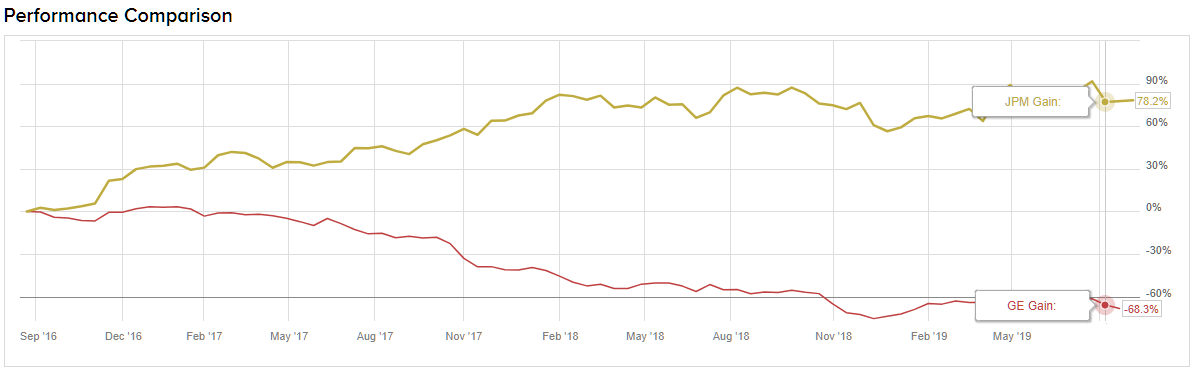

U.S. stocks started the week with a bang on Monday amid improved forecasts regarding the trade war with China and news of a potential government stimulus. As confidence has returned, investors are searching for stocks that will emerge as the winners from the market boost. New York brokerage firm, Wolfe Research, points to General Electric (GE) and J.P. Morgan (JPM) as two potential winners who can outperform the market over the next 12 months. Let’s take a closer look:

General Electric (GE)

Despite recent turbulence, one top analyst argues that the bears should take note of all of the progress GE has made in the past six months.

GE has placed a strong focus on meeting its balance sheet goals. Not only has the company fully liquidated its Wabtec stake, but it’s also likely that GE will finalize the sales of its Bio-Pharma and Baker Hughes segments in the next twelve months. Wolfe Research’s Nigel Coe, a four-star analyst according to TipRanks, believes that GE can make a significant dent in its $20 billion pension deficit, retire its $6 billion in preferred stock and $10 billion of fund insurance obligations, all with the $32 billion of surplus capital that is being realized.

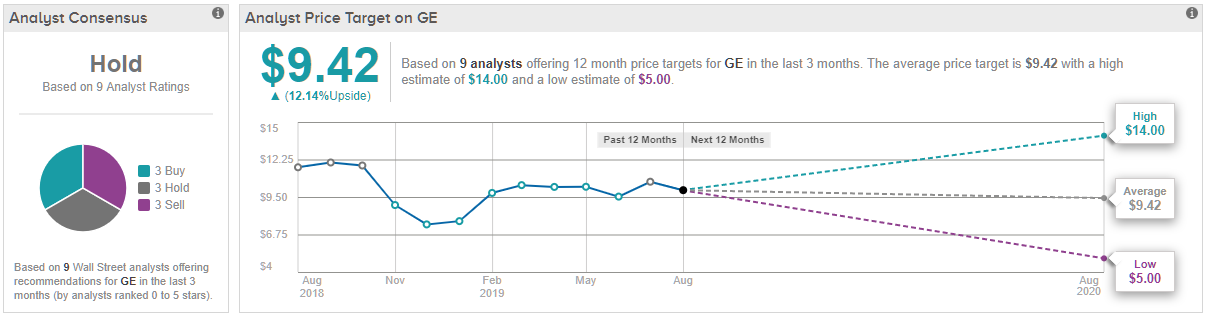

As a result, Coe reiterated his Buy rating on GE stock, with a $14.00 price target, which implies about 67% upside from current levels. (To watch Coe’s track record, click here)

The stabilization of the worldwide power market has also had an effect on GE. According to industry data firm McCoy, the power market could reach about 40GW of capacity orders this year, compared to expectations of sub-30GW. This has allowed the company to achieve quarter-over-quarter and year-over-year growth in its power backlog as well as HDGT backlog build. This means that it’s likely GE will be able to deliver more than the 40 to 45 gas turbines designated for 2019 and 2020.

