In a series of recent research notes, German financial giant Deutsche Bank weighs in on three stocks with excellent return potential – on the order of 30% or more.

Let’s take a close look at each of these companies, and at Deutsche Bank’s bullish stance.

VMware (VMW)

This cloud-based software company has been making headlines recently with its interest in acquiring Pivotal Software (PVTL). San Francisco-based Pivotal specializes in cloud applications and development tools; from the standpoint of fit, an acquisition could make sense and benefit both companies. It may also bring benefits to Dell Technologies (DELL), which owns controlling stakes in both companies. VMware, however, brings approximately 80% of Dell’s annual income.

Of the potential merger, VMware released a statement saying in part, “VMware regularly evaluates potential partnerships and acquisitions that would accelerate our strategy. Pivotal is a long-term strategic partner and we’re already successfully collaborating to help enterprises in their application development and infrastructure transformation.”

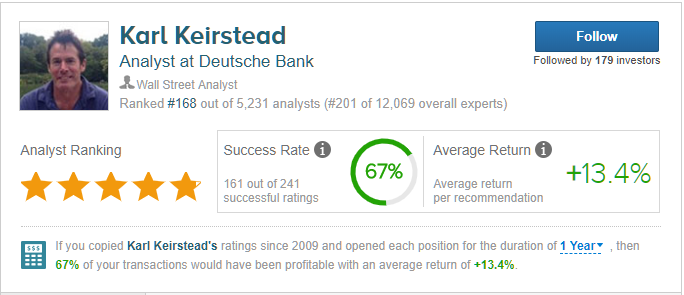

Deutsche Bank’s Karl Keirstead, a 5-star analyst on TipRanks, takes a generous view of the proposed M&A move: “The strategic logic is there, as PVTL’s focus on containerized workloads and its leading position as a development platform for new cloud-destined apps fits with VMware’s desire to shift its mix to container and cloud-native infrastructure technology.”

Keirstead goes on to rate VMW as a Buy with a price target of $190, indicating a 31% upside potential. He says, as his bottom line, “VMware shares look attractive for a 10%+ growth story making all the right moves to stay relevant in a cloud-centric world.”

Where does the rest of the Street side on this software maker? It appears mostly bullish, as TipRanks analytics demonstrate VMW as a Buy. Out of 6 analysts polled in the last 3 months, all 6 are bullish on VMware stock. With a return potential of nearly 37%, the stock’s consensus target price stands at $199. (See VMW’s price targets and analyst ratings on TipRanks)

Palo Alto Networks (PANW)

Palo Alto hasn’t had a great month, with shares falling nearly 13%. But things aren’t as bad as they may seem, argues Deutsche Bank’s Keirstead.

Palo Alto Networks is a Silicon Valley cybersecurity company developing advanced firewall and secure-cloud systems. Cybersecurity is a vital – and lucrative – business in our modern age of digital information, but recent report by IBM underlines it for those have not been paying attention: malware attacks are up 200% so far this year.

While business is good, the combination of US-China trade complications and a strong US dollar are putting downward pressure of the 2H19 outlook. And continuing churn among upper management at PANW also has investors worried. The company took on a new CEO last year, and the Executive VP of Worldwide Sales recently announced his own departure for the end of September.

Keirstead, in a review of PANW, takes note of the executive turnover, and says, “This level of Sales change, combined with the 2018 additions of a new CEO and President, is unsettling, but we haven’t picked up evidence of a material tone downtick on PANW fundamentals from our checks and we reaffirm our BUY rating.” He goes to say, in his bottom line, “We still lean bullish. Our unchanged PT [is] $275…” That price target implies an upside of nearly 40%.

