The once over hyped cannabis sector is now under pressure as results from the Canadian LPs fail to meet forecasts and the U.S. struggles to approve cannabis at the federal level. Investors need to finally move beyond the hype and separate the companies like Harvest Health & Recreation (HRVSF) that have a reasonable path to profits with a catalyst to higher stock prices.

Still Waiting

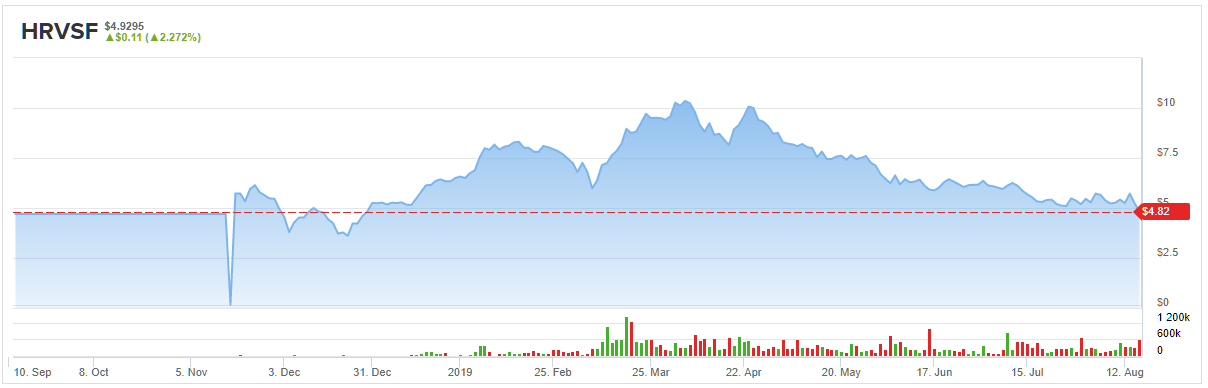

Harvest Health is now down 50% from the highs above $10. Most of the U.S. multi-state operators (MSOs) are down similar amounts this year as the cannabis trade falters in both Canada and the U.S. with one big difference. The American companies trade at much more reasonable market valuations.

For Harvest Health and the other big MSOs like Curaleaf (CURLF) and Cresco Labs (CRLBF), the companies are still waiting to close large scale deals announced earlier this year. Without digging into the details, Harvest Health on the surface still looks like a rather small cannabis player with Q2 revenues of only $26.6 million and a market valuation of $1.5 billion.

The company still looks like a minor player in the industry with Canadian companies reporting revenues topping C$100 million and constantly discussing big global expansion plans. The U.S. players face the lack of Federal cannabis approval that has made no progress during the summer months. The lack of approval has killed a major catalyst in uplisting the stocks in the major U.S. stock exchanges.

More importantly, none of the big cannabis deals in the U.S. have closed leading to more market uncertainty. The market hates uncertainty and a U.S. MSO is full of uncertainty right now.

Opportunity

Harvest Health reported Q2 proforma revenues of $78 million or an amount that would make the relatively unknown U.S. MSO the size of Aurora Cannabis (ACB) and far larger than the disaster at Canopy Growth (CGC). The problem is that the market is impatient in waiting for several large deals to close in the U.S. MSO sector.

Ultimately, the patient investor will be rewarded with Harvest Health closes deals for Verano, Falcon and CannaPharmacy this year. The company will have 494 million shares outstanding for a market valuation of only $2.5 billion.

An investor buying into the stock on this substantial weakness gets a cannabis company with projections of reaching 120+ dispensaries in 15 states by the end of 2020. The key figure is the revenue projection for sales reaching $900 million to $1 billion in 2020. Not many stocks in the sector trade at 2.5x ’20 sales estimates. Especially noteworthy is how Canopy Growth had a target for only C$1 billion in annual sales or $750 million with a market cap still up at $9.5 billion.

These sales projections come without much in the way of full financial reports including gross profits and operating expenses leaving investors to prefer taking a cautionary view until the deals close. The only forecast is for Harvest Health reaching a 2020 EBITDA goal of 30% to 35%, but an investor has very limited visibility into those targets.

Takeaway

The key investor takeaway is that Harvest Health & Recreation is an overlooked U.S. MSO. The company faces some risk due to the inability to close pending acquisitions, though the market appears to be extrapolating the risks too far. Use the weakness to snap up a leading cannabis stock at 2.5x ’20 sales projections.

Disclosure: No position.

To get TipRanks’ stock analysis report on Harvest Health, click here