When a company’s stock surges nearly 70% in one day, you know there’s something going on. In the case of Pivotal Software (PVTL), it’s talk of an acquisition with VMware (VMW).

The players involved with the acquisition — as well as Pivotal’s history — make the story a bit complicated. VMware’s majority owner is Dell — which also is the majority owner of Pivotal, which was formed after a spin-off from VMware in 2013. So, should VMWare go through with its plans, everything will come full-circle for the young software company, which went public in 2018. And the timing couldn’t be any better — prior to the acquisition news Pivotal, shares were down about 50% for the year.

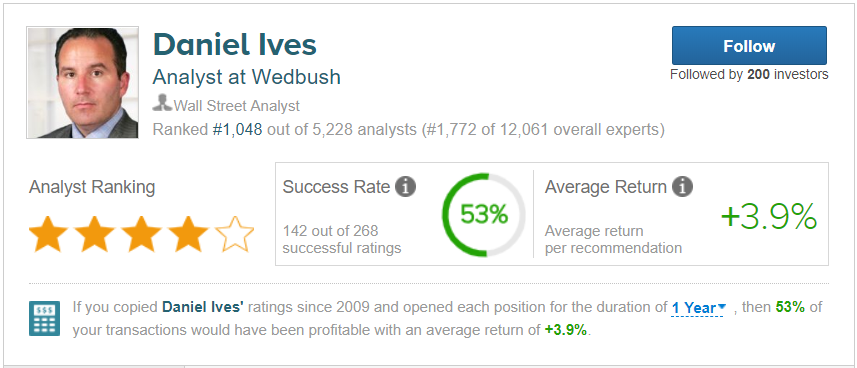

Wedbush analyst Daniel Ives believes the acquisition would “end the dark days” for Pivotal, but remains cautious on the stock as he reiterates a Neutral rating and $15 price target.

Ives says the move on VMware’s part is a “head scratcher.” Even though acquiring Pivotal’s “underlying cloud assets and complex developer tool ecosystem will add to the VMW product footprint and potentially expand opportunities within its installed base around cross-selling,” the analyst says the acquisition would not be “a clear plug and play fit.”

Aside from product-fit, adding to the trouble is that Pivotal’s performance has been disappointing. Ives noted, “Pivotal reported a disastrous deferred revenue/billings performance in FY1Q20 which significantly missed Street expectations (by 12%) due to company specific execution issues and has been a major factor in the stock being down significantly since early June, which as we have discussed in the past makes it an attractive M&A candidate.”

Moving forward, Ives’ believes the lingering question is what are the strategic merits behind this possible acquisition other than just the current valuation of Pivotal. The analyst believes the $15 price target is fair, which would also be the exact value the company went public with less than two years ago. While its possible the deal falls apart, given the history of the two companies, it’s more likely than average that things will work out.

All in all, Wall Street sizes up PVTL as a ‘Moderate Buy’ stock, as the bulls edge out the cautious on the cloud platform provider. In the last 3 months, PVTL has received 5 bullish ratings versus 3 analysts hedging their bets, and one bear who doubts the company can secure a turnaround. The 12-month average price target of $16.89 reflects about 20% upside potential from current levels. (See PVTL’s price targets and analyst ratings on TipRanks)