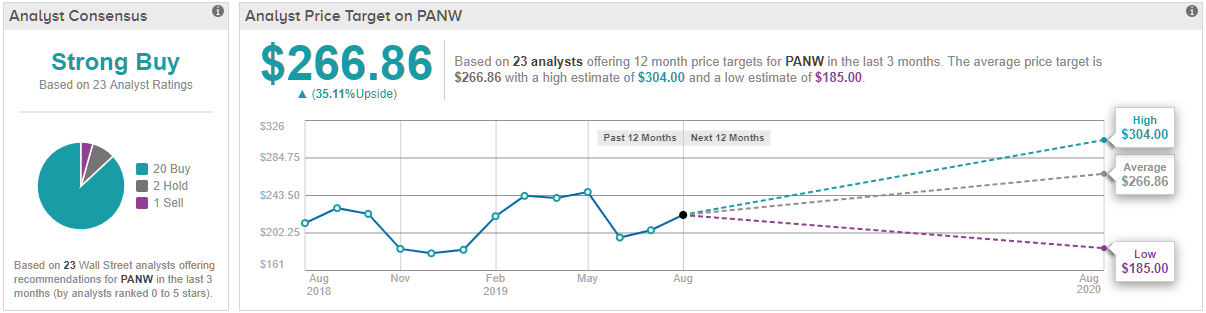

Keirstead’s outlook is in line with the analyst consensus on PANW — Strong Buy. The stock has received 20 ‘buy’ ratings in the last three months, compared to just 2 ‘hold’ and 1 ‘sell’ ratings. Shares are priced at $198, so the average price target of $266.86 suggests an upside potential of 35%.

Tapestry (TPR)

Originally Coach, the familiar maker of purses and other accessories changed its name and ticker symbol back in 2017. In its fiscal Q4 earnings report last week, TPR met the expected EPS of 61 cents per share. Net sales revenue, however, missed the target by 1%, coming in at $1.513 billion instead of the forecast $1.534 billion. The gross annual profit was $1.017 billion was up from one year ago, but gross margins contracted slightly to 67.3%. In short, the earnings release was a mix of good and bad news.

The stock price dropped sharply after the quarterly report, from $25 to $21. However, Deutsche Bank sees the lower price as a buying opportunity for an otherwise strong company.

In his research note, 4-star analyst Paul Trussell says, “The Coach brand sustained its international momentum and saw a sequential acceleration in North Americ, reassuring investors that the brand remains healthy with its FCF generating power intact.” Trussell’s $33 price target reflects his confidence – it suggests an upside of 57% for TPR stock.

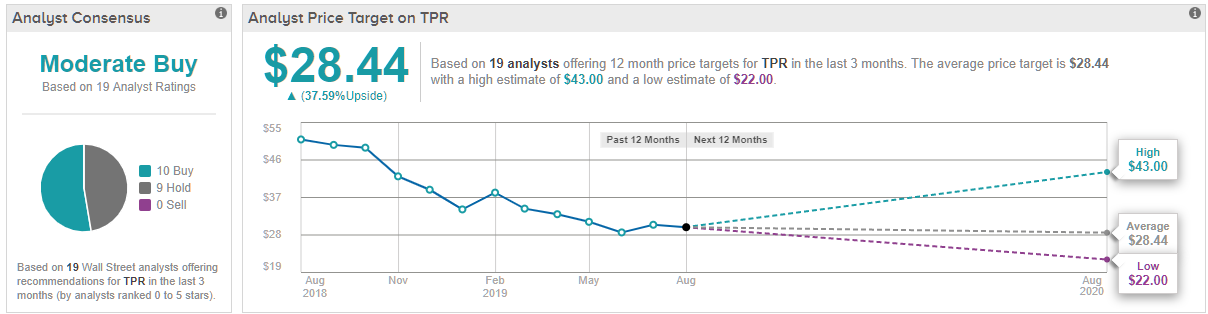

Overall, TPR gets a Moderate Buy rating from the analyst consensus, based on a near-even split: 10 of the stocks recent reviewers have rated it a Buy, while 9 say to Hold. However, even the low-ball price target is higher than the current share price, so it would seem that even the skeptics see potential here. With shares trading at $20.97, the average price target of $28.44 implies an upside of ~38%. (See TPR’s price targets and analyst ratings on TipRanks)