On Monday, when the FDA came out against Sarepta’s (SRPT) Duchenne muscular dystrophy drug Vyondys 53, investors knew the shockwaves would immediately hit shares. And they did.

The stock plummeted as much as 18% in Tuesday trading as the FDA expressed concern over the possibility of infection and kidney toxicity from the Vyondys drug. Sarepta’s CEO quickly came out saying he was “surprised” by the decision, given that the FDA has not expressed this concern during the formal review.

While the FDA isn’t giving the company much to work with, it is expected that the two sides will meet as Sarepta continues to work to bringing Vyondys to market.

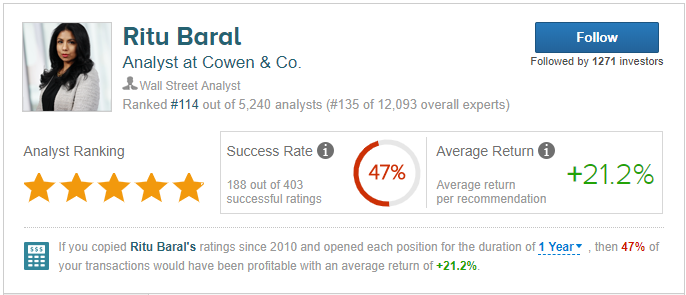

5-star Cowen analyst Ritu Baral isn’t very moved by the bad news, as she maintains an Outperform rating on SRPT stock, along with $213 price target, which implies about 110% upside from current levels.

Baral’s immediate reaction was the same as that of the Sarepta CEO — surprise.

The analyst says she was “surprised by the FDA’s reasons/concerns and did not anticipate a [Complete Response Letter] for safety reasons,” comparing Vyondys 53 to another Sarepta product, Exondys 51, which “has similar backbone chemistry and has never shown any serious safety signal (renal or port-related infection risk).”

The analyst thinks the FDA’s decision is “not cleanly [logical],” and doesn’t think Sarepta needs to do too much work in order to satisfy requirements. Baral says the company “could address the current renal toxicity concerns with current clinical and preclinical dataset,” with the worst-case situation of “an expanded open-label safety database with the 30 mg/kg…”

Overall, Baral views the port-related infection risk as easily addressable in the near term, like with analysis of the Exondys post-marketing experience (neither Exondys nor golo had any clinical infection signal and infusion times are generally identical). As a result, Baral says the FDA will eventually approve the drug, around 2021 by her estimates. Until then, the top analyst expects the company to address concerns and provide clarity on Vyondys’ path forward by the end of the year.

All in all, Sarepta has had an up-and-down year. Shares shot up nearly 40% by March, before slipping 20% in the subsequent three months. By July, its stock was up yet-again, with respectable 45% gains for the year, just before crashing again this month. In one word: roller-coaster.

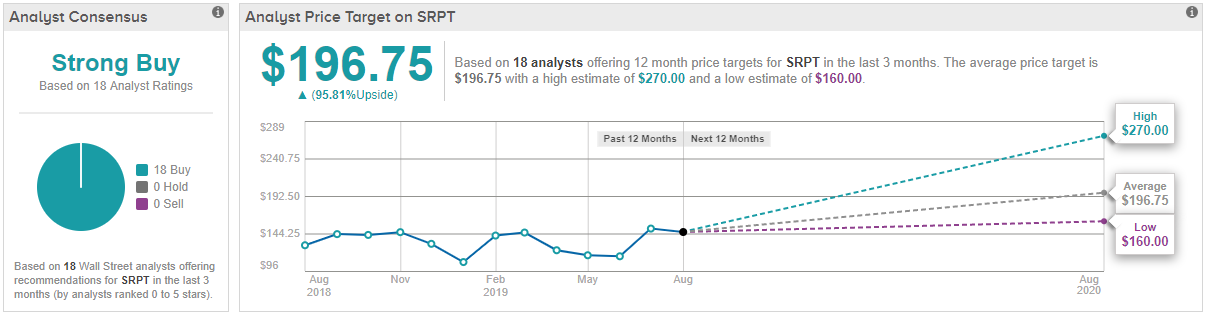

But TipRanks analysis of 17 analyst ratings shows that Wall Street is not so confused on where SRPT is headed. All 17 analysts rate the stock a buy, with an average price target of $191.87, which represents an 88% return from current levels. (See SRPT’s price targets and analyst ratings on TipRanks)