei competition is not a major challenge for Apple. The analyst believes the “vast majority” of the 60 to 70 million Chinese consumers due for an iPhone upgrade will convert.

Ahead of next month’s launch season, Ives expects a “trifecta of iPhone 11 releases,” including versions that have three-lens camera functionality. The analyst also expects the company to release an updated AirPods towards the end of the year, including new designs and waterproof capability.

All in all, for a long time, nothing could stop Apple, but the recent US-China tensions have shown that the company is vulnerable. While the company received good news this week, questions remain. Adding to the uncertainty is the recent recession alarm sounded in the US.

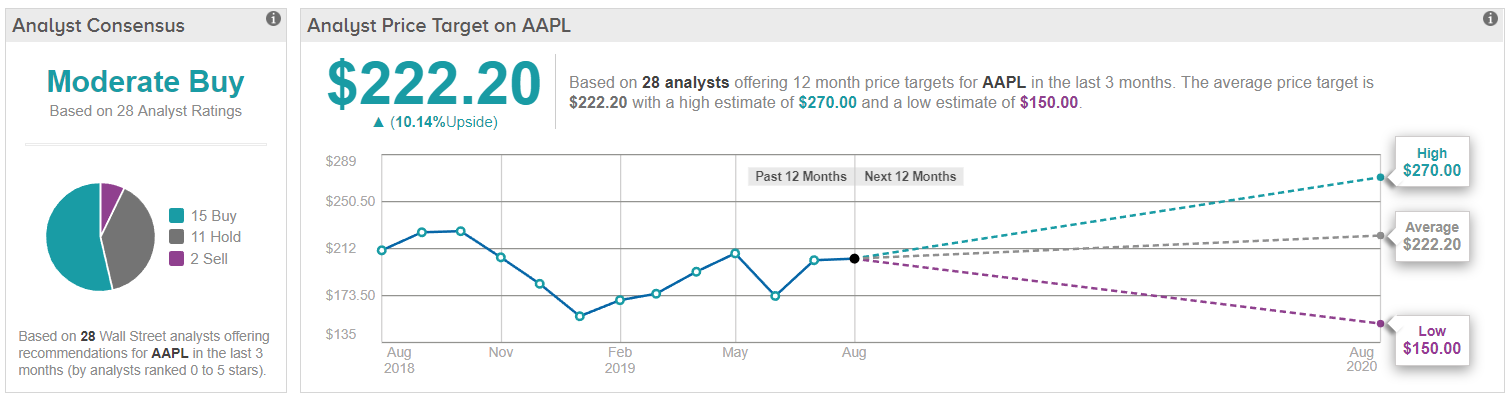

But nonetheless, Wall Street still views the company in good light. TipRanks analysis of 28 analyst ratings shows a consensus Moderate Buy, with 15 analysts saying Buy, 11 suggesting Hold and only two recommending Sell. The average price target among these analysts stands at $222.20, which represents about 10% upside from current levels. (See AAPL’s price targets and analyst ratings on TipRanks)