Furthermore, some investors have expressed concerns regarding CFO Jamie Miller’s departure as well as the $1.2 billion of working capital pressure from the grounding of the 737 MAX jets. However, Coe argues that these risks don’t change GE’s long-term growth narrative.

Coe concluded: “While we acknowledge a higher pension deficit and slightly more conservative long-term GE Capital funding requirements, risk/reward remains skewed to the upside and the stock is now re-energized as a fresh money idea.”

All in all, this troubled industrial giant certainly has the Street divided. Based on 9 analysts polled by TipRanks in the last 3 months, 3 rate a Buy on GE stock, 3 suggest Hold, while 3 recommend Sell. The 12-month average price target stands at $9.42, marking about 12% upside from where the stock is currently trading. (See GE’s price targets and analyst ratings on TipRanks)

J.P. Morgan (JPM)

Even with the possibility of interest rates being cut further, Wolfe Research is still betting on this banking stock.

According to five-star analyst, Steven Chubak, JPM should be able to offset negative impacts of low interest rates and the trade war based on its volume growth.

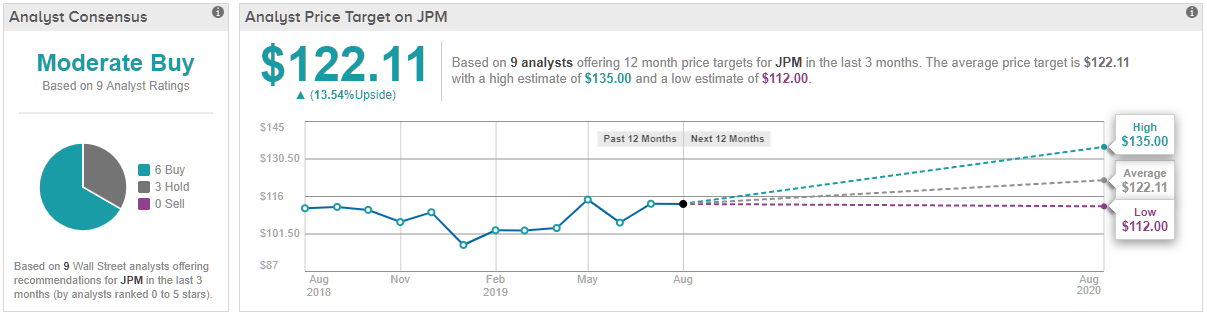

As a result, Chubak reiterated a Buy rating on JPM, with a price tag of $120, suggesting the stock can rise just over 10% from current levels.

“We believe the impact from lower rates should be largely offset by volume growth as JPM should continue to benefit from strong organic growth in IEA, which has been a significant driver of net interest income expansion in recent years,” Chubak explained.

Another threat to JPM is the possibility that the economy could enter into a recession. That being said, management stated that they believe recession fears are overblown based on the current low unemployment rate, healthy housing market and high consumer confidence.

Even so, the company has made itself more defensible as it has placed a significant focus on growing the payments segment of the business. JPM recently launched its cryptocurrency, JPM Coin, as well as expanded Chase Paymentech or its payment processing service. While it does face intense competition, Chubak points out that many of these competitors will likely use their platforms to serve banks as opposed to working against banks.

Chubak concluded, “We argue that JPM’s best-in-class organic growth, strong management team, and better performance track record in periods of stress justify a higher late-cycle multiple. We believe that JPM has room for further upside on returns as newer growth initiatives within Payments and Retail Brokerage scale.”

The rest of Wall Street largely buys into what this banking giant has to offer, as TipRanks analytics reveal JPM as a Moderate Buy. Out of 9 analysts polled in the last 3 months, 6 are bullish on J.P. Morgan stock while 3 remain neutral. With a return potential of nearly 14%, the stock’s consensus target price stands at $122.11. (See JPM’s price targets and analyst ratings on TipRanks)