Tesla (TSLA) and W.W. Grainger (GWW) are like those drivers motoring down the highway with the ever-blinking turn signal. Those following along behind are left wondering if that turn will ever come. Wall Street analysts clearly don’t see any turnaround in these stocks. Let’s take a closer look.

Slam on the Brakes with Tesla Stock

Investors don’t have a lot to be excited about when it comes to the electric car manufacturer.

Tesla has a history of overpromising and underdelivering, with the Street more willing to look past this as the company offered innovative and exciting technology. Now, Wall Street wants to see results that suggest a strong long-term growth narrative. Based on Tesla’s second-quarter results, investors aren’t going to get what they’re looking for.

Specifically, the earnings release revealed that losses were much larger than originally expected. Non-GAAP loss came in at $1.12 per share falling well below the $0.16 consensus estimate. Not to mention Tesla managed to burn through $333 million in cash, all while the company delivered a record breaking 158,000 vehicles.

Based on the current economic climate, the situation could get worse for Tesla. If fears are correct and the economy heads into a recession, oil prices could plummet as they’ve done in the past. This would have a drastic effect on TSLA as one of the key benefits of electric vehicles is being able to avoid high gas prices.

Joseph Spak, a five-star analyst according to TipRanks, doesn’t see gross margins improving anytime soon. He argues that TSLA’s profitability is tied to its full self-driving product, but the development team has experienced a high turnover rate. The company also can’t sell the product in the EU as regulation prohibits the feature.

“So growth is likely to be on hiatus and we don’t believe the valuation reflects this. That said, if there are material further price cuts, demand might be higher, but this would weigh on profitability,” Spak added. As a result, the RBC Capital analyst reiterated his Sell rating and $190 price target, as believes the stock could drop 16% over the next twelve months.

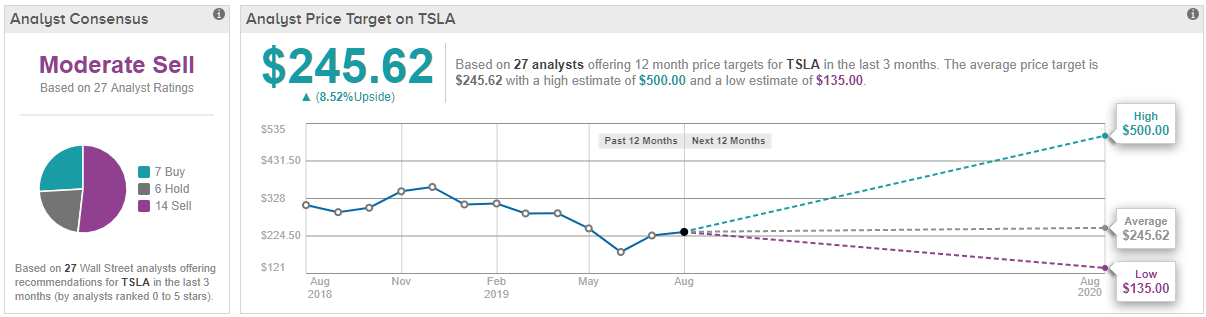

All in all, most of Wall Street is growing impatient with this electric player’s stumbles, as TipRanks analytics demonstrate TSLA as a Sell. Based on 27 analysts polled in the last 3 months, 7 suggesting ‘buy’, 6 recommending ‘hold,’ while 14 advising ‘sell.’ Interestingly, the 12-month average price target stands at $245.62, which marks about 8% upside from where the stock is currently trading. (See TSLA’s price targets and analyst ratings on TipRanks)

W.W. Grainger Stock Is Out of Favor on Wall Street

While the industrial supply company is slightly up year-to-date, Wall Street takes a firmly bearish stance on Grainger. With 3 Sell ratings received over the last three months, the consensus among analysts is that the stock is a ‘Strong Sell’.

GWW’s Q2 performance was better than originally expected thanks to lower prices and volumes, but the company by no means went above and beyond with EPS matching the consensus estimate. Analysts originally expected poor earnings after weak results from its competitors, Fastenal and MSC Industrial. GWW also decreased its full year 2019 sales guidance to be between 2% and 5% year-over-year growth, down from the original 4% to 8.5% growth estimate.

Despite GWW typically using a third of its operating cash flow to improve its base business, analysts are not seeing the level of growth they would like.

4-star RBC Capital analyst Deane Dray adds, “Grainger has little pricing power in a low-inflation environment and is vulnerable at negative inflection points in the economy, given its short-cycle, no-backlog distribution model.”

It doesn’t help that the Amazon Business service is now available in at least seven major international markets. Amazon Business poses a significant threat to Grainger’s Cromwell segment in the UK and Europe as well as Grainger’s 51% stake in Japan-based MonotaRO. Cromwell and MonotaRO account for 3% and 7%, respectively, of GWW’s total sales.

Dray concludes that GWW is unlikely to meet its target long-term growth rate. “Looking ahead, the guidance cut to 2019 sales and lowered market growth assumptions point to a tougher second half of 2019 operating backdrop, and Grainger’s 300-400 bps of outgrowth assumption appears optimistic to us. Short-cycle industrials like Grainger look vulnerable here,” the analyst explained.

Based on all of the above factors, the analyst reiterated his Sell rating and lowered the price target from $257 to $254, indicating 7% downside. (To watch Dray’s track record, click here)